Overview

- This introductory guide provides a short summary of what responsible investment is and how it can be done.

- It shares information on implementing the Principles for Responsible Investment.

- It also addresses some common misconceptions about what responsible investment involves and provides further reading throughout.

- Definitions of the responsible investment terms used in the guide can be found in the PRI’s Reporting Framework glossary.

- For more information on anything in this guide, or responsible investment more broadly, please get in touch.

The guide is split into five sections:

| What is responsible investment? | Why invest responsibly? | How to invest responsibly | Misconceptions | The role of the PRI |

|---|

What is responsible investment?

Responsible investment involves considering environmental, social and governance (ESG) issues when making investment decisions and influencing companies or assets (known as active ownership or stewardship). It complements traditional financial analysis and portfolio construction techniques.

Responsible investors can have different objectives. Some focus exclusively on financial returns and consider ESG issues that could impact these. Others aim to generate financial returns and to achieve positive outcomes for people and the planet, while avoiding negative ones.

ESG issues that investors can consider when investing responsibly include:

| ENVIRONMENTAL | SOCIAL | GOVERNANCE |

|

|

|

|

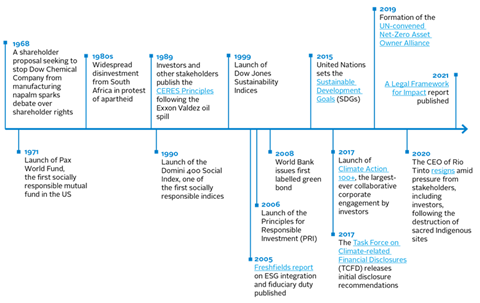

Milestones in the evolution of responsible investment

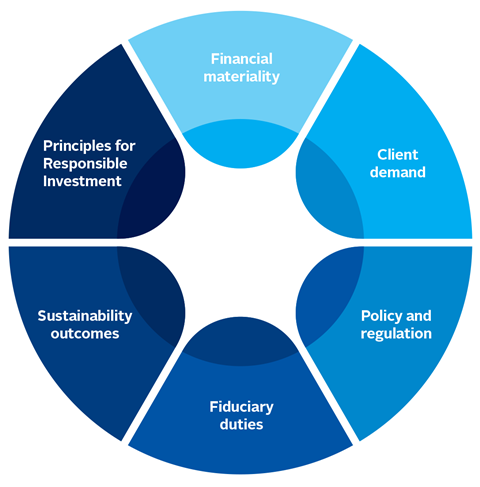

Why invest responsibly?

Several related, and in some cases overlapping, forces are driving the growth of responsible investment. These include:

Financial materiality

Increasing amounts of industry and academic research[1] indicate that there is a relationship between ESG issues and financial performance. PRI-commissioned research has also found that engaging with companies on ESG issues can create value for the businesses and their investors by encouraging better risk management and more sustainable practices.

Sustainability issues can significantly impact market and portfolio returns and in some cases, pose risks beyond a single company, sector or geography.[2]

Examples of financially material ESG incidents and sustainability issues

2019: A dam owned by the mining company Vale collapsed. The disaster resulted in the deaths of at least 270 people and caused extensive damage to the local community and environment. The company has paid over US$7bn to settle related claims.

2020: The payments firm Wirecard filed for insolvency amid accusations of accounting fraud linked to corporate governance failings.

2020: The World Health Organization declared the COVID-19 outbreak a global pandemic. Limited investment in pandemic preparedness by governments, companies and other institutions prior to the outbreak contributed to a sharp contraction in global GDP.

2022: A French court upheld charges of complicity in crimes against humanity against the cement company Lafarge in relation to actions it took to keep its €680m plant in Syria operating following the outbreak of civil war.

Client demand

Many asset owners – and their beneficiaries – recognise that ESG factors are financially material, while a significant portion try to align their investments with their values and with broader environmental and social objectives. They expect their investment managers and service providers to do the same.

Policy and regulation

Corporate and investor regulations and policies relating to ESG issues and disclosures have increased significantly in recent years. This reflects the important role that the financial sector can play in meeting global challenges such as climate change, modern slavery and tax avoidance.

Governments and financial regulators can use several policy and regulatory tools to make the financial system more sustainable, and to promote responsible investment. These include:

- Corporate ESG disclosure regulations

- Stewardship regulations

- Investor duties and disclosure regulations

- Taxonomies of sustainable economic activities

Fiduciary duties

Fiduciary duties (or equivalent obligations) exist to ensure that those managing other people’s money act with appropriate care, skill and loyalty, and in the interests of clients or beneficiaries.

Investors’ fiduciary duties require them to consider all factors that are relevant to investment returns, including ESG issues, and to act accordingly. In some countries, investors are required by law to consider pursuing sustainability outcomes where these can help achieve their financial objectives.

Sustainability outcomes

All investment activities can result in positive and negative sustainability outcomes to people and the planet.

Beneficiaries, clients, employees, governments, regulators and other stakeholders increasingly expect investors to manage these outcomes and to align their activities with global frameworks such as the SDGs and the Paris Agreement.

Principles for responsible investment

A significant portion of the investment industry has committed to the Principles for Responsible Investment. PRI signatories make the following commitments:

- Principle 1: We will incorporate ESG issues into investment analysis and decision-making processes.

- Principle 2: We will be active owners and incorporate ESG issues into our ownership policies and practices.

- Principle 3: We will seek appropriate disclosure on ESG issues by the entities in which we invest.

- Principle 4: We will promote acceptance and implementation of the Principles within the investment industry.

- Principle 5: We will work together to enhance our effectiveness in implementing the Principles.

- Principle 6: We will each report on our activities and progress towards implementing the Principles.

The six Principles were developed by investors for investors. In implementing them, signatories contribute to developing a more sustainable global financial system.

How to invest responsibly

There are many ways to invest responsibly, including:

| ESG incorporation | Stewardship | |||

|---|---|---|---|---|

|

Screening |

ESG integration |

Thematic investing |

Stewardship with investees |

Stewardship with other stakeholders |

|

Taking action on sustainability outcomes |

||||

(Definitions of terms in this table can be found in the PRI’s Reporting Framework glossary.)

ESG incorporation

ESG incorporation means assessing, reviewing, and considering ESG issues in existing investment practices, by combining any of these approaches: integration, screening, and thematic investing.

| Screening involves applying filters to a universe of securities, issuers, sectors or other financial instruments to decide whether to consider them for investment. It is based on criteria, such as an investor’s preferences or specific investment metrics, set out in an investment process or that reflect a client or fund mandate. Screening can be positive, norms-based or negative. |

ESG integration involves considering ESG issues in investment analysis and decisions to better manage risks and improve returns. |

Thematic investing involves looking for opportunities created by long-term ESG trends, such as the move towards renewable energy or circular economies. This could mean selecting a thematic product, such as a fund or index, or constructing a portfolio around such a trend. |

Stewardship

Stewardship means using influence to maximise overall long-term value – including of common economic, social, and environmental assets – that client and beneficiary returns and interests depend on.

Engagement is one of the ways investors can fulfil their stewardship obligations. It involves interactions and dialogue between an investor, or their service provider, and a current or potential investee or other stakeholder to improve practice on an ESG factor, make progress on sustainability outcomes, or improve public disclosure. In private markets, engagement also refers to investors’ direct control over and dialogue with management teams or boards.

Stewardship activities can be directed at existing and potential investees (e.g., companies, issuers, assets) and other stakeholders, such as policy makers and standard setters.

| Examples of ways to influence investees: | Examples of ways to influence other stakeholders: |

|---|---|

|

|

Responsible investors can collaborate on their stewardship activities to make them more effective. Collaboration can be informal, such as sharing insights on how to approach an issue with peers, or formal, such as joining initiatives where investors engage an investee or other stakeholder.

Taking action on sustainability outcomes

Investors can act to improve the sustainability outcomes associated with their investments through their investment decisions and stewardship of investees, policy makers and other stakeholders. This involves making their investments consistent with global sustainability goals and thresholds, aiming to increase positive outcomes for people and the planet and decrease negative ones.

Global sustainability goals and thresholds help establish the limits that society should try to operate in to prevent harm to people and the environment.

They are set out in internationally recognised frameworks, such as:

- The UN Sustainable Development Goals

- The Paris Agreement

- The Convention on Biological Diversity

- The OECD Guidelines for Multinational Enterprises

- The International Bill of Human Rights

- The ILO Declaration on Fundamental Principles and Rights at Work

- The UN Guiding Principles on Business and Human Rights

Responsible investment across asset classes

It is possible to invest responsibly across all asset classes; but the tools that can be used to achieve responsible investment objectives vary between private and public markets, and different security types. For example:

| Fixed income |

Bond covenants: Investors can try to improve the ESG performance of debt instruments by embedding provisions relating to ESG issues into the relevant contracts. These provisions can cover ESG disclosures and require issuers to conform to certain standards, such as those set out in the OECD Guidelines for Multinational Enterprises. |

|---|---|

| Listed equity |

Voting rights: In most markets, shareholders can use their votes on management and/or shareholder resolutions to formally communicate views and expectations about a company’s ESG performance. |

| Private equity |

Board seats: Private equity investors that take board seats can use these to help develop a company’s ESG strategy and, in doing so, influence the impact it has on society and the environment. |

PRI reporting data shows that responsible investment practices are more advanced in some asset classes than in others. Historically, for example, more investors have incorporated ESG factors into their listed equity investments than their fixed income investments.[3] But while differences remain, signatories have made significant progress across all major asset classes in recent years.[4]

Asset owners and responsible investment

Heading the investment chain, asset owners set the direction for markets globally. They are increasingly focused on managing their assets sustainably, as they often have long-term liabilities and investment horizons.

Asset owners that outsource all or part of their investment function can embed responsible investment principles into how they choose and monitor their external investment managers, consultants and other service providers.

Reporting

Reporting by investors usually involves providing public or private information to stakeholders, such as regulators and clients. Asset owners can use the information in these disclosures to assess the ESG incorporation and stewardship practices, and actions on sustainability outcomes, taken by their investment managers. Disclosures can also enable investors to show how they align with regulation or guidance.

Disclosures are increasingly regulated by bodies such as the European Union, the UK’s Financial Conduct Authority and the US Securities and Exchange Commission, and other national and supranational bodies.

Reporting from investment managers to clients might include quantitative and qualitative information and case studies. It can be standalone, or form part of wider reports or communications with stakeholders.

Key ESG issues

Responsible investors can consider a wide range of ESG issues in their analysis. They might give greater weight to some than others, due to their higher potential impact on people, planet, and financial returns.

Climate change is a high-priority ESG issue for investors, particularly asset owners, as outlined in the PRI’s analysis of asset owner signatories’ responsible investment practices. Investors are also increasingly recognising their responsibility to respect human rights.

Climate change

Climate change is having significant physical, economic and social effects on all aspects of human activity, as identified by bodies including the Intergovernmental Panel on Climate Change and the International Monetary Fund.

In 2015, 196 parties adopted the Paris Agreement, a legally binding international treaty on climate change. It aims to stop global temperatures rising by more than 2.0°C above pre-industrial levels this century and to limit that increase even further to 1.5°C.

To help meet the goals of the Paris Agreement, investors are trying to reduce the amount of greenhouse gases – such as carbon dioxide and methane – that the companies and other assets in their portfolios produce and emit.

Many asset owners, for example, are members of the UN-convened Net-Zero Asset Owner Alliance and have committed to ensuring their portfolio holdings remove as many greenhouse gas emissions from the atmosphere as they produce (known as net zero) by 2050. Similar alliances exist for investment managers and service providers.

Human rights

The idea of human rights is as simple as it is powerful: that people have a universal right to be treated with dignity. Every individual is entitled to enjoy human rights without discrimination – whatever their nationality, place of residence, sex, national or ethnic origin, colour, religion, language or any other status. Human rights are interrelated, interdependent and indivisible.

Institutional investors have a responsibility to respect human rights. This responsibility was formalised by the UN and the OECD in 2011, and since then expectations and requirements – from employees, beneficiaries, clients, governments, and wider society – relating to human rights have markedly increased.

The PRI has a multi-year programme of work to support signatories to implement the UN Guiding Principles on Business and Human Rights and the OECD Guidelines for Multinational Enterprises. It includes coordinating Advance, a collaborative stewardship initiative focused on human rights and social issues.

Misconceptions

The responsible investment industry continues to evolve rapidly, resulting in misconceptions about what it entails, including:

“…it involves investing in a specific strategy or product”

There are many ways to invest responsibly. Investors can use ESG information in investment and stewardship decisions, to make sure they consider all relevant issues when assessing risk and return. Investors can focus on their entire portfolio, on particular asset classes or on certain products, depending on their responsible investment objectives. They can also consider the effect their investments have on people and the planet and may combine these approaches for some or all their assets.

“…it leads to lower investment returns”

Responsible investment does not need to require sacrificing returns; it can, in fact, enhance risk and return characteristics. Investors apply a range of techniques to identify risks and opportunities that might remain undiscovered without analysing ESG data and trends.

“…it involves limiting the investible universe”

Responsible investment involves incorporating ESG issues in investment decisions and stewardship. While approaches such as screening are common, they are not required.

“…it is not possible to invest responsibly as an index investor”

ESG factors can be incorporated into index-investment strategies in different ways. Service providers can analyse ESG issues and sustainability outcomes when constructing indices. Investors can select indices whose constituents have been screened, or which have a thematic focus, to ensure they align with their values. They can use stewardship to influence the behaviour of current, and potential, index constituents and can also engage with regulators and industry bodies to drive reforms that enable responsible investment.

“…it is politically motivated”

Responsible investment does not mean promoting a particular political agenda. Analysing ESG factors and considering sustainability outcomes during the investment process allows investors to make more informed decisions; to better align investments with beneficiaries’ objectives and to pursue risk-adjusted returns.

“…it is not possible to substantiate responsible investment claims”

Greenwashing involves investors exaggerating how environmentally friendly, sustainable, or ethical a financial product or investment strategy, commitment or approach is. Many regulations and initiatives have been developed to counter these kinds of misstatements from investors. For example, sustainable finance taxonomies allow investors to objectively report on how much of their portfolios are invested in activities that meet ESG or sustainability goals.

The role of the PRI

The PRI is a global organisation that encourages and supports the investment industry to invest responsibly. It acts in the long-term interests of:

- its signatories;

- the financial markets and economies they operate in; and ultimately

- the environment and society more broadly.

PRI signatories commit to implementing thesix Principles for Responsible Investment. The PRI helps them to do this via:

- Resources: providing guidance and tools on a range of responsible investment topics.

- Collaborative stewardship initiatives: co-ordinating opportunities for signatories to engage collaboratively with companies and other stakeholders to address high-priority ESG issues, using the PRI Collaboration Platform.

- Public policy: engaging with policy makers to support and enable investors’ responsible investment approaches.

- Academic research: supporting innovative responsible investment research and showcasing research findings.

- Convening investors: connecting signatories with each other, through events and regional networks, to share knowledge.

- Reporting: helping signatories to understand their strengths and areas requiring improvement through the PRI Reporting Framework. Signatories are also confidentially scored and benchmarked against their peers. They can share private reports, and the PRI makes select information public to provide transparency on the PRI data portal.

- PRI Academy: training investment professionals through online courses.

CREDITS | Lead contributors: Eilidh Wagstaff, Senior Specialist, Investment Practices; Toby Belsom, Director, Investment Practices | Editors: Jasmin Leitner; Mark Kolmar | Design: Will Stewart

Downloads

What is responsible investment?

PDF, Size 3.08 mbWhat is responsible investment? (Portuguese) O que é o investtimento responsável?

PDF, Size 3.15 mbWhat is responsible investment? (Chinese) 什么是负责任投资?

PDF, Size 2.68 mbWhat is responsible investment? (Japanese) 責任投資とは何か?

PDF, Size 1.16 mbWhat is responsible investment? (French) Qu’est-ce que l’investissement responsable?

PDF, Size 1.12 mbWhat is responsible investment? (Spanish) ¿Qué es la inversión responsable?

PDF, Size 1.14 mb

References

[1] See, for example, Mozaffar Khan et al. (2016) Corporate Sustainability: First Evidence on Materiality and Robert G Eccles et al (2014), The Impact of Corporate Sustainability on Organizational Processes and Performance

[2] See, for example, Ravi Bansal et al. (2016) Price of Long-Run Temperature Shifts in Capital Markets and OECD (2014) Trends in Income Inequality and its Impact on Economic Growth.

[3] PRI (2021) The evolution of responsible investment: an analysis of advanced signatory practices.

[4] PRI (2022) Inside PRI data: asset owner action