Organisation name: Man Group

Signatory type: Investment manager

Assets under management: US$123.6 billion

Region of operation: Global

Man Group is firmly committed to responsible investment and is a long-term signatory to the United Nations-supported Principles for Responsible Investment. Our Man FRM unit is focused on alternative investments, through managed accounts, commingled strategies and advisory relationships.

Why we use responsible investment criteria to assess managers

In any nascent industry, it is often hard to distinguish between genuine innovation and hype. Assets increasingly come with responsible investment strings attached, incentivising investment managers to exaggerate their credentials to gain access to some of that capital. It is therefore more important than ever that hedge fund investors can distinguish genuine responsible investment managers from those that greenwash.

We typically use in-person or virtual meetings with an investment manager’s senior personnel, including a senior investment officer and a controller such as a Chief Operating Officer or Chief Compliance Officer, to conduct our due diligence appraisal. We believe such a combination provides a deeper insight into a manager’s investment process and governance.

How we assess an investment manager’s responsible investment criteria

When assessing an investment manager’s responsible investment credentials, we believe an allocator should consider adopting the following steps (which we have also incorporated into our framework):

Request to see the firm’s responsible investment statement or policy. A statement is an aspirational document, giving a sense of the firm’s overall direction on responsible investment issues, without including a prescriptive internal process to ensure responsible investment considerations are included consistently and associated governance measures are monitored. In contrast, a policy should have a clear, structured outline of how the firm handles responsible investment. Those investment managers that we score most highly have a responsible investment policy that governs the entire or vast majority of the investment process and is overseen by senior management who have an explicit responsibility for its application. The lowest-scoring managers generally have a non-descriptive or bland statement, with no clear guidance on how it will be consistently applied to the day-to-day operations of the firm’s investment process.

Understand exactly how responsible investment policies will be applied to investments. It is important that investment managers can demonstrate how varying responsible investment approaches do or do not suit their strategies. Many systematic hedge fund strategies can’t provide any evidence of stewardship – it is simply incompatible with the types of strategies that they run. However, these strategies can incorporate a policy of negative screening, especially as they lend themselves to managing stand-alone client fund mandates that often contain specific responsible investment restrictions. For discretionary investment managers, the bar is somewhat higher. The best investment managers may undertake a combination of approaches – using a negative screen to exclude certain asset classes and sectors regarded as the most harmful on an ESG basis and then applying a research-heavy integration process to identify sector leaders. If investment managers say that they take a stewardship approach, they should be able to demonstrate a track record of consistent voting or a record of corporate engagement advocating for positive change.

Understand how the firm’s investment/research personnel lead the responsible investment analysis. In firms that are more likely to greenwash their credentials, responsible investment governance is likely to be unclear or not strategically prioritised. In contrast, best-in-class[1] firms will establish an explicitly embedded process, with defined roles and responsibilities throughout the investment process. We score firms poorly if they can’t provide clarity on which team or individual is accountable for implementing the responsible investment policy, as this makes it harder for us to determine how that policy is being consistently implemented in practice. We consider this an indicator of greenwashing. Some investment managers – typically larger firms – have dedicated responsible investment analysts that work alongside the traditional financial analysts, although this is not a broad trend to date. Whilst an investment manager investing in a dedicated responsible investment resource gives a very positive impression, we want to understand how that team is integrated into the broader investment team and specifically how its output feeds into the investment decision-making process. We score a manager highly if it can demonstrate that the responsible investment team is formally integrated.

Measure success. This is arguably the hardest part of appraising an investment manager’s responsible investment credentials. The most obvious measure is P&L. While some managers are able to calculate the P&L impact of a responsible investment factor on an investment decision, it is important to acknowledge that this is quite difficult to do, given that most investment strategies will have a large number of factors feeding into an investment decision. Our experience shows that a minority of hedge fund managers are currently able to provide this P&L attribution reporting. We encourage our investment managers to identify, track, measure and report on stewardship activities – both voting and engagements with companies – around ESG topics. This is sometimes difficult to impose depending on the investment style and horizon (turnover) of alternative investment managers. Other ways to think of success include measuring the following metrics[2] across an investment portfolio:

- percentage of employees that are women or minorities

- making a carbon commitment (net-zero or tons of carbon emitted)

- contributions to local causes/charities

- number of lawsuits/fines/regulatory breaches

Understand the investment manager’s prospects for improvement. Is the firm committed to improving its research processes, portfolios and ultimately, its responsible investment standards? Regardless of their size, firms should be able to explain their roadmap for the next few years, showing an understanding of where their current standards may be falling short and identifying the actions they will take to improve.

Scoring hedge funds

After taking the investment due diligence steps outlined above to assess a manager’s responsible investment credentials, we score each of our hedge fund holdings using a proprietary scoring methodology that applies weightings to reflect our views on the importance of these credentials.

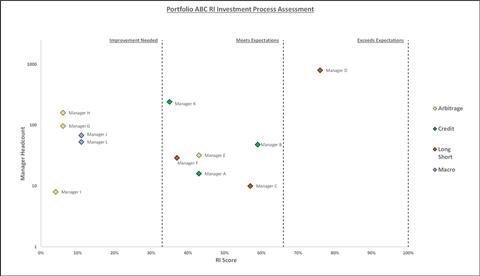

We also take into account the size of the investment management firm, given that we would not expect small firms to have the same financial and human resources as larger firms. Once this analysis is completed, we award each hedge fund holding a responsible investment rating, using a simple three-tier system (Improvement needed, Meets expectations, and Exceeds expectations).

Figure 1 illustrates our client reporting, which summarises the individual hedge fund holding scores for a client portfolio. Over time, we can use this type of reporting to map the progress of each investment manager, enabling incentives or remedial actions.

Figure 1: Manager investment process assessment. Source: Man Group

Example: Using responsible investment criteria to assess an investment position

We describe here an example of a due diligence meeting we had with a discretionary European equity long/short fund that takes a responsible investment approach using positive screening, discussing a recently bought position in an oil and gas company.

- While the portfolio is managed using a positive screening responsible investment policy, the investment manager explained that this did not mean that oil and gas companies were automatically excluded. However, we expect the investment manager to demonstrate the positive screening process, and how it seeks to invest in companies that lead on responsible investment issues in the oil and gas sector.

- The hedge fund firm had recently enhanced its order management systems to require the investment analyst to enter a responsible investment narrative as part of the investment thesis submission process; the firm was able to demonstrate this by walking us through its system. If the investment manager had operated a more manual process, we would have expected to see how this worked in practice with appropriate personnel at the hedge fund firm, and to understand any control features that formally embedded the responsible investment policy into day-to-day investment activity. In this example, our work included engaging with a controller at the firm – the COO – who was able to provide a good insight into this embeddedness and how potential conflicts are managed.

- The firm was able to demonstrate that its investment committee challenged the analyst over the proposed trade’s responsible investment credentials before approving it (by walking us through the committee meeting minutes covering that investment, alongside an ESG data vendor’s report included in the analyst report). The firm’s analyst successfully argued that the oil and gas company’s direction was positive: it had recently expanded its operations by buying wind farms, and in its annual report had set a target that 50% of revenue would come from renewable energy sales by 2030. In addition, while the oil and gas company had below-average ratings on ESG metrics compared to broader indices, its performance compared to other firms within the oil and gas index was very positive. For higher-volume discretionary trading strategies, or firms with multiple portfolio managers who each may follow different responsible investment strategies, investment decisions may be made at a portfolio manager’s desk. As such, it is important for us to understand how the responsible investment factor is formally presented in the research thesis and that this written form is stored centrally in the firm’s systems and is accessible by the firm’s controllers.

In summary, we would expect that such a trade is not only justified on an economic basis but that the fund has a formal mechanism for decisions to be challenged (the investment committee or other process), with the CIO or portfolio manager taking a lead and interrogating the research thesis from a responsible investment perspective. Moreover, by keeping formal records of the initial analysis, the challenges presented and an ongoing plan to monitor the investment, the fund has a clear methodology that ensures decisions are defensible on a responsible investment basis. If the oil and gas firm does fail to make progress towards its target, this will become apparent, and the fund can either increase pressure on the management or exit the position – both actions would avoid a charge of greenwashing.