By Xia Li, Boston University

Companies across the globe are facing increasing physical climate risks. Droughts and heat stress gripped the US, Europe, and China this summer, affecting labour productivity, resource availability, and cargo shipping. Floods in Pakistan and Australia halted factory operations and wiped out crops.

How are companies responding to these problems and the growing risks of climate change?

In my recent study, I developed a dataset to measure companies’ climate change adaptation, merged it with climate science data, and examined whether and how public companies globally are adapting to physical climate risk exposure.

Are companies adapting to physical climate risks?

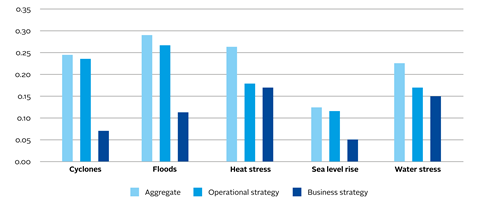

Most companies are not adapting to the majority of climate risk drivers. The average rate of disclosed adaptation across all companies and climate risks is 23%. Figure 1 shows the likelihood – on average – of public companies’ adaptation to various climate risk drivers.

Several factors may stop companies from adapting to physical climate risk exposures:

- Not being able to accurately estimate the long-term impacts of climate change, which cannot be easily calculated based on historical data;

- Not being able to adapt to all climate risk drivers as they are broad and adaptation is costly;

- Having a short-term focus, leading to less investment at the expense of long-term adaptation benefits; and

- Trying to transfer adaptation costs to other parties, such as governments.

Figure 1 also suggests that companies are adapting more through operational than business strategies. This could be because operational measures are relatively quick to initiate or less costly than business strategies, and can be easily justified. In contrast, shifting business strategies is more difficult and takes a longer time.

Figure 1: Disclosed climate change adaptation by climate risk driver

What is driving companies to adapt to physical climate risks?

Companies are sensitive to the type of physical climate risks they face and their level of exposure to them. On average, they are more likely to adapt more often and more completely to higher climate risks that affect their own business.

However, the relationship between climate risk and adaptation varies across regions and industries, and evolves over time:

- Companies headquartered outside Europe and North America are not responsive to climate risks that affect them the most;

- Companies in the real estate industry face the highest overall level of climate risk, and those in the energy and utilities industry have the highest adaptation rate; and

- Companies become more responsive to high climate risks over time, particularly for adaptations categorised as business strategies.

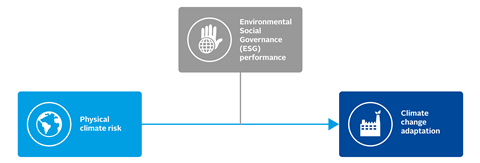

Physical climate risk exposure is not the only driver of companies’ adaptation strategies. Other factors, such as companies’ ESG performance, can influence their willingness and capabilities to adapt. Figure 2 illustrates this relationship. Organisational resources obtained by companies to improve their environmental and social impacts are linked to climate change adaptation and prepare them to adapt more when facing higher climate risk.

Figure 2: Physical climate risk, climate change adaptation, and ESG performance

What are the policy and managerial implications?

My study offers insights for policy makers, company managers, and investors.

Environmental policies have traditionally focused on regulating companies’ environmental impacts, such as reducing pollution. In recent years, governments have been trying to mitigate the effects of climate change by introducing carbon pricing or setting targets to cut greenhouse gas emissions. Yet, climate change adaptation policies are rare, as regulators usually expect companies to have the necessary foresight to pursue adaptation strategies as an obvious preventative measure.

The findings of this study suggest that although companies are sensitive to their own type and level of climate change exposure, they do not always adapt automatically. How companies adapt is influenced by factors such as their adaptive capability and how they perceive climate risks. Adaptation policies that guide and encourage companies to address the impact of climate change are therefore needed.

The different adaptation strategies categorised in the study can help company managers seeking to identify best practices or to compare their own risk management policies and adaptation measures to those of their peers and rivals.

The results can also inform investors about the climate risk exposures their portfolio companies face and the adaptation strategies they have taken. This information can help them manage the overall risk exposure of their investment portfolio and to allocate capital more efficiently.

This paper was presented at the PRI Academic Network Week 2022.

The PRI’s academic blog aims to bring investors insights from the latest academic research on responsible investment. It is written by academic guest contributors. Blog authors write in their individual capacity – posts do not necessarily represent a PRI view.