Message from Cathrine Armour, Chief Responsible Investment Solutions Officer

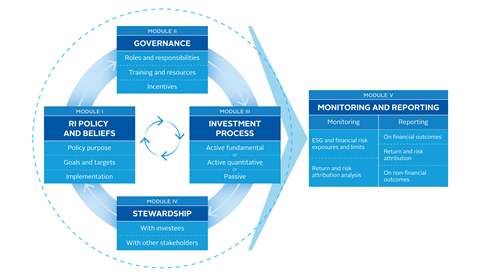

The tangible products and services – reporting, assessment, tools, knowledge and guidance – that the PRI offers, enable our signatories in their adoption of responsible investment, and support them in furthering their ESG processes and practices. Additionally, they address the advance of the mission whilst providing insights – to signatories and the wider market – into progression and performance, informing future focus of efforts for both our signatories and the PRI.

Strengthening our approach to determining, designing and delivering products and services that create value across the mission ecosystem enables us to support a growing signatory base, address diverse signatory needs and extend our change agency as new challenges emerge.

Mission-led, signatory-centric solutions

Our objective for our responsible investment solutions work is to create value for our signatories that is in line with our mission. We will do this through products and services that are mission-led and signatory-centric.

We will look to develop and deliver practical, accessible solutions, to build market capability, drive progression and ensure accountability. With more than 5,000 signatories, designing our offering to meet a variety of signatory needs will be crucial. Our approach will be informed by signatory engagement, research and data insights as well as by internal and external thought leadership.

The PRI in a Changing World consultation identified a strong desire for the PRI to support signatories in making progress, and to provide ways for signatories to demonstrate that progress. Guidance, tools and training were called out as our most important offerings, particularly to new joiners.

Reporting and assessment, guidance and investor education will thus form the core of our responsible investment solutions offering.

Supporting individual needs

Better tailoring our offerings to different groups will mean taking a more disciplined approach to determining, creating and delivering value to our signatories, and will require us to work in an agile, iterative way.

We will do this through products and services that are mission-led and signatory-centric.

We have started the transition from a project to a product and services approach to determining, creating and delivering value to our signatories. This will be expanded upon and embedded.

Through a product development function, we will undertake the research, design and development of new and enhanced products and services, as required by signatories and by stakeholders across the organisation, and informed by the PRI’s strategic and research objectives.

Product management will align and optimise the value to signatories of the products and services we offer, as well as product managing our portfolio of products to ensure that they continue to meet signatory needs and provide clear value, while furthering the PRIs mission – this includes our reporting and assessment suite, accountability, guidance, content and standards.

Investor education, such as through the PRI Academy, will continue to build market responsible investment capability and capacity, leveraging the PRI’s unique thought leadership, content and standards expertise. We will design, develop and curate the education and training offer for signatories, building market capability and capacity, and expanding the offering to meet changing market needs.

A new approach to data science and analytics will enhance how we manage the data that underpins our product and services. Data analysis will also drive development of actionable insights, including the provisioning of associated data products and services to signatories.

Value for signatories

To enable increased benefit for our signatories, we need to become more specific, focused and agile in our delivery. This is the reason we have chosen to adopt a product approach to meeting signatory needs and enhancing cross-functional collaboration to deliver our value proposition.

We will need to ensure that this approach is understood and embedded across the organisation; leveraging insight and thought leadership from across the PRI, aligning with our strategy and across like and thematic requirements, designing viable, desirable and feasible offerings, and prioritising development and delivery.

Reporting and assessment

Delivering a reporting process that meets the needs of our signatories and provides visibility of global responsible investment practices

Following the pilot of our ambitious new Reporting Framework and Reporting Tool in 2021, we have worked hard this year to deliver 2021 Transparency Reports and Assessment Reports, roll out improvements to our platforms and deliver an improved reporting experience in 2023.

Wrapping up 2021 reporting

In September 2022, we released the 2021 Transparency Reports and Assessment Reports, closing out the rescheduled 2021 reporting process. The reports were accompanied by improvements to the Data Portal, with new features allowing signatories to compare their results across peer groups and download public datasets. Responding to suggestions from signatories, further enhancements were rolled out in early 2023, adding new filters and visualisations.

Launching 2023 reporting

In January 2023, we published the 2023 Reporting Framework, enabling signatories to familiarise themselves with the structure and content a few months ahead of reporting opening. The 2023 Reporting Framework is a significant iteration on the Reporting Framework piloted in 2021, responding to signatory feedback on the need to improve clarity, consistency and applicability, and to reduce the reporting effort.

Improvements include fewer indicators, less granular breakdown of AUM indicators, rewritten indicators and restructured pathways. Enhanced guidance materials and an upgraded and more user-friendly Reporting Tool have significantly improved the process of reporting.

We are also piloting embedding Net Zero Asset Managers (NZAM) reporting into PRI Reporting.

Due to the significant changes to the Reporting Framework for the 2023 reporting cycle, the existing minimum requirements remain in place and the Leaders’ Group remains paused.

Service provider reporting

The Reporting Framework for service providers has remained largely unchanged from when it was fully implemented in 2018, through to the most recent reporting cycle in 2021. Given the need for our reporting to keep pace with the realities of the rapidly evolving responsible investment industry, this year we decided to pause reporting for service providers until we have reviewed how best to update service provider reporting to ensure it continues to deliver meaningful insights – for our signatories and the wider industry.

Guidance

Providing the tools and practical support for signatories to improve their practices

Updated ESG integration guidance for listed equities

Our new technical guide on ESG integration in listed equity updates our ever-popular 2016 guide with the latest investment practice. Providing practical examples of ESG integration techniques, it particularly expands coverage of passive and quantitative approaches.

Guidance for asset owners

Delivering tailored guidance for asset owner signatories continues to be a priority.

In response to COP26, an increasing number of asset owners have set ambitious targets for supporting delivering of The Paris Agreement. The increased scrutiny accompanying a wave of public announcements has made it more important than ever for investors to back up commitments with actions. Sharing insights from interviews with 18 leading multi-asset investors, our discussion paper on achieving climate commitments in multi-asset portfolios outlines relevant considerations on how to develop a consistent approach across asset classes, through each stage of the asset owner-manager relationship.

Our suite of due diligence questionnaires (DDQs), which continue to be popular tools for asset owners to use as a basis for challenging managers, has seen two additions, covering fixed income and venture capital – with DDQs now available for all major asset classes for the first time.

We published more than 70 case studies throughout the year, providing examples of signatory practice on topics including net zero commitments (measuring progress, approaches across sectors and the role of engagement) and human rights (across employee issues, modern slavery and in sovereign debt).

Analysing investment manager practice

Following our analysis of asset owner practices, this year we explored the work of investment manager signatories, finding that there are many responsible investment approaches that are now widely practised.

A large majority publish core policies and have executive oversight of their implementation. Almost 85% say they make their overall approach to responsible investment publicly available, including how it is implemented and overseen. Roughly 70% say they have a stewardship policy, and most track and manage climate-related risks, allocating responsibility to senior management teams.

We also identified a range of areas where investment manager signatories could go further – across the detail seen in both overall responsible investment policies and stewardship policies, accountability for implementing responsible investment, the quantity and quality of ESG information in client reporting and implementation of TCFD recommendations.

Investor education

Training investment professionals on how ESG issues affect investment decision making

PRI Academy

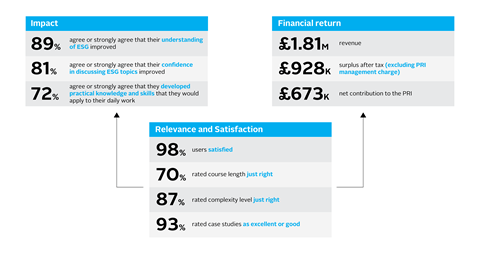

Demand for the PRI Academy’s courses remains high, with investors increasingly keen to build organisation-wide fluency in ESG approaches. The year saw 29% year-on-year revenue growth, reaching £1.8m (£1.4m in 2021/22).

Responding to increased interest from private markets, this year we launched new course ESG in Alternative Investments, for both asset owners and managers. To ensure an accessible and engaging learning experience, we took a new approach to course development, utilising new tools and extensive user experience testing. Following positive results, we have since began a full refresh of PRI Academy courses, with further course launches due in mid-to-late 2023.

New mechanisms for feedback and impact evaluation have shown us not only that overall satisfaction rates remain extremely high, but that almost three-quarters of learners had developed practical knowledge and skills that they would apply to their daily work.

PRI Academy at PRI in Person

At PRI in Person, the PRI Academy introduced delegates to the platform, and held a breakout session highlighting research on the importance of ESG training in realising responsible investment strategies. Adrie Heinsbroek, Chief Sustainability Officer at NNIP, presented on the impact that NNIP had seen from widespread use of the PRI Academy across the organisation.

<< Responsible Investment EcosystemsHome Investor Initiatives >>