Case study by Hermes Investment Management

Signatory type: Investment manager

Operating region: Global

Assets under management: US$45.8 billion

The Hermes SDG Engagement Equity Strategy, launched in December 2017, was established in recognition of the role that investors can play in promoting and supporting sustainable business practices. The strategy has the dual purpose of aiming to deliver both attractive returns and, via engagement with companies, real-world impact.

Why we engage with companies on the SDGs

We have a number of core beliefs, including that the enduring success of companies is intertwined with that of the economies, communities and environments in which they operate and in which their employees and customers live. In that context, the 17 Sustainable Development Goals (SDGs) – and the more detailed 169 underlying targets – provide an ideal framework for governments, investors and companies alike to understand the scale of the challenges being faced by the world and to identify what contribution they can meaningfully make.

The public increasingly and rightly expects businesses to have a more positive impact on society and the environment. Corporate support for the SDGs offers a strong signal to shareholders and third parties – such as consumers or employees – that the company is aligning their purposes and practices with the greater good. Engaging with companies around their ability to contribute towards the Goals paints a comprehensive picture of a company’s intrinsic sustainability as well as providing us as investors with valuable insights into investment risks and longer-term commercial opportunities.

How we engage with companies in general

We believe, as public market investors, that it is through purposeful engagement that we have the opportunity to catalyse or instigate corporate change to create social or environmental impact – while seeking to enhance long-term shareholder returns.

Constructive partners

As long-term investors, our horizon will commonly extend beyond that of any individual CEO. More pertinently the SDGs themselves look out towards 2030. Thus, successful engagement necessitates achieving buy-in from the company. Our approach is to treat companies as partners rather than combatants.

Our understanding of effective shareholder engagement has been developed over many years and in our view, dialogue with board members and senior executives is more effective than wielding the big stick of voting power (although that can help).

Intentionality and additionality

Upon initiating an investment, we write to the company chair to reiterate our purpose and open a dialogue on those issues we have identified as most relevant to that business in the context of their geographical footprint and business model. By taking a company-specific approach to identifying issues where a firm can most effectively support individual SDGs, we increase the likelihood of achieving tangible, positive outcomes. While enduring change may involve some short-term costs, we understand these may be required in order to generate long-term gains.

Results cannot be achieved overnight – but those worth pursuing are also worth waiting for. Through engagement we can give boards and management teams the confidence to be bold and imaginative in developing more beneficial relationships with stakeholders.

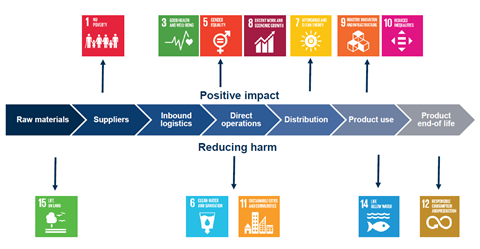

During dialogues with companies we continually reassess and refine our thesis for where and how the company can generate positive impact towards key beneficiary groups – this may be through their sourcing and supply chain relationships, via more equitable employment models, or identifying new markets for much-needed products.

We endeavour to share those insights we have gleaned through our wider interactions with companies across industries and geographies, highlight innovative practices and make connections in order to establish mutually beneficial relationships.

Measurement of progress and impact

After developing an engagement thesis – our theory of change – we formulate specific company objectives against which we monitor progress. We are cognisant that any meaningful new initiative will likely require new budgets, processes and relationships – as well as data gathering to measure and report on the resultant benefits.

The value of investments and income from them may go down as well as up, and investors may not get back the original amount invested. Past performance is not a reliable indicator of future results and targets are not guaranteed.

Example of an SDG engagement

Engaging to support good health outcomes and gender pay equity

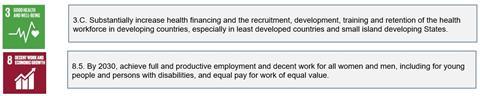

We have been engaged in a positive dialogue with the largest US healthcare staffing company in relation to their ability to support, among others, the below SDG targets:

According to a Pew Research Centre Survey in 2018, one-in-four employed women in the US reported earning less than a man who was doing the same job. Gender pay inequality is an issue across professions as this engagement illustrates.

While the company itself can be rightly proud of its own record, the industry which it serves cannot. There is substantial evidence of sizable gender pay differentials across US healthcare professions (and in many other markets), from male nurses out-earning female nurses by 10% to a near 40% gap among physicians.

We challenged management and the board to take a leadership position in respect of this agenda. We contended that the fact a sizable pay differential exists in the nursing profession, where women massively outnumber men 10:1, is an inequity that is impossible to justify and the result of multiple failings. In addition we argued the recruitment industry is uniquely positioned to not only highlight the scale of the problem but to play an important role in redressing it through both supply side and demand side interventions.

The company has responded enthusiastically and recognised their ability to take a leadership position on this agenda by refining their own recruitment practices and raising the agenda among industry peers. This commitment was made public in their most recent Corporate Sustainability Report where our engagement was cited as a catalyst.

Of course, an important part of an SDG agenda is to make a positive impact amongst the constituencies or within those regions where the need is greatest. In that spirit, we have encouraged the company to both further support the development and training of its candidates, in particular nurses, and build on existing volunteering efforts to more impactfully support healthcare training in lower- and middle-income countries. To that end, we introduced the company to a global NGO which is campaigning to raise the profile of nurses worldwide. Both organisations have expressed a strong desire to collaborate and we are hopeful that meaningful outcomes will materialise. Watch this space.

References

This information does not constitute a solicitation or offer to any person to buy or sell any related securities or financial instruments.