Proxy season webinar, 31 July 2024

Join us for a webinar that will look at trends and insights from ESG-related votes, spotlight outcomes from climate resolutions and discuss the outlook for 2025: register for our webinar on 31 July.

By Bonnie Groves, PRI Stewardship Specialist

Proxy season remains a critical lever for influence and accountability on ESG issues. At the PRI, we support investors in using their voice and their votes to hold companies to account.

This year, ambitious resolutions are being filed already. Requests for companies to consider issues such as the just transition, adopting greenhouse gas emission targets and living wages are appearing on the proxy ballet for the second and third consecutive years, indicating a more holistic approach to ESG. And more recent resolutions are not just asking companies to disclose their policies in these areas; investors want to see corporate action.

It’s now well-established that ESG risks are financially material. At its core, responsible investment is about helping investors identify the risks and opportunities arising within our changing world. This holds true, despite the politically driven rhetoric emerging, particularly within the US market.

Listed equity investors understand that to be serious about addressing ESG risks at a company and system level, they need to use the tools at their disposal during proxy season - and that doing so is consistent with their fiduciary responsibilities.

It’s now well-established that ESG risks are financially material. At its core, responsible investment is about helping investors identify the risks and opportunities arising within our changing world.

Declining levels of support – or more ambitious demands?

The 2022 proxy season had one of the highest records for majority-supported ESG shareholder proposals in recent years; however, that trend reversed in 2023.

But it is important to remember that declining support for shareholder resolutions does not always indicate a lack of investor engagement.

For example, investors looking for more demanding and prescriptive resolutions, focusing on implementation rather than commitments, is just one of the reasons why support for more moderate ESG resolutions has wavered in recent years. Higher rates of successful withdrawal agreements, where shareholders withdraw their proposal in return for a corporate commitment, is another.

Aligning asset owners’ and managers’ interests

While investors’ expectations are increasing, their investment managers and investee companies are not always on the same page.

Research from the UK Asset Owner Stewardship Review 2023 on oil and gas company-related voting behaviour revealed the extent to which there is misalignment between asset owners’ long-term interests, and voting preferences, and investment managers’ actions on the ballot.

Asset owners and others who appoint external managers can act to make sure their interests are aligned with that of their investment manager.

The PRI has created a guide for investors to evaluate and compare how managers use stewardship to address sustainability issues such as human rights, climate change and biodiversity, both within their own organisation as well within their investee companies.

The guide specifies what stewardship practices look like from an investment manager’s perspective at a developed, intermediate or advanced level. Voting is a key part of that. For example, a manager with an advanced stewardship strategy may have voted against relevant directors and / or have filed a shareholder resolution, or explained why they did not do so for selected priority investees.

This proxy season, we have seen asset owners file shareholder resolutions at managers’ AGMs calling for a review of the managers’ voting policies, and their 2023 voting records. These resolutions can be found on the PRI Resolution Database, which contains records of ESG-related shareholder resolutions and management votes.

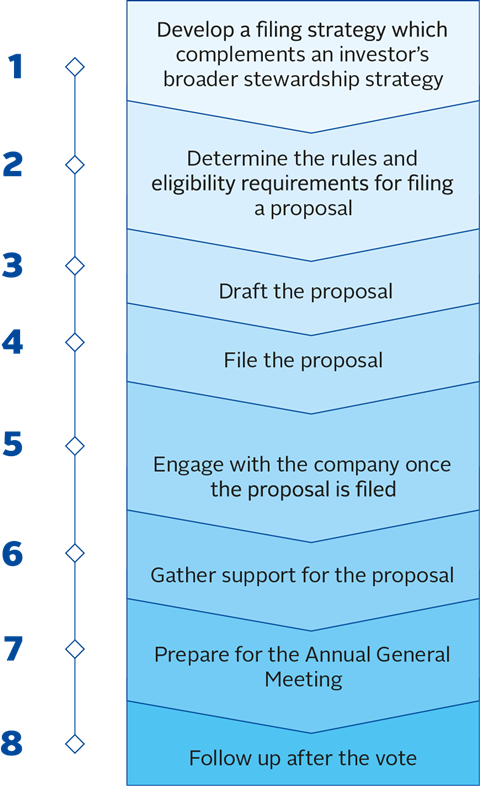

Filing the resolution is just the first step

The post-filing actions investors take are crucial in garnering support and maximising the impact of proxy season.

Once investors have filed a resolution, it is important to have a communications plan to gather support for your proposal, and use this plan to hold companies to account over their commitments, even if a proposal is later withdrawn in return for a specified action.

The chart below outlines the multiple steps investors can take to ensure their resolution has the maximum chance of success.

Figure 1: Steps involved in filing a shareholder resolution

Increasing transparency is helping accountability and impact

Public communication is not just important when it comes to negotiating with companies over their withdrawal commitments.

Increasingly investors are using tools like pre-declaration (announcing voting intentions ahead of time) to increase transparency on key sustainability challenges.

A recent academic study in partnership with Norges Bank Investment Management found that NBIM’s pre-disclosures against votes between 2019 and October 2022 led to an average increase of 2.7% in against votes by other shareholders.

Last year, the PRI Resolution Database saw a 288% increase in the number of pre-declarations made by investors[1].

We hope that investors will continue to pre-declare their voting intentions on high-impact votes and use our Resolution Database to do so.

Where companies are failing to act on their resolution-induced commitments, we encourage investors to leverage management proposals and director elections to communicate their dissatisfaction.

Holding companies to account post-AGM

Even when an ESG-related shareholder resolution is passed, the work is not over. Last year, our research found that of the 78 majority-supported proposals identified in 2022, less than 40% of them are being implemented by companies a year on from the AGMs, according to the resolution proponents.

Where companies are failing to act on their resolution-induced commitments, we encourage investors to leverage management proposals and director elections to communicate their dissatisfaction.

In this regard, successes last year included National Grid updating its climate lobbying policies after an investor pre-declared their intention to vote against directors at the AGM. Public investor opposition to the re-election of non-executive member Muriel Dube prior to Sasol’s AGM was followed by significantly reduced levels of support for the company’s climate plan, from 94.5% support in 2022 to 77.36% in 2024.

Join our July webinar

ESG risks cannot be ignored. Voting is a clear way for investors to align and express their expectations.

To learn more, register for our webinar on 31 July.

Visit the Resolution Database

The PRI’s Collaboration Platform hosts the Resolution Database - the go-to place for ESG-related resolutions and votes. Investors can use the Resolution Database to add resolutions they’ve filed, find upcoming votes, see vote results and to pre-declare their voting intentions. Please note you need to register for the Collaboration Platform for access.

References

[1] Pre-declarations on the PRI Resolution Database are subject to a disclaimer.