Close menu

- Home

- About us

- Signatories

- News & events

- Investment tools

-

Sustainability issues

- Back to parent navigation item

- Sustainability issues

-

Environmental, social and governance issues

- Back to parent navigation item

- Environmental, social and governance issues

- Environmental issues

-

Social issues

- Back to parent navigation item

- Social issues

- Social issues - case studies

- Social issues - podcasts

- Social issues - webinars

- Social issues - blogs

- Cobalt and the extractives industry

- Clothing and Apparel Supply Chain

- Human rights

- Human rights - case studies

- Modern slavery and labour rights

- Covid-19

- Just transition

- Governance issues

- Climate change

- Sustainability outcomes

- Sustainable markets

- Research

- Policy

Nature

- Quick links

Nature provides essential services – such as food, clean air and energy – that we all rely on. For investors, the ability to optimise risk-adjusted returns to end-clients and beneficiaries both depends on and impacts nature.

Nature programmes and investor action

Nature in responsible investments

Nature provides ecosystem services that benefit businesses and society. The investment value chain, and investors’ ability to optimise risk-adjusted returns to end-clients and beneficiaries, depends on and impacts nature.

Investing for nature: Resource hub

The PRI has developed a resource hub hosting its own guides, initiatives, blogs and webinars as well as relevant resources from partner organisations, to help PRI signatories find relevant guidance in their efforts to integrate nature into decision-making.

Spring

Spring is a PRI stewardship initiative for nature, convening investors to use their influence to halt and reverse global biodiversity loss by 2030

Nature Reference Group

The Nature Reference Group, with around 70 PRI members, facilitates discussions on investment practices, tools, disclosure framework and initiatives (full Terms of Reference).

Nature Policy Roadmap: Policy recommendations for scaling up investor action for nature

This discussion paper sets out the importance of nature to economic and social systems, its relevance to responsible investors and the PRI’s approach to nature policy.

Nature Positive Initiative

The PRI is part of the Nature Positive Initiative, supporting broader, longer-term efforts to deliver nature-positive outcomes by halting and reversing nature loss.

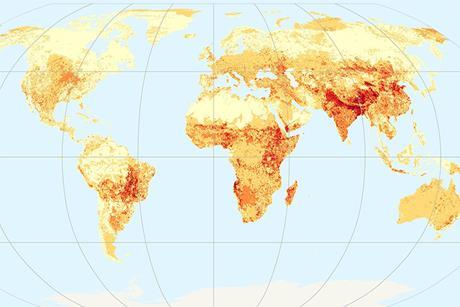

Mapping natural capital depletion

The PRI and UNEP-WCMC have developed maps to showcase hotspots of relative natural capital depletion on a global scale, available for visualisation in ENCORE – an interactive, online tool that highlights how businesses may be exposed to accelerating environmental change.

Investor initiative for sustainable forests: engagement results

The PRI-Ceres partnership aimed to tackle commodity-driven deforestation within cattle and soybean supply chains at investee companies

PRI investor working group on Sustainable Commodities

The PRI has previously coordinated collaborative investor engagements on sustainable commodities, including on palm oil, soy, and cattle supply chains. The investor expectations statements set out their disclosure and practice expectations of companies operating within these supply chains; and have been signed by more than 50 investors representing more than US$ 6 trillion in assets under management. The engagement results from the PRI-Ceres partnership to tackle commodity-driven deforestation within cattle and soybean supply chains at investee companies are available here.

Related resources

An introduction to responsible investment: Biodiversity for asset owners

2024-03-26T08:00:00+00:00

Introducing biodiversity to asset owners, focusing on drivers of biodiversity loss.

Developing a biodiversity policy: A technical guide for asset owners and investment managers

2024-03-26T08:00:00+00:00

How institutional investors can integrate biodiversity considerations into their responsible investment policies and investment processes

Blogs

- Previous

- Next

Webinars

- Previous

- Next

Case studies

- Previous

- Next

- The PRI is an investor initiative in partnership with UNEP Finance Initiative and UN Global Compact.

- PRI Association, 25 Camperdown Street, London, E1 8DZ, UK

- Company no: 7207947

- +44 (0)20 3714 3141

- [email protected]

-

PRI DISCLAIMER

The information contained on this website is meant for the purposes of information only and is not intended to be investment, legal, tax or other advice, nor is it intended to be relied upon in making an investment or other decision. All content is provided with the understanding that the authors and publishers are not providing advice on legal, economic, investment or other professional issues and services. PRI Association is not responsible for the content of websites and information resources that may be referenced. The access provided to these sites or the provision of such information resources does not constitute an endorsement by PRI Association of the information contained therein. PRI Association is not responsible for any errors or omissions, for any decision made or action taken based on information on this website or for any loss or damage arising from or caused by such decision or action. All information is provided “as-is” with no guarantee of completeness, accuracy or timeliness, or of the results obtained from the use of this information, and without warranty of any kind, expressed or implied.

Content authored by PRI Association

For content authored by PRI Association, except where expressly stated otherwise, the opinions, recommendations, findings, interpretations and conclusions expressed are those of PRI Association alone, and do not necessarily represent the views of any contributors or any signatories to the Principles for Responsible Investment (individually or as a whole). It should not be inferred that any other organisation referenced endorses or agrees with any conclusions set out. The inclusion of company examples does not in any way constitute an endorsement of these organisations by PRI Association or the signatories to the Principles for Responsible Investment. While we have endeavoured to ensure that information has been obtained from reliable and up-to-date sources, the changing nature of statistics, laws, rules and regulations may result in delays, omissions or inaccuracies in information.

Content authored by third parties

The accuracy of any content provided by an external contributor remains the responsibility of such external contributor. The views expressed in any content provided by external contributors are those of the external contributor(s) alone, and are neither endorsed by, nor necessarily correspond with, the views of PRI Association or any signatories to the Principles for Responsible Investment other than the external contributor(s) named as authors.

Site powered by Webvision Cloud