Case study by Aberdeen Standard Investments (ASI)

- Signatory type: Investment manager

- Region of operation: Global

- Assets under management: US$500bn

Aberdeen Standard Investments (ASI) is a large diversified asset management company based in the UK. We manage over US$500bn of assets for a variety of institutional and retail clients across a wide range of asset classes. We use strategic asset allocation (SAA) as an input for the management of US$200bn. We set up our ESG team in the early 1990s and are a founding signatory of the PRI.

Why corporate governance should not be ignored in strategic asset allocation

SAA aims to build resilient, long‐term portfolios that best achieve fund investment objectives. It decides the optimal mix of government bonds, credit, equity and alternatives based on views about the long‐term returns, risk and correlation of each asset class.

We believe that structural trends in ESG are very important drivers of return and risk for equity and credit assets and should be taken into account when estimating future returns.

We think that corporate governance is often largely ignored by SAA. Investors focus on economic growth and valuation, without asking enough about whether the aggregate quality of governance will affect the ability of companies to translate that growth into shareholder returns.

We don’t have to look very far to see why this is a mistake. Perhaps the biggest event for corporate equity and credit prices within the last 80 years – the Global Financial Crisis – was largely triggered by a systemic failure of governance in the global banking industry.

The governance failings were numerous: the mis‐selling of subprime mortgages, their indiscriminate bundling into ‘CDOs’which were then incorrectly assessed by the credit rating agencies and bought by banks with poor risk controls, and insufficient capital buffers to protect themselves against defaults. Then, once these defaults started to occur, banks’ over‐reliance on short‐term wholesale finance resulted in widespread insolvency and bank failures.

These governance deficiencies had massive implications for the relative returns of different asset classes, both during the crisis and subsequently. The failure of corporate governance in the banking sector led to much tougher regulation and subsequently much lower returns in the sector – with implications for regional equity markets as a whole.

How we take a sector approach to measure the strength of corporate governance

Our SAA process monitors trends in governance within sectors and asset classes. The goal is not to focus on the idiosyncratic governance performance of individual companies, but on marketwide changes that have implications at the asset class level. In the global financial crisis, the problem was not one bank, but the fact that poor governance became systemic in the sector.

Example: Japan embraces corporate governance and boosts equity returns

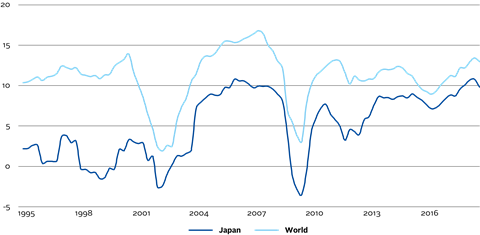

Chart 4 – ROE, Japan vs World, 1995-2019

Our Japan equity return forecast provides a good example of how we attempt to integrate corporate governance into SAA returns modelling. Over the last 30 years the Japanese corporate sector has had a terrible history of generating shareholder returns. As the chart below shows, until the last few years return on equity has been extremely low relative to other regional equity markets.

We believe this is partly a function of poor corporate governance. Japanese boards were simply not sufficiently focused on maximising shareholder value and had little accountability to investors.

Only 15% of companies had independent directors to represent the interests of minority shareholders in 2011. In addition, most Japanese companies held their AGMs on the same two or three days each year making it very hard for shareholders to question directors.

There were also few activist shareholders to challenge boards including international investors.

Poor governance meant little focus on shareholder value creation, very low profit margins, cash hoarding and low pay‐out ratios.

Our Japanese equity long‐term return forecasts used to reflect this reality. Ten years ago, our return forecasts were half those of other equity markets, partly because we expected profit margins and dividend pay‐outs to remain disappointingly low. The low return forecasts resulted in lower allocations to this region.

In recent years this has changed. Following Japanese Prime Minister Shinzo Abe’s commitment to corporate governance reform, and the adoption of the new Corporate Governance Code in 2015, we have regularly reviewed the quality of Japanese governance with our local equity team.

We have seen steady improvements – with more independent directors being appointed to boards – up from that 15% in 2011 to 91% in 2019 - and AGMs moving to different days.

There are more activist shareholders now – including the large domestic pension funds - and more focus on shareholder returns. As a result, there has been a higher return on equity (as the chart below shows) and higher buyback and dividend payouts.

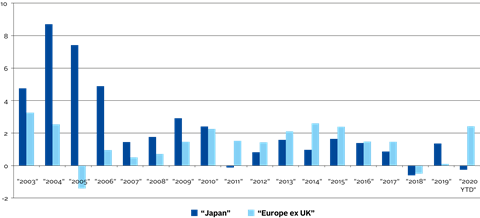

Japan vs Europe equity buybacks vs share issuance (%, negative numbers meant net buybacks)

While corporate governance in Japan still has further to go, the improvements so far have already led us to revise our modelling assumptions about earnings per share growth for the Japanese market.

We do not believe profit margins and payouts to shareholders (including buybacks) will revert to their long‐term average, but instead will remain much nearer the global average. As a result, our return forecasts are materially higher – nearly 2% per annum more than they would have been otherwise ‐ and we are more likely to allocate to the Japanese market.

Japan is just one example. Governance quality materially affects our assumptions about margins, buybacks and valuation multiples for several equity markets. And it doesn’t stop at equities – we see governance as a key part of our evaluation of default risk and recovery rates for credit portfolios.

We believe ESG integration is not only something for bottom up stock selectors. ESG often has big systematic, long‐term impacts on the returns of asset classes. It is essential to take it into account when building resilient and successful strategic portfolios.