This report was created to provide guidance to PRI signatories – both asset owners and investment managers – on investing for sustainability impact.

Executive summary

Long-term investors who overlook sustainability outcomes or systemic risks may be neglecting crucial factors that are essential for protecting the investments of their beneficiaries or clients.

For this reason, institutional investors are increasingly undertaking investing for sustainability impact (IFSI). This shift is driven by evolving investor practice, changes in policy and regulations, and a growing recognition of the systemic risks and opportunities associated with issues such as climate change, biodiversity loss, and human rights.

This guide introduces a four-part framework for investors to implement IFSI, drawing on the findings of the report, A Legal Framework for Impact.

The four parts are:

- Determine the investor’s intention, including beliefs, financial return goals, and how real-world sustainability impact contributes to and results from those beliefs and financial return goals.

- Set real-world sustainability goals that align with intentions.

- Take action through capital allocation, stewardship, and policy engagement, which are best used in combination.

- Measure and report on progress.

In addition to the actions an investor might take, this guide considers the degree of influence of those actions, potential KPIs, and how to get started. For example, escalation in stewardship or real-economy policy engagement may be highly effective in pursuing sustainability goals.

Putting this framework into practice is not without its challenges.

Complex intermediation chains and misaligned incentives can hinder the achievement of goals. Corporate lobbying may conflict with investors’ goals, and the long-term nature of sustainability outcomes can be hard to capture within traditional investment time horizons. This guide explores these challenges and provides insights into potential solutions.

Alongside this guide, we encourage the review of asset owner case studies, which we have published to demonstrate IFSI in practice.

Introduction

This report was created to provide guidance to PRI signatories – both asset owners and investment managers – on investing for sustainability impact.

If an asset owner or investment manager concludes, or on the available evidence ought to conclude, that one or more sustainability factors poses a material risk to its ability to achieve its financial investment objectives, it will generally have a legal obligation to consider what, if anything, it can do to mitigate that risk (using some or all of investment powers, stewardship, policy engagement or otherwise) and to act accordingly.A Legal Framework for Impact: sustainability impact in investor decision-making’, Freshfields Bruckhaus Deringer, 2021 - p141

Published in 2021, a Legal Framework for Impact (LFI) found that, in the jurisdictions analysed, investing for sustainability impact, which we abbreviate as IFSI, is consistent with fiduciary duties and, in many cases, required.

IFSI occurs when asset owners and/or their investment managers take action to pursue a sustainability impact goal.

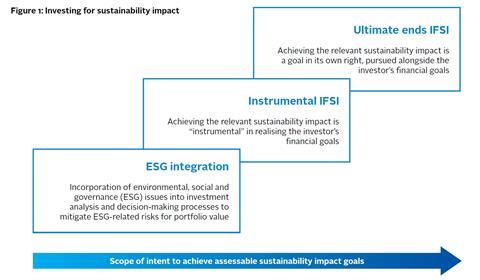

To support the development of the legal analysis, the LFI report identified two approaches to IFSI. IFSI pursues a realworld sustainability goal, either to achieve financial goals and fulfil legal duties (instrumental IFSI), or in parallel to such objectives (ultimate ends IFSI). In more detail:

- In instrumental IFSI, achieving the sustainability impact goal is ‘instrumental’ in realising the investor’s financial return goals. This could include pursuing a sustainability goal intended to reduce a systemic risk or address the drivers of financially material, system-wide sustainability risks (or take advantage of a systemic opportunity) to help an investor achieve their financial objectives.

- Ultimate ends IFSI is where achieving the sustainability impact goal is pursued as an end in itself, alongside the investor’s financial return goals. This could include an investor’s pursuit of a sustainability goal irrespective of its potential contribution to their financial goals.

IFSI is related to but different from what is commonly termed ‘ESG integration’. ESG integration is the practice of using sustainability data to inform investment decisions. That process may not involve the intent to have a positive impact. When it does, the intention to have an impact and the associated actions would be considered IFSI.

This guide does not replay the legal arguments set ot in LFI. Rather, it provides guidance to investors on IFSI.

We recognise that IFSI is not market-friendly language[1]. We believe that it is best expressed through the actions involved. This report introduces four main steps, adapted from the insights found in the LFI report:

This is an iterative process whereby the assessments of both progress and context feed back into ongoing updates to analysis and strategy.

|

IDENTIFY REQUIRED OUTCOMES |

Identify system-level risks and required outcomes |

|

E.g. Climate change is a system-level risk to the entire world economy. Mitigating it requires limiting global warming to 1.5C, as per the Paris Agreement. |

⬇

|

SET STRATEGY |

Set specific sustainability impact goals |

|

E.g. Reduce the combined CO2 emissions of companies in the investment portfolio to a level commensurate with the 1.5C goal. |

⬇

|

TAKE ACTION |

Use levers to invest for sustainability impact |

|

E.g. participate in collective engagements on emissions reductions, use voting powers accordingly. |

⬇

|

ASSESS IMPACT |

Monitor and assess impact |

|

E.g. monitor investee company strategy, targets and actions; monitor company and portfolio CO2 emissions; assess alignment with 1.5C goal. |

Because not all actions are equally influential, within the third step, ‘Take action’, we also encourage investors to onsider ‘influence’ - the extent to which their actions influence progress towards the real-world sustainability goal.

Finally, we consider some of the challenges in implementing IFSI.

Download the report in full below

The Legal Framework for Impact programme is a collaboration between PRI, the UN Environment Programme Finance Initiative (UNEP FI), and The Generation Foundation.

Downloads

References

[1]The legal researchers used the term as a conceptual framework to capture whether a specific set of behaviours was permitted or required. IFSI includes asset allocation, stewardship and policy advocacy.