We are excited to share more detail about PRI Reporting in 2025.

We recognise that our diverse signatories have varying needs, practices and market requirements. PRI Reporting in 2025 aims to ensure that we have a stable baseline of reporting that can support the transition towards streamlined mandatory reporting and the Pathways model while responding to the changing context our members operate in.

Below you can find the following information:

What is changing in 2025?

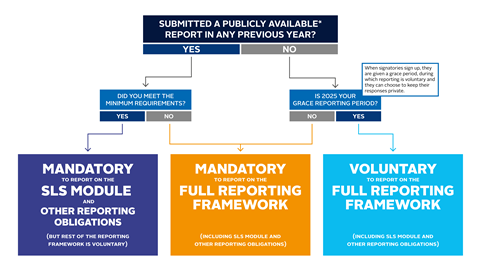

There will be an element of mandatory reporting for all investment manager and asset owner signatories that have passed their grace period, in the form of completing the Senior Leadership Statement (SLS) module.[1] We will also ask reporting signatories to indicate whether they are subject to any other reporting obligations.

Beyond this, most reporting signatories will be able to choose whether to complete the remaining modules in the Reporting Framework. For signatories in their grace period, reporting is completely voluntary, as it has been previously.

Investment managers and asset owners that have not reported publicly before, or that have not met the minimum requirements in the previous cycle, will be required to report in full.

We will confirm the reporting status of signatories in the next few months. Reporting remains on hold for service provider signatories.

The content of the 2025 Reporting Framework will be closely aligned to that of 2024 and 2023, ensuring the stability of the reporting dataset for a third consecutive year, while the dates of the reporting cycle will be broadly aligned with 2024.

Reasons for this change

Reporting showcases signatories’ responsible investment practices and provides the basis for several tools and outputs, such as the Transparency and Assessment Reports. Signatories have told us that they value these outputs, which can showcase the progress that they make over several reporting cycles.

At the same time, the reporting landscape is becoming more complex and fragmented. More jurisdictions are mandating sustainability reporting, while the number of voluntary investor initiatives is also growing.

The role of the Reporting Framework as a driver of accountability among signatories has changed as a result of these broader industry shifts, while its utility has decreased for some of our members as their needs have changed.

The changes for 2025 reporting aim to:

- ensure that we have a stable baseline of information from all signatories about how they are striving to meet the six Principles;

- support investment managers and asset owners that want to further showcase their responsible investment practices and progress by reporting fully; and

- minimise potential duplication for signatories that are subject to several reporting requirements.

These changes are a crucial step - or bridge - towards the introduction of Pathways.

What happens next

We will share details on 2025 reporting on the R&A Updates page over the coming months and look forward to providing more information on the 2024 reporting outputs with signatories that reported this year in the meantime.

If your organisation has any questions about reporting in 2025, please contact [email protected].

Frequently asked questions

What is changing about reporting in 2025?

It will be mandatory for all investment manager and asset owner signatories that have passed their grace period to complete the Senior Leadership Statement (SLS) module and to indicate whether they are subject to any other reporting obligations.

Signatories that have not reported publicly before, or that have not met the minimum requirements in the previous cycle, will be required to report in full.

All other reporting signatories will be able to choose whether to complete the remaining modules in the Reporting Framework. For signatories in their grace period, reporting is completely voluntary, as it has been previously.

When will signatories be asked to report in 2025?

The 2025 reporting cycle will likely be the same as it was in 2024, with signatories having a 12-week reporting window opening in May. We will aim to release the Reporting Framework and associated guidance in the first quarter of the year and to deliver reporting outputs in the fourth quarter and will confirm exact dates in due course to aid signatories with their planning.

Why is PRI making further changes to reporting?

The PRI is transitioning towards the Pathways model, which will introduce Foundational and Progression Reporting. As the co-design of Pathways is ongoing, we wanted to ensure a minimum level of continuity in reporting for the next year, while also taking steps to respond to the feedback signatories have given us during the A changing world consultation. The changes we will be making are a logical step towards reporting under Pathways.

Will signatories still receive Transparency and Assessment Reports?

Investment manager and asset owner signatories that report in full will receive Transparency and Assessment Reports. Those that choose to only complete the mandatory sections of the Reporting Framework (the SLS module and section on other reporting obligations) will not receive an Assessment Report as they are not scored.

Where can I read more about Pathways?

More detail about Pathways can be found on this dedicated webpage, while broader context is provided in our new three-year strategy.

What will the 2025 Reporting Framework look like and when will it be released?

The content of the 2025 Reporting Framework will be closely aligned to that of 2024 and 2023, ensuring the stability of the reporting dataset for a third consecutive year, while the dates of the reporting cycle will be broadly aligned with those of the 2024 cycle. We may make some small adjustments to the modules based on feedback we have received from signatories, such as providing more free-text boxes to allow reporters to provide clarifications or caveats to their answers.

Why are you asking signatories whether they are subject to other responsible investment reporting obligations?

The reporting landscape is becoming more complex and fragmented. More jurisdictions are mandating sustainability reporting, while the number of voluntary investor initiatives is also growing. We are aware that a growing number of signatories may be subject to other reporting obligations and our aim for future reporting is to minimise potential duplication.

Asking investment managers and asset owners to indicate whether they are subject to other reporting obligations is a first step to understanding the challenges they may face and will ultimately inform future iterations of Foundational Reporting in the Pathways model.

References

[1] An example of the Senior Leadership Statement module can be found on the Investor Reporting Framework webpage, which details the modules in the 2024 Reporting Framework. These may be amended in the 2025 Reporting Framework.