By Marco Ceccarelli, University of Zurich - Department of Banking and Finance; Swiss Finance Institute; Stefano Ramelli, University of Zurich - Department of Banking and Finance; and Alexander F. Wagner, University of Zurich - Department of Banking and Finance; Centre for Economic Policy Research (CEPR); European Corporate Governance Institute (ECGI); Swiss Finance Institute

The 2015 Paris Agreement recognises finance as a central element of a successful transition to a low-carbon economy. In that agreement, world leaders established “making financial flows consistent with a pathway towards low greenhouse gas emissions” (Article 2) as one main long-term objective.

One way policy makers are trying to achieve this is by improving the information available to investors about the climate impact of their investments. The success of such policies, however, relies on the twin assumptions that investors will respond to more transparency by demanding more climate-conscious products and that fund managers and other intermediaries will in turn shift their assets towards more climate-friendly holdings.

In this blog, we investigate whether these assumptions hold, exploiting a quasi-experimental situation in the mutual funds industry.

In April 2018, the investment platform Morningstar introduced an eco-label for mutual funds, the Low Carbon Designation (LCD). This event represented an unexpected increase in the level of information available to investors on the climate performance of mutual funds. Using data for both European and US funds, we establish two key results.

- Investors showed a preference for LCD funds: From May through the end of December 2018, funds that were awarded the LCD enjoyed significantly higher monthly flows than conventional funds. This effect is at least partially driven by non-pecuniary preferences for climate-conscious investment products, as opposed to considerations of future performance.

- Fund managers’ behaviour changed significantly following the release of the LCD: Managers of active funds that missed the label at its initial release shifted their holdings to more climate-friendly firms, in the attempt of obtaining the designation in subsequent updates.

Introduction of the low-carbon designation

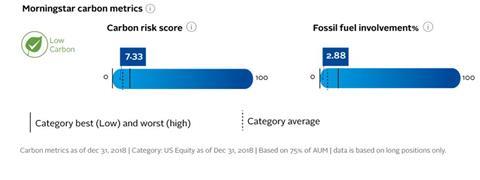

On 30 April 2018, Morningstar introduced the LCD identifying mutual funds that have a portfolio aligned with the transition to a low-carbon economy. This label is depicted as a green leaf icon, which is visible on the fund’s report, as shown in Figure 1 below. While it is not the first type of sustainability evaluation for funds, the LCD is particularly interesting because it is focused on climate change, and specifically aimed at helping clients easily identify low-carbon funds.

To receive the LCD, a mutual fund has to comply with two criteria: (1) a 12-month trailing average “Portfolio Carbon Risk Score” below 10 (out of 100); (2) a 12-month trailing average “Fossil Fuel Involvement” below 7%. The portfolio scores are based on firm-level variables from the research provider Sustainalytics, which are updated on a yearly frequency.

“Carbon Risk” quantifies the exposure of portfolio companies to material risk related to their carbon emissions as well as how well they are managing these risks (Morningstar, 2018). Morningstar computes the fund-level Carbon Risk scores by weighting the firm-level scores by the total investment (debt and equity) that a mutual fund holds at the end of the quarter in a given company. As of April 2018, having a Portfolio Carbon Risk Score below 10 represents being amongst the 29% of funds with the best performance on this dimension.

“Fossil Fuel Involvement” measures the percentage of portfolio firms that derive a significant share of revenues from activities related to fossil fuels. As of April 2018, having a 12-month trailing average fossil fuel involvement below 7% represents a 33% under-weighting of fossil fuel-related companies relative to the global equity universe.

Rewards for LCD

If receiving the Low Carbon Designation is desirable, we should observe that, when faced with two similar funds in terms of size, general sustainability ratings, and other financial characteristics, investors will choose the LCD fund over the Non-LCD one. If this is the case, we should observe an abnormal increase in fund flows for Low Carbon funds after the label is released.[1]

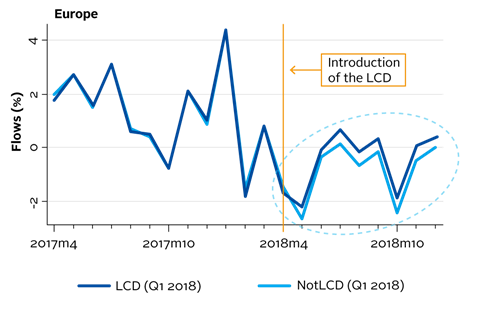

Figure 2 illustrates the average assets-weighted monthly flows into or out of European funds that were categorized as Low Carbon at the end of April 2018 and into or out of European funds that did not (No Low Carbon), from April 2017 through December 2018.[2] Importantly, information about the LCD became available to investors only from the beginning of May 2018.

Before the LCD was published, the variation over time of flows into funds that would be later designated low carbon are very much in line with the average flows in other funds. In other words, the two groups show common trends. With the release of the LCDs at the end of April 2018, low carbon designated funds started enjoying a clear and persistent increase of flows compared to other funds. A formal test (using a difference-in-differences specification) confirms this finding: funds that received the label in April, experienced a flow premium of around 2% in assets under management over the eight months from May to December 2018. These findings are robust to the inclusion of several controls, e.g., past returns, fund size, volatility, age, and Morningstar star ratings. This even includes Morningstar’s generic sustainability “Globes” label, which themselves have an impact on fund flows.[3]

Moving towards LCD

We have seen that investors in the mutual fund industry prefer climate-conscious investments. Do mutual fund managers react to these revealed preferences? Specifically, do managers of funds that did not receive the label shift their portfolios towards more climate-friendly firms?

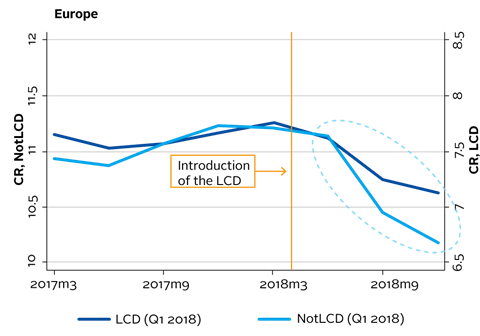

In Figure 3, we plot Carbon Risk of active mutual funds over our sample period. The figure shows two things.

First, before the introduction of the LCD, Carbon Risk follows a parallel trend in funds receiving and those not receiving the LCD at its introduction. This fact suggests that fund managers were not aware of the impending introduction of the label, or at least of the criteria upon which it was awarded.

Second, after the introduction of the label, both groups of funds decreased their carbon risk, but the drop in carbon risk is much more pronounced in the NotLCD group.

These findings again hold in a formal difference-in-differences regression and are robust to the inclusion of several control variables. Compared to funds that did receive the LCD, non-receivers decreased their Carbon Risk by an average of 0.26. They achieved this improvement by increasing their holdings of negligible and low Carbon Risk firms by 0.60% and 0.82% of assets under management (AUM) and by decreasing their holdings of high and severe Carbon Risk firms by 0.26% and 0.19% of AUM, respectively.[4]

Conclusion

Around the introduction of Morningstar’s Low Carbon Designation (LCD) label in April 2018, mutual fund flows demonstrated investors’ preference for climate-responsible investments: Keeping other factors constant, funds labeled as Low Carbon enjoyed 24 basis points higher monthly net flow of money than funds that were not labeled as Low Carbon.

Investors’ call for climate responsibility did not fall on deaf ears: mutual funds that did not receive the LCD subsequently reduced their holdings in high carbon-risk and fossil fuel-related companies and instead shifted their holdings towards more climate-responsible firms.

Overall, our findings suggest that, as investors call for climate-conscious investment products, financial intermediaries use the vehicles at their disposal to compete for this change in demand. These results have important practical implications: First, they alert active mutual fund managers to the importance of sustainability – and especially climate responsibility – as a key competitive edge, particularly valuable to an industry under strain from the rise of passive investment. Second, they encourage policy-makers looking to eco-labeling schemes to re-orient capital flows towards the transition to a low-carbon economy.

This blog is written by academic guest contributors. Our goal is to contribute to the broader debate around topical issues and to help showcase research in support of our signatories and the wider community.

Please note that although you can expect to find some posts here that broadly accord with the PRI’s official views, the blog authors write in their individual capacity and there is no “house view”. Nor do the views and opinions expressed on this blog constitute financial or other professional advice.

If you have any questions, please contact us at [email protected].

References

[1] It is also possible that investors were already aware of the climate performance of their mutual funds when the LCD was introduced, or that, on average, they are not concerned about climate-related performance. If this is the case, we should not observe any reaction.[1]Ammann, Bauer, Fischer, and Muller, 2018; Hartzmark and Sussman, 2019.

[2] The figure for U.S. funds shows a similar effect (see the full paper).

[3] Ammann, Bauer, Fischer, and Muller, 2018; Hartzmark and Sussman, 2019.

[4] Negligible, low, medium, high, and severe Carbon Risk (CR) corresponds to firms with a CR score of 0, 0.01 - 9.99, 10 - 29.99, 30 - 49.99, and >50 respectively.