By George O. Aragon, Arizona State University, Yuxiang Jiang, Southwestern University of Finance and Economics, Juha Joenvӓӓrӓ, Aalto University School of Business and Cristian Ioan Tiu, University at Buffalo

Does the adoption of a responsible investment policy benefit the investors who choose to do so?

University endowments represent an ideal laboratory to study this question because these entities seek investment returns. Still, they also cater to the preferences of other stakeholders such as donors or university students and faculty and have an infinite lifespan.

If society assigns exceptional value to social responsibility in investments, resources will flow to encourage a corresponding shift in how investment portfolios are chosen. In the microcosm of university endowments, this reallocation of resources will translate to increased advocacy for responsible investment from university stakeholders. It could also lead to additional donations for the endowments that are more advanced on the path of responsible investment.

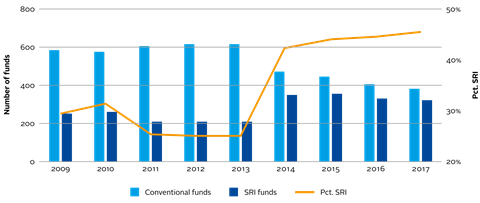

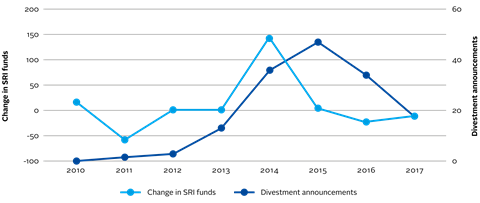

We therefore examine the socially responsible investment (SRI) policies of university endowment funds between 2009 and 2017. This is possible thanks to a unique dataset from the National Association of College and University Business Officers detailing responsible investment actions by university endowments.

The incidence of SRI adoption increased in our sample, especially after the Paris Climate Agreement Adoption, with 46% of endowments considering some form of SRI adoption in their investment policies in 2017. The range of responsible actions is wide, varying from simply recognising the importance of social responsibility in an endowment’s investment policy to full divestment from irresponsible companies.

We find that SRI policies are more common when funds face greater stakeholder pressure to adopt them, and among universities that are more donation-dependent and located in areas where attitudes towards corporate social responsibility are more prevalent. We further find that SRI actions result in decreased exposure to oil and vice stocks, consistent with the assertion that these policies result in concrete investment actions rather than portfolio “greenwashing.”

Since the energy and vice sectors underperformed during the period covered in our data, endowments that decreased their exposure to these assets outperformed. However, when we measure alphas that control for energy and vice exposures, we find that the performance of SRI endowments lags.

This may be partly explained by a reduction in the opportunity set for the more socially responsible endowments. It may additionally be more directly explained by an increase in the costs of managing a more responsible endowment – this is something we observe in the data.

While SRI endowments may underperform (on a risk-adjusted basis), SRI policy adoption predicts greater donations, especially from “socially-conscious” donors. Indeed, this is what we find in the data: SRI endowments receive more gifts, especially from donors whose wealth was created from sources other than oil or vice investments, and from donors who live in an area where attitudes towards corporate social responsibility are more prevalent.

Since SRI endowments underperform but receive more gifts, the critical question is whether total fund additions (donations plus net investment returns) are positive or negative.

We observe that additions from gifts, as well as losses due to underperformance, are small – that is, in the range of 20 basis points in absolute value. Netting both effects shows that, on balance, SRI and non-SRI funds produce similar total additions (net investment income plus donations), consistent with an optimal contracting equilibrium.

These results suggest that in the short term, SRI adoption does not impact the endowment significantly in terms of growth. Simply put, adopting an SRI policy does not tremendously hurt, nor significantly add value to an endowment.

While the impact of SRI on investments can be measured on a more immediate basis, the effect of social responsibility on gifts is admittedly better measured over more extended periods – longer than our available data.

As such, we might underestimate the positive effect of adopting an SRI policy on donations. It is, therefore, imperative to additionally assess some of the longer-term effects that a shift toward responsibility may have on university endowments.

We find that SRI endowments experience several positive long-term effects. First, SRI endowments establish a better risk management process, tracking or managing more risk measures than the less SRI endowments.

Second, we find that universities whose endowments shift toward SRI receive more student applications – which could result in larger or better-prepared freshmen classes (these students may also be the donors of tomorrow).

Third, universities with SRI endowments receive more grant money, especially to study climate change and related issues, than the universities with less SRI portfolios.

These results suggest that the adoption of SRI policies by endowments correlates with an increase in the productivity of universities –from both the students and faculty.

To conclude, our study directly analyses the impact of adopting SRI policies by university endowments. When judged based on dollars of endowment growth – via investment performance and donations – we find that the results of SRI adoption are superficial.

However, importantly, we can measure some positive longer-term effects of SRI adoptions, especially in student demand, as well as in the volume of faculty research. Netting these short and long-term effects suggests that the adoption of SRI policies by the endowment is a net positive for universities.

Read the full paper here.

This blog is written by academic guest contributors. Our goal is to contribute to the broader debate around topical issues and to help showcase research in support of our signatories and the wider community.

Please note that although you can expect to find some posts here that broadly accord with the PRI’s official views, the blog authors write in their individual capacity and there is no “house view”. Nor do the views and opinions expressed on this blog constitute financial or other professional advice.

If you have any questions, please contact us at [email protected].