Case study by EthiFinance

Growth and challenges of ESG integration in private debt

Institutional investors have been the driving force of SRI/ ESG in France since the early 2000s. The 2016 Law on Energy Transition and Green Growth has spurred further momentum; Article 173 requires investors to report on their integration of ESG criteria and climate risks across all asset classes. Combined with the general growth of private markets, this has led to growing demand from asset owners (AOs) for such strategies in private debt investments. EthiFinance has been providing OneTrack to an asset manager (AM) that specialises in private debt ($5 billion AUM) to fulfil the mandate requirements of a pension fund: pre-investment ESG assessment, annual ESG assessment update and portfolio ESG reporting. These requirements are in line with this AO’s general SRI policy.

Taking the aforementioned fund as an example, several challenges had to be overcome to yield appropriate quality in the assessment process. In this case, the target portfolio companies are unlisted French SMEs.

- Availability of information: most target companies are small and unlisted, with poor ESG reporting. Furthermore, the CFO is often the only contact person, as the organisation might not have dedicated resources to address ESG/CSR issues in-depth;

- Influence on the company: the AM generally has limited leverage due to the credit structure of the investment; obtaining the necessary ESG information and engaging in a dialogue can be difficult. In one instance the CFO completed the questionnaire but left some questions on social matters unanswered, even though these were KPIs that are subject to a legal reporting obligation in France. Other answers appeared inconsistent (e.g., the share of women in the workforce was identical to the share of women in management positions); and

- Time constraints: the pre-investment phase requires high reactivity from the AM and the company for the ESG assessment to be of material value to the investment decision. Upon request, the CFO in the example was unable to collect and report the missing information in time for the closing of the deal.

Developing a tailored assessment framework

The relevance of the assessment framework is critical to the successful integration of ESG considerations in a private debt fund. EthiFinance develops a tailored ESG framework with client investors based primarily on the AM’s ESG policy, AOs’ expectations and characteristics of portfolio companies in a private debt environment. Using the fund as example, two factors were identified as important when selecting indicators:

- Availability: the type and number of indicators should always be in line with the companies’ size and thus with their ESG reporting resources. If not disclosed publicly, indicators should at least be monitored within the portfolio company. As a result, the framework consists of some 40 indicators, half of which are quantitative (e.g. share of independent directors) and the other half qualitative (e.g. eco-design in product and service development). A good example of availability challenging the quality of the assessment is the construction sector. Accident frequency rates are generally available, but rarely with a distinction between permanent and temporary staff, even though this can be material information on health and safety performance. A rating formula was then set for each indicator.

- Materiality: the materiality of individual indicators varies depending on the industry, the country and size, etc. This means weights were allocated to each theme and sub-theme based on company industry, adding a materiality approach to the framework.

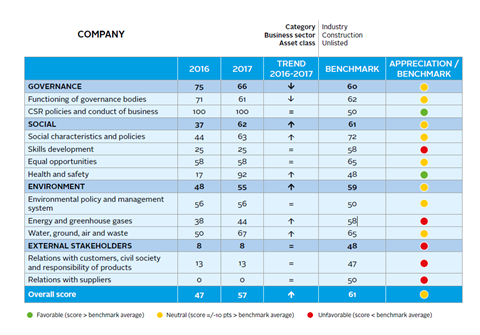

The three steps (determining a list of indicators, individual rating formulas and weighting factors) enable an aggregate ESG score (on a scale of 0 to 100) to be automatically generated. This contributes to another critical element of a successful private debt ESG strategy - the efficiency of the assessment process.

Maximising assessment efficiency

To tackle the above-mentioned challenges, the involvement of each actor should be optimised. For the company, this contributes to a higher response rate of the ESG questionnaire and quality of information. Assessments conducted on the OneTrack platform follow three main steps:

- Data collection: EthiFinance’s analysts review public documents and any internal ESG documents previously shared by the company, seeking to complete the framework as much as possible and minimising the time and effort demanded from the company;

- Company response: analysts send the pre-filled questionnaire to the company. The OneTrack platform provides explanatory notes to support the methodology for each indicator. A call with management can also be arranged and a support line is available to help companies provide missing information; and

- Quality check: analysts review the consistency of the collected data following internal control processes and then finalise the assessment. The ESG assessment report is automatically generated.

When conducted in the pre-investment phase, assessments show a high company response rate and average framework completion rate, both at over 90 percent. The annual assessment update can be more challenging, due to a lower leverage on companies during the investment phase. The assessment methodology (framework and process) is updated yearly to take into account internal and external trends. A change has already been made to the abovementioned fund’s framework, where companies showed a high level of performance on the sub-theme, “skills development”, leading to an insufficient score dispersion. The ever-growing focus on climate change in SRI/ESG is likely to lead to further developments in the assessment.

Creating win-win outcomes

Our ESG assessment reports include for each portfolio company an ESG score as well as a benchmark (based on EthiFinance’s database of around 140 indicators on over 600 companies), thus providing an in-depth overview of ESG risks and opportunities of each company.

We see the final report adding value to:

- AM: pre-deal, the report is included in the investment case. Rather than a “go” or “no go” opinion, the objective is to provide additional information for investment teams as a value-added part of the investment process. It can also help identify further ESG due diligence that may need to be conducted. Annual updates help monitor progress as well as engagement with companies.

- Company: the report can be used for internal and/or external communication on CSR practices and through the benchmark offers a means of comparison. It serves as an incentive for companies to respond.

EthiFinance also provides the AM with SRI fund reporting, presenting the consolidated ESG performance of the fund and key ESG indicators (otherwise called impact indicators e.g. average share of women on the board). It can then be sent to the AO (in compliance with mandate requirements) or to other clients. It may also help the AM identify areas of improvement, either companies with a poor ESG score or a specific ESG theme where portfolio companies generally show low performance.

Downloads

Case study - ESG assessment tools for private debt managers

PDF, Size 0.15 mb

Spotlight on responsible investment in private debt

- 1

- 2

- 3

- 4

- 5

- 6

- 7

Currently reading

Currently readingCase study: EthiFinance

- 8

- 9

- 10