Signatory type: Investment manager

Organisation name: Aviva Investors

Location of HQ: UK

Total AUM: US$423.6bn

SDG goals/targets: SDG 7, 13

Practice area: Investment practice

Asset class: Real assets

Investment region: Global

Why we use the SDGs

As long-term investors in real assets, we consider ESG factors to be materially important, which can help us select projects or investments where the asset can make a positive impact on society. In this context, the consideration of the SDGs was a logical evolution of our existing practices, to ensure we had a balanced view on risk and impact. The SDGs provide a framework to assess whether a project contributes positively towards environmental and social outcomes. This aids project selection and ESG analysis to ultimately inform investment decision making.

For example, standard ESG due diligence assessments can often identify high risks in proposed emerging market transactions (for example, due to a lack of relevant data, and/or concerns over transparency and corruption). The SDGs can then be used to define a set of intended objectives for the underlying project and can therefore be used as a frame of reference during the negotiation of terms and conditions of the investment agreement.

How we consider the SDGs in our investments

Traditional ESG risk assessments for proposed real asset investments may solely focus on identifying potentially material red flags, whilst impact investment assessments focus on possible positive ESG outcomes of the transaction.

Our approach involves providing an ESG opinion for proposed transactions comprising a risk assessment and an impact identification, which seeks to identify positive outcomes or contributions to the SDGs. This enables a balanced perspective, recognising that there may often be a mixture of positive and negative contributions, and can be used across all our investment decision making.

The global Responsible Investment team works closely with origination and investment teams to apply this framework, which ultimately supports the Investment Committee in making investment decisions.

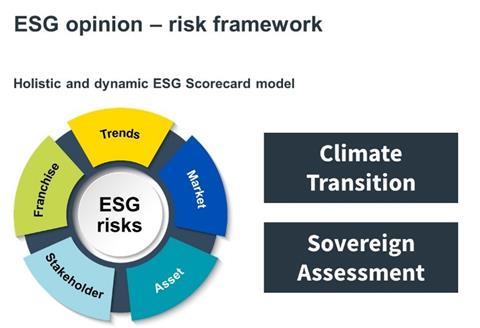

The in-house ESG risk-scoring methodology evaluates transactions using our five-factor framework, which includes assessing the target or asset, counterparty, and impact on stakeholders, as highlighted in Figure 1 below. This is supported by two models we deploy to assess climate transition risk and potential sovereign risks for infrastructure assets.

Figure 1. ESG opinion – risk framework

Using this holistic approach allows for a dynamic assessment of the most material ESG risks relevant to the transaction – this is then used to inform whether commitments can be established to help prevent downside risks or improve the ESG credentials of the project.

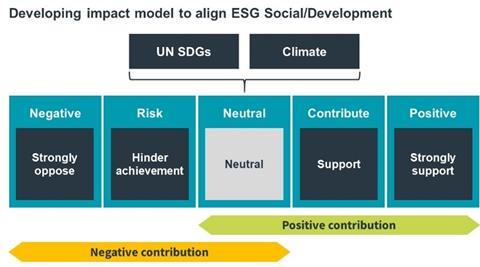

We assign an impact score to transactions by assessing a project’s potential contribution to outcomes in line with the SDGs. When undertaking this assessment, we consider the nature and magnitude of these outcomes and whether they can be realised, by understanding outcomes of previous, similar projects in a specific country and asset class.

This is conducted through the application of our in-house ESG sector review as well as information from third parties (such as multilateral institutions or due diligence providers). Where ESG data is not available, we will engage with the project sponsor/developer to gain such information.

Figure 2. Impact model for real assets investments

From this information we can assess how various transaction structures may affect the direct and indirect social and environmental outcomes that can be achieved through our investment, and therefore drive the level of material contribution to different SDGs.

Example: European Utility Company

Aviva was considering the financing of a European utilities company, whose primary business is the construction, refurbishment and operation of small-scale generation plants supplying localised energy to adjacent real estate and industrial customers, with a strong focus on efficiency improvements. The company had a clear roadmap for reducing the carbon footprint of its operations, but still supplied energy generated from a highly polluting source – lignite – albeit this exposure was declining.

Before investing, Aviva wanted additional assurance that the company would adhere to its decarbonisation plans. Whilst the business has a diversified fuel mix including gas, biomass and lignite – they expect to shift significantly towards greener sources by 2025 in line with regulatory developments. The company’s agenda includes broadening its business to greener technologies, such as solid process waste products; and biogenic dust fuels.

We negotiated to impose an ESG-specific covenant onto an infrastructure debt issuance, prohibiting the building of any new lignite or coal plants, and including tight limitations on transaction activity (e.g. acquiring any company or business that is building lignite or coal plants). Reporting obligations were also included in the agreement, ensuring that Aviva is kept up to date with the decarbonisation program’s progress.

The specific obligations include the company’s management providing an annual presentation on the implementation of its decarbonisation strategy:

- explaining the lignite, coal and biofuel strategy being implemented;

- providing an overview of its exposure to lignite and coal fuels (including the number of plants and share of revenue);

- commenting on any material change to the regulatory and legal framework;

- providing any other information relevant to the decarbonisation strategy which may be requested by investors.

In this way we seek to ensure that positive SDG outcomes, for example in relation to SDG 7 on Affordable, Clean Energy, and SDG 13 on Climate Action, flow through from detailed ESG due diligence.