Since COP26, expectations have increased dramatically that investors will help deliver the Paris Agreement. In response, an increasing number of asset owners have set ambitious targets. The accompanying scrutiny means it has never been more important for investors to back up commitments with actions.

Executive summary

Multi-asset portfolios allow owners to diversify risk by combining asset classes in a single portfolio or strategy. They can enable asset owners to protect or enhance returns through different economic or market conditions. The allocation of assets within multi-asset portfolios has also been seen as a major determinant of expected long term portfolio returns.

Multi-asset portfolios are also increasingly subject to climate commitments. These portfolios, due to the inclusion of multiple asset types, pose challenges and opportunities for asset owners that have undertaken or are considering climate commitments.

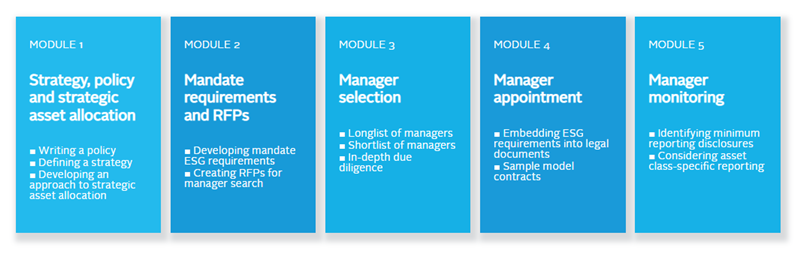

This report highlights considerations for asset owners and asset managers when implementing and monitoring climate commitments across multi-asset portfolios. It will not provide all the answers, but the asset owner toolbox (see Figure 2) provides a starting point when implementing climate commitments. This toolbox outlines a series of considerations asset owners will need to make when setting a policy, designing a mandate and selecting, appointing and monitoring managers.

This report is based on insights taken from interviews with 18 leading investment managers and asset owners that use multi-asset portfolios or strategies and are considering, or have introduced, climate commitments.

The report begins by assessing the availability and reliability of the emissions data that is necessary to set baselines and measure progress. The first section offers an asset class perspective on this issue. For large companies (listed or debt issuers) in major capital markets such data sets are now more mature. In other asset classes, such as private equity and sovereign credit, data sets are often not available, incomplete or there continues to be a lack of established methodology to calculate greenhouse gas (GHG) emissions. Commonly used in multi-asset portfolios, financial instruments (e.g. derivatives) and strategies (e.g. long/short) raise a different set of issues around the calculation of portfolio GHG emissions.

The second section shares interviewees’ strategies in implementing climate commitments. These are grouped under three approaches – asset allocation, engagement and divestment. Each approach has advantages and disadvantages which vary across asset classes, requiring a flexible approach depending on portfolio composition.

Signatories identified benchmark selection, mandate design and allocation towards climate solutions as key considerations in the construction of portfolios designed to meet climate objectives and produce real-world emission reductions.

Signatories saw both engagement with investee companies and support for effective climate policies as critical to advancing portfolio commitments. They also identified the following as key steps in designing an effective engagement strategy: collaboration, a focus on achievable quantitative measures, outlining a clear engagement plan, targeted engagement, and leveraging cross-portfolio holdings.

Interviewees recognised that divestment could play an important role in reducing a portfolio’s financed emissions and contribute to leverage during engagement. Questions were raised around the real-world impact of divestment and its utility in asset classes where there are high barriers to divesting. It was broadly accepted that divestment could, where appropriate to the mandate, be used alongside other approaches in meeting climate commitments.

Asset owner toolbox

To provide a practical tool for asset owners, investment managers or their advisers we have outlined a series of relevant questions or considerations. This toolbox covers each stage in the asset owner-manager relationship and is aligned with the PRI’s asset owner technical guides.

Figure 1: Asset manager review and assessment process[1]

MODULE 1

Strategy, policy and strategic asset allocation

■ Defining a strategy

■ Developing an approach to strategic asset allocation

MODULE 2

Mandate requirements and RFPs

■ Creating RFPs for manager search

MODULE 3

Manager selection

■ Shortlist of managers

■ In-depth due diligence

MODULE 4

Manager appointment

■ Sample model contracts

MODULE 5

Manager monitoring

■ Considering asset class-specific reporting

The asset owner toolbox is not meant to be conclusive but a guide for trustees, advisers or fiduciaries when considering implementing climate commitments across multi-asset portfolios – providing questions to ask and challenges to consider.

Figure 2: Asset owner toolbox

| Strategy, policy and strategic asset allocation |

|---|

|

Investment strategy

Asset allocation process

|

| Mandate requirement and RFPs |

|

|

| Manager selection |

|

|

| Manager appointment |

|

|

| Manager monitoring |

|

Delivery strategies

Client reporting

|

About this report

Using signatory interviews and working alongside Deloitte LLP, the PRI has published this report to assess current market practice when implementing climate commitments across multi-asset or balanced portfolios.

The first stage involved preliminary desk research on current global market practice on the implementation of climate commitments in multi-asset portfolios. This included guidance provided by relevant stakeholder groups, such as the UN-convened Net-Zero Asset Owner Alliance (NZAOA), Net Zero Asset Managers initiative (NZAM), the Institutional Investors Group on Climate Change (IIGCC), Science Based Targets initiative (SBTi) and Partnership for Carbon Accounting Financials (PCAF).

The second stage of the project involved interviews with 18 leading asset owners and investment managers. The findings and conclusions within this report do not represent their organisations’ positions. Interviewees included:

- Aetos Alternatives Management – Juliette Menga

- Allianz – Carsten Quitter & Udo Riese

- A global hedge fund

- AustralianSuper

- BMO Global – Joe Horrocks-Taylor

- CalSTRS – Brian Rice

- Harvard Management Company – Michael Cappucci

- Invest Industrial – Serge Younes

- Legal and General Investment Management – Catherine Ogden, Michael Marks, Amelia Tan & Bruce White

- Nissay Asset Management – Tomoaki Fujii & Hayashi Loaned

- Nomura – Teppei Yamaga

- Nordea – Peter Sandahl

- Sumitomo Mitsui Trust Asset Management – Takeshi Wada & Ono Kenichiro

- Swiss RE – Claudia Bolli

- Transtrend – Harold de Boer, Joris Jan de Vliegar & Imra Geluk

- United Auto Workers Retiree Medical Benefits Trust – Kenneth Stemme

- Universities Superannuation Scheme – David Russell

- University of Toronto Asset Management Corporation – Chuck O’Reilly & Doug Chau

The interviews covered the following topics:

- Targets set/plans to set targets

- Target scope

- Asset allocation

- Engagement

- Reporting

The conclusions were drawn using a balance of views expressed during the interviews and primary desk research. The PRI has constructed a toolbox based on these interviews to help asset owners through the process of making and implementing climate commitments. The toolbox mirrors the PRI’s existing approach to the selection, appointment and monitoring of asset managers.

This report is not intended to provide technical guidance on the implementation of climate commitments across multi-asset portfolios, rather it highlights some of the relevant issues and considerations for asset owners.

Establishing baselines and setting targets

Key messages

This section reviews the challenges of establishing and pursuing climate commitments in multi-asset portfolios. Issues and options are explored across equities, corporate bonds, private equity, sovereign bonds, derivatives and short selling.

Multi-asset portfolios pose unique challenges for owners considering climate commitments. Each asset class, sector and region will have unique decarbonisation pathways, making it difficult to compare data and implement appropriate methodologies when setting targets to achieve climate commitments.

Data availability and quality

Interviewees described the availability of Scope 1, 2 and 3 data on greenhouse gas emissions (GHG) as one of the primary challenges when measuring portfolio emissions and setting climate targets for multi-asset portfolios.

A lack of consistent, accurate and timely GHG data across asset classes limited the ability of asset owners to quantify the emissions associated with their portfolio investments and to effectively develop GHG emissions targets across multiple asset classes. Where GHG emissions data from companies or assets can be obtained, the methodologies to calculate and apportion these emissions to certain asset categories are still in development.[2] A closer look at these issues, by asset class, follows.

Listed securities and corporate issuers

Carbon emissions data for many publicly listed companies and large corporate issuers are now reasonably complete across Scope 1 and 2 emissions, especially in jurisdictions with mandatory disclosure requirements for certain climate metrics and developed markets. The availability of such data has accelerated the development of comprehensive GHG emissions calculation methodologies, such as the Partnership for Carbon Accounting Financials (PCAF). Uncertainty over data and methodologies associated with measuring Scope 3 emissions remains an issue across all markets and asset classes.

Private equity

Interviewees commented that in some ways the private equity model is well adapted to setting climate commitments. Longer holding periods and, in some circumstances, closer governance relationships, mean investors ought to be better placed to collate data and set climate targets.[3] However, data collection and quality remain issues for respondents as private companies often do not have the same mandatory disclosure requirements as public companies.

Some private equity companies also have complicated ownership structures, making allocation of GHG emissions to an asset owner or investor more complex than listed equities or corporate issuers.

Interviewees described two approaches investors have taken to address the problem of data availability across private equity assets.

- Top-down: focus on the use of sector averages or other proxy data to estimate the GHG emissions of privately owned assets or companies.

- Bottom-up: focus on obtaining or estimating company and asset-level GHG emissions data based on company reporting. This approach has the added benefit of facilitating engagement with and between general partners and investee businesses in pursuit of improved emissions data.

Sovereign bonds

Investors in sovereign debt also face issues when calculating GHG emissions and allocating them to financed emissions. Current guidance for calculating financed emissions was developed to measure emissions associated with loans and investments to companies.[4] There is no single definition of financed emissions but broadly this is understood to be a measure of GHG emissions associated with an investment or lending activities. This might include Scope 1, 2 or 3 related to investments in a specific portfolio or by an institution. As interviewees highlighted, the existing approach to financed emissions is difficult to transpose into sovereign debt investments. Possible approaches are under development. For example, PCAF’s draft New methods for public consultation paper provides two potential methods to calculate and attribute the emissions of sovereign debt.

In the Territorial Approach, a sovereign is seen primarily as a national territory and attributable GHG emissions are those produced and consumed within its boundaries. As with a corporate entity, it has been proposed that these can be split into Scope 1, 2 and 3. Direct emissions (Scope 1) are attributed to activities within the sovereign’s boundaries. Indirect emissions (Scope 2) are attributed to the goods and services the country imports. Scope 3 emissions are attributed to gross exports. The primary challenge of this approach is that the emissions of corporates and sub-sovereigns within the territory are counted twice, resulting in double counting of listed equity or debt issuers operating within that national boundary.

The Government Approach focuses on the activities of central governments when attributing GHG emissions to sovereign bonds. Under this approach the government’s Scope 1 and 2 emissions are calculated in the same way as corporates, reflecting that they arise from government-owned buildings and purchased energy. Scope 3 emissions are calculated using indirect emissions (associated with expenditures, subsidies and investments) and non-governmental territorial production/consumption (e.g. from the corporate sector). This allows the separation of emissions between public and private sector activity, however Scope 1 and 2 will account for an extremely small percentage of GHG emissions compared to in-country emissions or those associated with national exports.

For these reasons, the majority of asset owners were cautious about including sovereign bonds in current climate commitments due to issues surrounding double counting, lack of clarity on calculation methodology and data quality.

This reticence may change over time as methodologies are developed. For example, the Assessing Sovereign Climate-related Opportunities and Risks[5] (ASCOR) Project was established to create a tool to provide investors with a common understanding of sovereign exposure to climate risk and of how governments plan to transition to a low-carbon economy.

Other financial instruments

Interviewees had a range of issues when investing in financial instruments or investment strategies with different economic exposures or governance relationships than listed equity, corporate issuers or real assets.

Derivatives, for example, are widely used in multi-asset portfolios to manage risk, lower costs and gain exposure to certain asset classes. Derivatives are financial contracts that derive their value from exposure to one or more underlying asset. Investors using derivatives do not necessarily have the same ownership rights as they would by holding a position in the underlying asset. As a result, asset owners and investment managers found it challenging to attribute and measure the GHG emissions relating to positions that are based on a financial contract between parties other than the company or underlying asset.[6]

Reporting short positions

A similar challenge exists for investment strategies such as shorting – where assets or securities are borrowed rather than owned.[7] Some interviewees advocated short strategies as an effective way to help meet climate commitments by offsetting emissions and influencing the cost of capital. Most of the discussion on this topic addressed issues of reporting GHG emissions and the effectiveness of engagement.

Shorting presents particular challenges when calculating and reporting portfolio GHG emissions due to the ability to short a range of asset classes and instruments and the different ownership structure of the underlying assets. Interviewees highlighted different approaches to reporting, including:

- not reporting short positions

- separate reporting of long and short positions

- netting long and short positions

Most interviewees stated that short positions should not be netted for the following reasons:

- Transparency: Ownership rights and ability to engage differ for long and short positions thus a single net portfolio calculation may provide a confusing presentation of portfolio emissions and the ability to engage.

- Intent: Short selling is incorporated into investment strategies for a range of valid and important purposes, which may bear no relation to climate commitments.

Though most interviewees agreed that providing GHG emissions based on gross portfolio positions provides a clearer representation of financed emissions, netting long and short positions may provide a clearer representation of certain risk exposures.

The IIGCC consultation paper on derivatives and the PRI paper on short positions discuss different issues surrounding the reporting of GHG portfolio emissions tied to long, short and net exposures and the use of derivatives. The interviews with signatories for this paper focused in particular on measuring real-world GHG emissions reductions, the effectiveness of engagement and the implications of different underlying ownership structures.

Though there was no consensus on these issues, there was a desire by interviewees to select calculation metrics that help them avoid misrepresentation of claims. Asset owners were generally keen to receive GHG emissions data that enabled calculation of underlying financed emissions using their own methodology rather than a pre-selected method.

Selected PRI resources

- Climate risk: An investor resource guide: Investors can use the resources, tools, and investor examples in this short guide to address the four pillars of risk management identified by the Task Force on Climate-Related Financial Disclosures (TCFD).

- An introduction to responsible investment: climate change for asset owners: Reviews the implications of climate change for asset owners and possible range of actions in response.

- ASCOR Project: Working alongside investors, the PRI is supporting a project to provide public debt investors with a common understanding of climate-related risk as it relates to sovereign countries.

- Incorporating climate change in private markets: An investor resource guide: A guide to different approaches required across private markets when considering climate change and introducing commitments.

- Target Setting Protocol Second Edition: Net-Zero Asset Owner Alliance protocol for setting climate targets to meet the 1.5-degree goal.

- Inside PRI Data: This report analyses asset owner signatories’ responses to the 2021 PRI reporting process and covers climate commitments, TCFD and approaches across asset classes.

Approaches to implementation

Key messages

This section reviews methodologies investors use when implementing climate commitments and shares strategies to increase their effectiveness. These strategies fall under three categories: divestment, engagement and asset allocation. For multi-asset portfolios, it was recognised that a flexible approach is required depending on the mix of assets.

Interviewees used a variety of techniques to implement climate commitments across multi-asset portfolios. These can be grouped into asset allocation, engagement and divestment with most using a combination of approaches to deliver reductions in real-world and portfolio GHG emissions. Though opinions varied on the effectiveness and relevance of different approaches in different asset classes, interviewees largely followed the structures similar to certain collaborative agreements, such as the NZAOA’s Target Setting Protocol.

Other commonly referred to methodologies are shown in Figure 3. This list is undergoing constant change and development.

Figure 3: Selected methodologies and guidance

- Science Based Targets initiative

- Glasgow Financial Alliance for Net Zero recommendations and guidance on net zero transition plans for the financial sector

- Paris Agreement Capital Transition Assessment

- Investor Climate Action Plans Expectations Ladder

- Paris Aligned Investment Initiative Net Zero Investment Framework

The specifics of these frameworks are available elsewhere. This section addresses some of the broader considerations around asset allocation, engagement and divestment across multi-asset portfolios.

Asset allocation

When discussing climate commitments in the context of asset allocation, interviewees explored two topics: transitional finance (also known as investing in climate solutions) and passive strategies.

Transitional finance

Transitional finance is defined by the NZAOA’s Target Setting Protocol as economic activities that contribute to climate change mitigation or adaptation. In addition, they “must be assessed to ensure they do not cause significant harm to all remaining environmental or social objectives.”

Despite significant pledges by many asset managers and owners as part of net-zero strategies and targets, the proportion of assets committed to climate solutions remains low relative to the capital required to meet the goals of the Paris Agreement.[8] Interviewees highlighted different steps they had undertaken to increase allocation to climate solutions. These included:

- Introducing specific % or AUM target invested in climate solutions such as renewable infrastructure;

- Introducing broader % or AUM target invested in more loosely defined sustainable investments and ESG tilted assets;

- Setting future dates for when these % or AUM targets might be met;

- Increasing allocation to asset classes which were perceived as making potentially large contributions to climate commitments, such as infrastructure.

Passive investment strategies

Interviewees reported widespread adoption of passive strategies across multi-asset portfolios. They discussed the important implications and trade-offs for implementing climate commitments, including:

- Limitingdivestment: Replicating standard benchmarks restricts the ability of the asset owner to divest from companies or specific assets when engagement has been unsuccessful.

- Managing climate-related risk: The inability to manage sector and country exposures makes it more difficult to manage GHG emissions levels.

Interviewees are responding to these challenges in different ways:

- Benchmark selection: Shifting allocations to quantitative strategies or benchmarks with ESG tilts, stated GHG emissions reduction targets and/or engagement strategies;

- Mandate design: Aligning investment mandates with climate commitments to enable the selection of ESG benchmarks;

- GHG emissions reporting: Developing approaches to reporting on passive portfolios that enable comparisons with active portfolios on GHG emissions and effectiveness of engagement.

Engagement

It was widely recognised throughout the interviews that – without an engagement process connected to climate commitments – asset owners have little prospect of achieving reductions in either financed or real-world emissions. This observation was also clear during the PRI’s recent workshops with active listed equity asset managers – engagement is perceived as the key tool to reaching climate and net-zero commitments.

Interviewees described several important considerations when undertaking engagement with investees in multi-asset portfolios.

Adapting engagement to investment style

The role and effectiveness of engagement differs based on investment strategy and portfolio composition. For example, interviewees identified that approaches to engagement need to reflect and adapt to different investment strategies (e.g. passive strategies), asset classes (e.g. those with higher barriers to divestment, such as real assets) or different governance structures (e.g. private equity).[9]

Collaboration

The diversity of holdings in multi-asset portfolios often means position size is a perceived barrier to effective engagement. Several interviewees referred to the importance of collaborative initiatives such as Climate Action 100+ to sharing the burden and cost of engaging with multiple companies.

Interviewees participating in such initiatives reported that it was important to ensure investors and stakeholders have a full understanding of programme involvement and its contribution to climate commitments. This includes providing a clear picture of membership status, levels of involvement, actions as members and alignment of the organisation’s climate commitments.

Focus on achievable quantitative measures

Asset owner interviewees had strong views on the benefits of quantifying and tracking engagement processes and results. Achievements were usually monitored through regular meetings between asset owners and managers and tracked through qualitative engagement milestones or certain quantifiable activities (e.g. exercising voting powers). Measuring actions or processes such as proxy voting was relatively straightforward but transposing these into portfolio or real-world emissions was more challenging. Interviewees referred to frameworks such as the Climate Action 100+ Net Zero Company Benchmark as useful when attempting to measure the impact of engagement on emissions reductions, disclosure and governance.[10] However this and similar benchmarks have largely been designed for listed companies or corporate debt issuers and remain undeveloped for other asset classes.

Engagement plan

For multi-asset portfolios, a lack of a clear engagement plan or process was an issue identified by many interviewees. They identified three important aspects for multi-asset portfolios:

- Leveraging cross-portfolio holdings

Multi-asset strategies may result in investing in a single asset or company through different investment vehicles or across asset classes. This provides an opportunity for asset owners to leverage influence across multiple ownership structures, including public equity, private debt and corporate fixed income.

- Targeted engagement

A sizeable minority of interviewees targeted engagement on the small percentage of the portfolio constituents that represented a high percentage of Scope 1 and 2 emissions. In some examples the majority of portfolio GHG emissions was generated by under 10% of total portfolio AUM. Investors also prioritised engagements where they could have a strategic advantage in influencing outcomes, such as holding size (e.g. large absolute AUM), domicile (e.g. local to the investor or asset owner) or overlooked companies, perhaps because they are smaller.

- Creating a structured escalation plan

A recent analysis from the PRI’s 2021 Reporting Framework highlighted that many asset owners do not have effective escalation strategies. Interviewees provided examples of approaches taken within multi-asset portfolios, including:

- providing a public engagement plan with specific objectives

- prioritising selected holdings[11]

- providing a timeframe for action and associated strategies for escalation and communicating progress

Divestment

Interviewees noted that divestment can play an important role in reducing a portfolio’s financed emissions, although some countered that it does not necessarily result in real-world GHG emissions reductions. Considerations around the use of divestment as a tool to meet climate commitments included:

Asset relocation

Interviewees debated the impact on real-world GHG emissions of divestment when publicly quoted assets were sold to other investors or private markets with lower expectations around transparency or engagement. This was noted as being particularly important in high emitting or energy intensive sectors, such as commodity extraction, oil and gas and utilities.

Meeting interim targets

Interviewees reported that, for many portfolios or mandates, divestment was a simple mechanism for achieving interim portfolio targets, given that a high percentage of Scope 1 and 2 emissions originated from a small number of companies or assets. This raised a debate among interviewees about whether meeting interim targets through selective divestment was an effective mechanism to produce real-world GHG emissions reduction.

Despite these issues, those who use the strategy outlined three ways divestment might influence real-world GHG emissions reductions:

- Increasing capital available to allocate to climate solutions or transitional finance;

- Prompting action by other asset owners through public signalling;

- Impacting on the cost of capital.[12]

CREDITS: Deloitte LLP contributors: Katherine Lampen – Partner, Ido Eisenberg – Director, Ruby White – Associate Director, Rosie Woodall – Senior Manager, Luke Dickinson – Manager, Samuel Menon – Consultant | PRI contributors: Jack Balsdon, Toby Belsom, Elke Pfeiffer | Editor: Casey Aspin

Downloads

Achieving Climate Commitments in Multi-Asset Portfolios

PDF, Size 0.77 mb

References

[1] The PRI (2020) Technical guides: selection, appointment and monitoring

[2] Partnership for Carbon Accounting Financials (Nov 2020) The Global GHG Accounting & Reporting Standard for the Financial Industry

[3] CERES (June 2021) The Changing Climate for Private Equity | Ceres

[4] PWC (reviewed summer 2022) Financial institutions are pledging to lower carbon footprints. Here’s what you need to know about financed emissions

[5] ASCOR (reviewed Summer 2022): Project update

[6] IIGCC (May 2022) Derivatives and hedge funds discussion paper

[7] Partnership for Carbon Accounting Financials (Nov 2020) The global GHG Accounting & Reporting standard for the financial industry

[8] Various sources including: European Commission (Summer 2019) Financing Sustainable Growth (PDF)

[9] The PRI (2020) ESG engagement for sovereign investors

[10] Climate Action 100+ (reviewed Summer 2022) Net Zero Company Benchmark

[11] Legal & General (reviewed Summer 2022) LGIM Climate Impact Pledge score

[12] Broccardo, Hart and Zingales (2020), Exit vs. voice; Berk and van Binsbergen (2021), The impact of impact investing; Teoh, Welch and Wazzan (1996), The Effect of Socially Activist Investment Policies on the Financial Markets: Evidence from the South African Boycott. For a literature review: Kölbel et al (2020), Can Sustainable Investing Save the World? Reviewing the Mechanisms of Investor Impact