According to the Principles for Investors in Inclusive Finance (PIIF), about two billion adults – more than half of the world’s working population – are excluded from formal financial services. In developing countries, 80% of the most economically disadvantaged individuals do not have bank accounts.

Inclusive finance bridges this gap, offering savings, credit, insurance, remittances and payments services to those who would otherwise not have access to them.

“The Market Map project brings more structure to the impact investing world, particularly for investors. It’s a rich platform, giving a clear overview of companies active in each thematic area, and hosting common terms”.

Adisty Raissa Fitri, Sustainability Portfolio Analyst, Triodos Investment Management

Inclusive finance is a mature industry and well known to impact investing companies. A study by ING indicates that total AUM in the inclusive finance is over $80 billion, and international organisations such as the World Bank, IFC, Inter-American Investment Corporation, FMO and others play an important role in catalysing investments as well as in fostering technical skills, metrics and approaches to best identify and invest in companies in emerging economies.

In addition, there are large NGOs and international networks that specialise in promoting best practices in inclusive finance, as well as in defining voluntary standards and metrics for investors and microfinance finance institutions. For instance, the Social Performance Task Force (SPTF), the PIIF and Inclusive Finance Network design basic criteria and baselines for responsible investors in this industry.

These organisations and other inclusive finance networks work together and share resources and knowledge on the inclusive finance topic, and it is one of few examples of institutional coordination in the impact investing industry. Inclusive finance organisations and investors are also known for their expertise in measuring and collecting impact data.

Nevertheless, challenges remain. Firstly, there are no institutional certifications available to verify inclusive finance institutions. Secondly, inclusive finance data is not linear or standardised, and most of the Microfinance Finance Institutions (MFIs) and investors in this field provide self-reported data (i.e. GIIN, PIIF, SPTF). Lastly, it is a market that is best suited to traditional impact investing organisations.

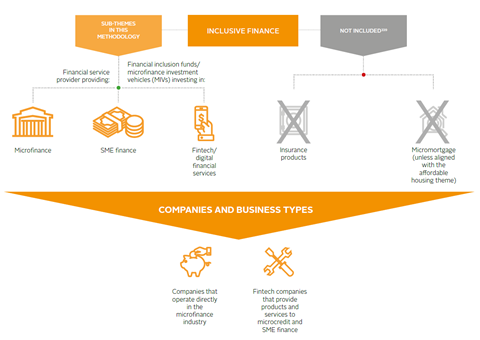

Since the scope of the Market Map is to bring more clarity to the impact investing industry, and take impact investments to the mainstream, the PRI developed a methodology using information from the PIIF, SPTF and mid and large-scale financial institutions that operate in the inclusive finance field. Concepts and approaches used by traditional impact investors (i.e. theory of change and additionality) were removed, since these belong to the more illiquid or early-stage impact investing industry.

Definition: Inclusive finance

Inclusive finance is defined so as to include microfinance and SME finance. Microfinance includes investments in retail institutions that provide financial services such as loans, savings, insurance and other basic services to low-income clients who run productive activities and who traditionally have lacked access to banking and related financial services. SME financing refers to providing financial services to small- and medium-sized enterprises that may struggle to access banking and related financial services.

Principles for Investors in Inclusive Finance (PIIF)

Download the full report

-

Impact investing market map

August 2018

Impact investing market map

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

Currently reading

Currently readingInclusive finance