Organisation name: Aware Super

Signatory type: Asset owner

Region of operation: Australia

Assets under management: AU$144bn

Why we engage with managers after their appointment

Responsible investment is an integrated part of our due diligence process. Engagement with managers after their appointment can result in a more collaborative relationship and a more aligned approach to responsible investment.

We will appoint managers even if they do not currently meet best practice if they are willing to improve and collaborate. We assess this by meeting with them and discussing their planned improvements to their ESG integration process, their resourcing plans, participation in industry working groups and interest in collaborating with us.

These conversations form part of our assessment on alignment, which counts for 15% of the overall score we give to managers and also includes collaboration, treatment of reputation risk and the incentive structure of the investment team as it relates to ESG integration.

How we engage with managers after appointing them

We have an established responsible investment manager assessment framework to review internal and external investment managers. This not only forms an integrated part of the initial due diligence process but is used as an engagement tool for improvements in ESG integration over time. The PRI guides on manager selection, appointment and monitoring provided an invaluable reference point in creating and improving this framework.

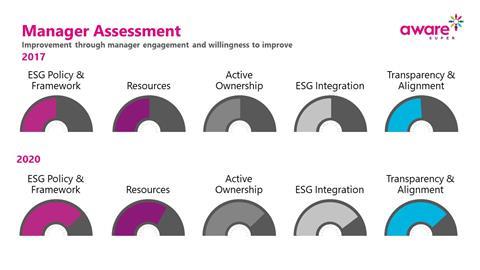

Managers are scored out of five across the following assessment categories – the percentage weight of each depends on the asset class:

- ESG policy and framework

- Resources

- Active ownership

- ESG integration

- Transparency and alignment

Example: Engaging with Adamantem

We appointed Adamantem, an Australian private equity firm, in 2017. Since then, we have seen a significant alignment as they implemented their strategy to create long-term value and sustainable businesses by strengthening their responsible investment approach, including through:

- the appointment of a senior responsible investment director;

- the establishment of a responsible investment policy;

- the introduction of an integrated ESG due diligence framework, including TCFD-based climate risk assessments; and

- the introduction of detailed quarterly responsible investment reporting and a dedicated annual responsible investment report.

The diagram below shows how Adamantem’s score under the responsible investment manager assessment framework improved as a result:

Adamantem had an average score (2.5) against the ESG manager assessment framework prior to our initial investment in its fund, but since then has demonstrated a commitment to continuous improvement.

Since inception, Adamantem has recognised that incorporating responsible investment into its decision-making processes and ongoing portfolio management could enhance its long-term value creation.

We have engaged regularly, through meetings with the managing director and Adamantem’s investor relations team and provided transparency regarding our approach to manager selection, appointment and monitoring. This, alongside the manager’s leadership and investment in ESG resources, has supported an improved responsible investment approach.

Adamantem is now closely aligned with us on how it assesses areas such as climate risk, modern slavery, diversity and inclusion, and data privacy and protection, and integrates these issues into its portfolio company stewardship – driven by its director of responsible investment.

Importantly, Adamantem’s initiatives add value to our investments. For example, by measuring greenhouse gas (GHG) emissions, portfolio companies with manufacturing operations are identifying opportunities to improve resource efficiency, and those with sustainability-focused customers are considering how revenue can be enhanced through actively reducing their emissions.

Our engagement is enhanced by opportunities to collaborate. Adamantem has been open to investor engagement on topics such as the development of their responsible investing policy. Alongside other investors, we are now part of the newly created Adamantem Emission Reduction Committee, established to develop and oversee detailed plans for each company in its second fund, Adamantem Capital Fund II, to achieve their GHG emission reduction targets.

Following last year’s review, Adamantem is among the best scoring managers within our PE portfolio, which we believe will support stronger returns for our broader portfolio – and therefore our members – and improvements across the industry.