Investors should address plastic waste and pollution through their stewardship activities. Failing to do so impacts the environmental systems and ecosystem services that support economic performance, investor returns and beneficiary interests more broadly.

To help investors do this, we have produced engagement guidance focused on four sectors in the plastic packaging value chain.

Plastics: What risks are investors exposed to?

When analysing the plastics value chain, investors need to understand that they and their investee companies are exposed to a range of risks[1], including:

- Policy and regulatory risks: many developed and developing countries are regulating – or in some cases banning – certain plastics. Companies that rely on plastics could also face higher taxation, extended producer responsibility fees and increased raw material costs.

- Reputational risks: companies that are heavily reliant on plastics face growing scrutiny and potentially significant reputational damage, as consumers become increasingly aware of the impacts of plastic pollution. Packaging has been the target of several campaigns against plastic.[2]

- Climate-related risks: projections suggest that emissions from plastic could account for 10% – 13% of the Earth’s remaining carbon budget by 2050 if plastic production and use grow as currently planned.[3]

- Wider environmental risks: mismanaged plastic waste contributes to waterway and ocean pollution, which clogs urban infrastructure and degrades natural systems, such as the ocean. The cost of such externalities to society, when considered alongside the greenhouse gas emissions of plastic packaging production, is conservatively estimated to amount to US$40 billion annually.[4]

- Human health risks: microplastics, which have been detected in bottled water and the tissue of fish and other marine life[5], may have negative health impacts when ingested by humans. These are not yet fully understood but if they are determined, may cause heightened societal concern and health-related restrictions on plastic use if detected in the future.

With most plastic packaging used only once, 95% of its potential economic value (US$80 billion – US$120 billion annually) is lost [6]

Addressing these risks and transitioning to a circular economy – where plastic production is decoupled from fossil fuel use and all plastic packaging is reused, recycled or composted – will create investment opportunities, while reducing the impact of plastic packaging, meeting consumer needs and contributing to achieving the Sustainable Development Goals, for example:

SDG 12.5: substantially reducing waste generation through prevention, reduction, recycling and reuse by 2030;

SDG 14.1: preventing and significantly reducing marine pollution of all kinds, particularly from land-based activities, including marine debris and nutrient pollution, by 2025.

Emissions from plastic could account for 10% – 13% of the Earth’s remaining carbon budget by 2050 if plastic production and use grow as planned [7]

A circular economy for plastics

A circular economy – by design – eliminates waste and pollution, keeps products and materials in use, and regenerates natural systems, offering a solution to plastic pollution. The Ellen MacArthur Foundation’s New Plastics Economy offers a vision of a circular economy for plastics that investors can support through their engagement activities.

Achieving this will require changes along the entire plastics value chain.

What should investors do?

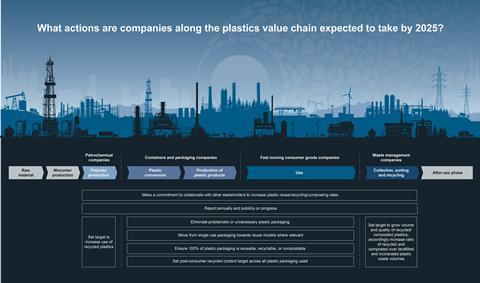

Investors should constructively engage with companies in the plastic packaging value chain to determine how they are managing risks and opportunities in relation to plastic packaging and encourage them to take action by 2025 to:

- eliminate the production and use of problematic or unnecessary plastics[8];

- innovate to ensure that all plastics are reusable, recyclable, or compostable; and

- circulate materials to keep plastics in the economy and out of the environment.

Some actions are applicable across the plastic packaging value chain, others vary depending on the sector (petrochemicals, containers and packaging, fast-moving consumer goods and waste management):

Using the PRI’s engagement guides

Each engagement guide includes:

- a sector overview related to its use of or role in producing plastic packaging, waste, and pollution;

- questions focused on governance, risk management and reporting, performance, and impact, to support engagement dialogues;

- a table to help investors understand company progress against the actions and outcomes required to address plastic waste and pollution; and

- examples of company best practice.

These are based on extensive research, input from the Plastics Investor Working Group and the Ellen MacArthur Foundation, as well as the New Plastics Economy Global Commitment.

For action on plastic packaging to be effective, it needs to be taken across several areas, including an organisation’s own products, in the value chain, and with wider stakeholders. [9]

The use of plastic packaging and the contribution to waste and pollution differs across the petrochemical, containers and packaging, FMCG, and waste management sectors due to their positions in the plastic packaging value chain. There are also varying practical considerations in each sector that can present challenges for engagement.

About this project

In 2019, the PRI published the Plastics Landscape Series, consisting of three reports and an online interactive data tool.

In 2020, the Plastic Investor Working Group[10], with input from the Ellen MacArthur Foundation, initiated a follow-up project to develop guidance for investors engaging with companies in the plastics packaging value chain across four sectors: petrochemicals, manufacturing (of containers and packaging), fast-moving consumer goods and waste management.

While investors can also address plastic pollution using other stewardship strategies, such as shareholder resolutions, voting, and policy engagement, these actions are beyond the scope of this project. The PRI may consider them in the future.

References

[1] World Economic Forum, Ellen MacArthur Foundation and McKinsey & Company (2016) The New Plastics Economy — Rethinking the future of plastics

[2] A range of research exists regarding plastics risks, including: Federated Hermes (2020) Investor Expectations for Global Plastics Challenges; Ellen MacArthur Foundation (2016) The New Plastics Economy Rethinking the Future of Plastics; Ellen MacArthur Foundation (2017) The New Plastics Economy: Catalysing Action; Ellen MacArthur Foundation (2020) Financing the Circular Economy: Capturing the Opportunity; Pew Charitable Trusts and SystemIQ (2020), Breaking the Plastic Wave: A Comprehensive Assessment of Pathways Towards Stopping Ocean Plastic Pollution.

[3] PRI (2018) The plastics landscape: Risks and opportunities along the value chain

[4] The carbon budget refers to the total amount of carbon emissions that can be emitted for temperatures to remain at or below a specified limit i.e. the 1.5-degree limit outlined in the Paris Agreement. See CIEL (2019) Plastic & Climate: The Hidden Costs of a Plastic Planet for more detail.

[5] Ellen MacArthur Foundation (2016) The New Plastics Economy Rethinking the Future of Plastics

[6] Pew Charitable Trusts and SystemIQ (2020), Breaking the Plastic Wave: A Comprehensive Assessment of Pathways Towards Stopping Ocean Plastic Pollution.

[7] CIEL (2019) Plastic & Climate: The Hidden Costs of a Plastic Planet

[8] According to the Ellen Macarthur Foundation, problematic or unnecessary plastic packaging may be identified through using the following criteria: it is not reusable, recyclable, or compostable; it contains, or its manufacturing requires, hazardous chemicals that pose a significant risk to human health or the environment; it can be avoided (or replaced by a reuse model) while maintaining utility; it hinders or disrupts the recyclability or compostability of other items; it has a high likelihood of being littered or ending up in the natural environment. For more detail, see Ellen Macarthur Foundation (2020) New Plastics Economy Global Commitment: Commitments, Vision and Definitions.

[9] Global dependency on plastics is so pervasive that bold, concerted, and large-scale actions on upstream and downstream solutions are needed – see Pew Charitable Trusts and SystemIQ (2020) Breaking the Plastic Wave: A Comprehensive Assessment of Pathways Towards Stopping Ocean Plastic Pollution.

[10] The PRI’s Plastic Investor Working Group consists of 29 global investors representing US$5.9 trillion in assets.