By Claudio Rizzi, University of Miami – Miami Herbert Business School

Even if carbon emissions fall dramatically, the effects of climate change will continue to impact economies worldwide. We face a new reality of extreme weather, with storms and flooding, and we must find new ways to adapt.

Research in environmental economics shows that natural ecosystems are excellent at absorbing weather shocks. For instance, wetlands and forests collect excess precipitation and reduce flooding.

In my paper, I focus on the economic benefit of natural areas (or natural capital) and, specifically, how nature conservation can impact financial markets. I find robust evidence that nature’s mitigation role against extreme weather translates into a decrease in borrowing costs for counties in the United States. The results provide evidence in favour of preserving local natural areas.

Natural capital and municipal bond yields

My study looks at the relationship between natural capital loss and municipal bond yields. Municipal bonds are financial instruments that local governments use to fund local projects, such as schools and hospitals. I focus on the United States and two types of natural capital loss: long-term changes in wetlands and loss of forests and wetlands in protected areas.

Such natural capital loss is triggered by federal regulations that decrease the size of a protected area or allow the clearing of vegetation for various purposes, such as small commercial activities or infrastructure projects. For example, the government permitted the construction of trails and car parks to facilitate access to wildlife refuges and national parks.

First, I examine long-term changes in wetlands and, specifically, I compare the impact of changes in upstream wetlands to changes in downstream wetlands. This allows me to estimate the flood risk mitigation effect of wetland loss on municipal bond yields since only wetlands upstream mitigate flooding (except for coastal areas).

In particular, when studying long-term wetland changes across 11 years, I find that a 748-hectare loss in upstream wetlands (more than twice the size of New York City’s Central Park) is related to an increase in municipal bond yields of 0.47%.

The implications for a county’s borrowing costs are substantial. In fact, such a wetland loss equates to an 11% increase in annual interest expense (US$4 million) for an average county. Interestingly, almost all yield changes happen during extreme precipitation events.

Next, I examine the difference in municipal bond yields between counties that experience a loss in natural capital and those that do not. I restrict the study to counties impacted by extreme precipitation, which allows me to estimate the extreme-weather mitigation value of natural capital and determine how its loss is priced in the market.

After a storm, how did each area fare?

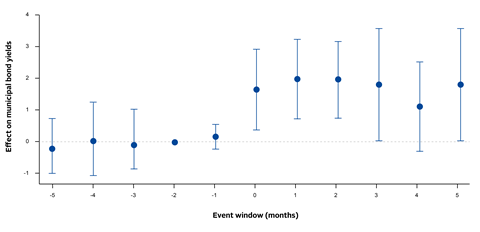

In the five months following a period of extreme precipitation, I find that counties that experience a loss in natural capital see an increase in municipal bond yields of about 17 basis points compared to counties that do not lose natural capital.

Figure 1: The difference in municipal bond yields between counties with natural capital loss and counties with no natural capital loss after an extreme weather event

On the other hand, I find no difference in municipal bond yields when the natural capital is lost – the increase only occurs once there has been an extreme weather event.

The economic magnitude of such yield increases is huge. In particular, the loss to bondholders’ wealth is equivalent to US$2.45 billion.

And the effect is not limited to just these few months after an extreme weather event; evidence shows that it can persist for up to three years.

Why municipal bonds are related to nature

To clarify the way natural capital loss affects municipal bond yields, I investigate the relationship between local climate change risk, natural capital loss, and extreme weather events.

Areas exposed to wetland loss see an increase in property and crop damages between US$13,000 and US$15,000 for each hectare of wetland lost. This result emphasises how nature conservation directly decreases local extreme-weather risk.

In addition, counties more dependent on local revenue experience the largest bond yield increases, showing a direct link between natural capital loss and a decrease in local cash flows available to repay bonds.

Policy implications of natural capital loss

The dangers of natural capital loss do not hit equally. I found that counties where the economy depends on farming experienced the worst impact, due to the industry’s exposure to the effects of extreme weather. Without natural areas to buffer those impacts, crop damage threatens the broader food supply.

In addition, areas exposed to more frequent and more intense precipitation events (i.e., hurricanes and tropical storms) are affected up to three times more than other areas. This shows how coastal areas threatened by sea level rise are even more vulnerable to global warming.

These insights suggest that policy makers should account for the innumerable roles of nature when assessing urban and economic development that entails the destruction of natural capital.

Policy and corporate agendas seem to target emissions reductions, which are important but only part of the picture. So it is essential to clearly identify the pros and cons of infrastructure projects and how nature and biodiversity loss will impact local communities.

In addition, it would be valuable to promote nature-based solutions through novel financial instruments such as green bonds. For example, the state of Massachusetts funded the acquisition of conservation rights for 70 acres of coastal land. These bonds attract new environmentally conscious investors while helping to reduce risk.

The more we protect nature, the easier the path will be towards a cleaner and more resilient future. There is a role for all: from individuals to governments and large corporations. Recognising nature’s financial and economic importance provides additional arguments for nature conservation.

This paper was presented at the PRI Academic Network Week 2022.

The PRI’s academic blog aims to bring investors insights from the latest academic research on responsible investment. It is written by academic guest contributors. Blog authors write in their individual capacity – posts do not necessarily represent a PRI view.