By Robin Döttling, Erasmus University Rotterdam, and Sehoon Kim, University of Florida

The past decade has seen remarkable growth in socially responsible investing (SRI or ESG investing), and with it, a natural rise in regulatory and academic interest in understanding investor demand for sustainable investments. Is SRI viewed by investors as a necessity and can it, therefore, command resilient demand, or does it reflect cyclical non-essential demand that becomes buoyant during good times but falls when the going gets tough?

In our recent study, we investigate individual ESG preferences revealed by retail mutual fund flows in the face of the economic crisis following COVID-19. We find that:

- retail fund flows fall more sharply for funds with higher Morningstar sustainability ratings compared to lower-rated funds domiciled in the US;

- the decline persists beyond the early stock market crash and even during the post-stimulus market rebound, as the economy continues to deteriorate;

- institutional flows into sustainable funds are more robust.

Our research provides insights about sustainability preferences by individual investors, highlighting retail demand as a source of fragility in SRI when they are hard-hit by economic downturns and emphasising the importance of investor heterogeneity in understanding SRI demand.

Retail flows into sustainable funds fall during COVID-19

The economic crisis that has followed the outbreak of the novel coronavirus provides an ideal setting to study the impact of a significant and unexpected economic shock on sustainable investment preferences. First, it has triggered the first major crisis originating in the real economy seen during this period of growth in sustainable investing. Second, the root cause of the economic shock was unrelated to economic preconditions, helping us establish a causal link between economic stress and individual sustainability preferences. Third, the continuous deterioration in economic conditions contrasts starkly with the initial stock market crash and subsequent post-stimulus rebound, helping us distinguish shifts in sustainability preference from simple valuation effects.

Using this shock, we study the response of investments by retail investors in mutual funds with high Morningstar sustainability ratings, as a measure of revealed preference for sustainability. Retail sustainable fund flows are a suitable measure, given that retail investors are known to actively reallocate capital across funds in response to sentiment and preference shifts. Retail investors are also economically important, representing over 60% of total net mutual fund assets.

Based on Morningstar data covering US domiciled open-end equity mutual funds and their weekly retail fund flows as well as sustainability ratings, we find that retail investor preference for sustainability weakens substantially under the economic stress imposed by COVID-19. Funds with five-globe Morningstar sustainability ratings that received higher than average flows prior to the crisis experience a sharper decline in flows after the onset of the pandemic-induced economic downturn, dropping to the level of funds with low sustainability ratings.

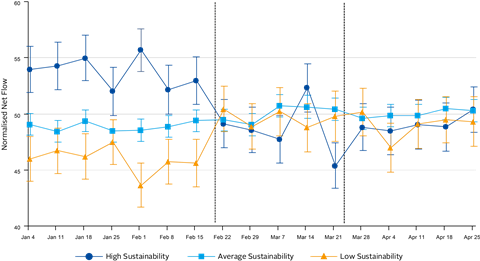

This key result is illustrated in Figure 1, where we plot weekly average retail fund flows, normalised as percentage net flow rankings within similarly sized groups of funds, over the sample period from January 4 to April 25, with different sustainability ratings. Our estimates imply that weekly net flows into highly rated funds as a fraction of beginning-of-week net assets dropped by 0.2 percentage points more from pre-COVID levels during the crisis, compared to average funds.

Moreover, this shift not only manifests early during the market crash weeks, between February 22 and March 21, but also persists between March 28 to April 25, when the stock market rebounded dramatically after the US stimulus package was announced, all the while the economy continued to deteriorate.

Institutional flows continue into sustainable funds

Our interpretation is that investor preferences or attention are shifting away from sustainable investments in the face of economic distress. To test this, we compare these to institutional fund flows. Distinctions between mutual fund investments by retail and institutional investors provide important clues to explaining the retail flow responses. For example, institutional investors are much less financially constrained – they face higher minimum investment requirements (e.g., $200,000 or more) – and are also highly committed to explicit ESG related mandates.

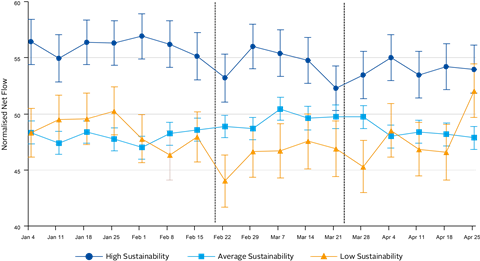

Given these differences, one would expect cash-strapped retail investors to cut spending on SRI more sharply in bad times than deep-pocketed and committed institutions do, if indeed SRI is viewed as a “non-essential” good. Consistent with this idea, we find that institutional flows do not disproportionately decline for high sustainability funds in response to the COVID-19 crisis.

This is illustrated in Figure 2, where we plot weekly normalised institutional fund flows. In fact, we find that institutional flows drop sharply – mainly for low sustainability funds – but only temporarily during the early market crash period. This further indicates that our main result on retail flows is consistent with a shift away from sustainability preference, a perceived luxury good that retail investors can no longer afford under economic distress.

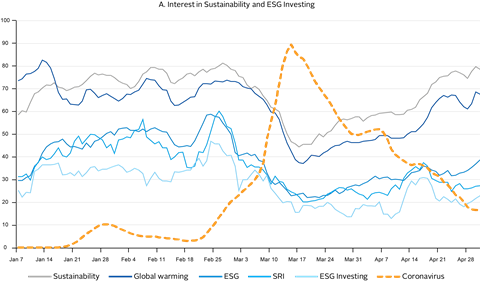

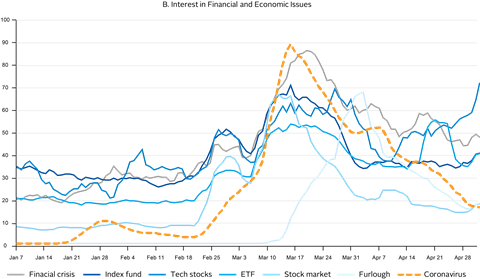

Shifting interests from sustainability to financial and economic issues

Our interpretation is also supported by evidence of Google search traffic shifting away from sustainability or ESG-related topics toward issues related to the economy or investing more broadly (see Figure 3). We further exclude potential alternative explanations, based on conventional factors known to affect fund flows, such as fund style, age, size, expenses, past returns and flows, star ratings, time trends, “buying the dip” behaviour, or changes in risk tolerance. Overall, we find our evidence consistent with non-financial incentives for sustainable investments by retail investors that are adversely impacted by a large-scale economic crisis.

Implications for ESG investing

A long-term implication of our findings is the fragility and cyclicality in SRI demand stemming from retail investors. Under prolonged economic distress, this means there could potentially be a broader shift in investor preferences – retail demand may also affect the institutional push for ESG and weaken the intensity and influence of institutional ESG engagement. Thus, to make sustainable investing “sustainable”, individual investors must understand clearly any tangible financial and economic value that may arise from SRI. Leaning on social signals and preferences to attract SRI demand will only sustain such investments for so long, mostly when times are good and the societal need for ESG investments is at its lowest.

Related evidence

Our study contributes to a growing line of inquiry on what motivates sustainable investments (see Bollen, 2007; Renneboog et al., 2011; Riedl and Smeets, 2017), by highlighting the importance of economic distress and uncertainty in the resilience of SRI preferences.

By emphasising the implications of important investor heterogeneity, namely that retail investor preferences for sustainability are more fragile than institutional preferences, we also complement contemporaneous work by Pastor and Vorsatz (2020), as well as recent quarterly reports by Morningstar, which demonstrate that fund investors continue to invest in sustainable funds during the COVID-19 crisis. Consistent with our study, another contemporary study by Glossner et al. (2020) also documents that retail stock investors invested very differently from institutional investors during the COVID-19 crash, exhibiting reduced interest in environmental and social stocks.

Pastor and Vorsatz (2020) show that sustainable funds earn higher returns during the COVID-19 market crash. Other recent studies document that stocks of firms with better ESG profiles exhibit more resilience in their returns during the crash (see Albuquerque et al., 2020; Ding et al., 2020). This related evidence further highlights the non-financial motives for sustainable investing by retail investors and their responses – despite superior returns – to the economic constraints imposed by COVID-19.

Concluding remarks

Our study provides a clear stepping stone to understanding investor preferences for sustainable investments: retail SRI fund flows pose a source of fragility and cyclicality in ESG investing. This finding underscores the importance of contemporary and future investigations of the SRI landscape taking into consideration the scarcity of socially responsible capital, differences across distinct investor classes, and changing sustainability preferences over time.

The full version of our paper can be found here: https://ssrn.com/abstract=3656756

References

Albuquerque, R., Y. Koskinen, S. Yang, and C. Zhang (2020). Resiliency of environmental and social stocks: An analysis of the exogenous COVID-19 market crash. The Review of Corporate Finance Studies, forthcoming.

Bollen, N. P. B. (2007). Mutual fund attributes and investor behavior. Journal of Financial and Quantitative Analysis 42(3), 683–708.

Ding, W., R. Levine, C. Lin, and W. Xie (2020). Corporate immunity to the COVID-19 pandemic. Journal of Financial Economics, forthcoming.

Glossner, S., P. P. Matos, S. Ramelli, and A. F. Wagner (2020). Where do institutional investors seek shelter when disaster strikes? Evidence from COVID-19. CEPR Working Paper.

Pastor, L. and B. Vorsatz (2020). Mutual fund performance and flows during the COVID-19 crisis. The Review of Asset Pricing Studies, forthcoming.

Renneboog, L., J. Ter Horst, and C. Zhang (2011). Is ethical money financially smart? Nonfinancial attributes and money flows of socially responsible investment funds. Journal of Financial Intermediation 20(4), 562–588.

Riedl, A. and P. Smeets (2017). Why do investors hold socially responsible mutual funds? The Journal of Finance 72(6), 2505–2550.

This blog is written by academic guest contributors. Our goal is to contribute to the broader debate around topical issues and to help showcase research in support of our signatories and the wider community.

Please note that although you can expect to find some posts here that broadly accord with the PRI’s official views, the blog authors write in their individual capacity and there is no “house view”. Nor do the views and opinions expressed on this blog constitute financial or other professional advice.

If you have any questions, please contact us at [email protected].