By Toby Belsom, Director Investment Practices, PRI and Catie Wearmouth, Investment Practices Consultant, PRI

It is not much of an exaggeration to suggest screening is where responsible investment started. In its early form, screening provided the tool for excluding certain activities from portfolios – normally to reflect a set of values or beliefs. Its foundation and implementation dates back hundreds of years and still constitutes one of the key approaches undertaken by PRI signatories. Our latest introductory guide provides an easy-to-use overview of the process and history, as well as practical steps for implementing it. It builds on our growing list of introductory guides covering responsible investment in equities, fixed income and private equity assets classes.

Screening is largely perceived as a fixed process, stuck where it started, avoiding ‘sin’ stocks such as alcohol, tobacco, gambling and defence. But this does not reflect reality. Values and social expectations change and develop depending on client perspective. New concerns have emerged, developed and receded. Opposition to the South African apartheid resulted in screening of businesses with South African associations, especially in the US. The use of genetic modification in agriculture has been added to certain screened approaches. These types of developments have been a powerful tool for asset owners to signal their values and beliefs or reflect a changing scientific or political backdrop.

Climate change and fossil fuels are the big ones. McKinsey estimates that around 10% of all assets under management globally are committed to divesting or avoiding some or all their fossil fuel exposure. Screening is no longer just reserved for investors with a certain set of values. It has been adapted and adopted by some of the largest global asset managers and owners and integrated into existing approaches. Often this is part of the active ownership or engagement process, where negative screening or divestment is often seen as the final tool when engagement has failed.

Screening does not just come in ‘one variety’, and takes many forms. Negative screening might cover certain activities or products, and universal norms such as the UN Global Compact are often used as the basis for normative screens. Positive screening can also be used to focus a portfolio on leading performers in areas such as employee conditions or environmental impact. Done well, it is a process that involves a series of steps.

Screening inevitably has implications on the characteristics of a portfolio, such as tracking errors and style factors. For instance, the exclusion of fossil fuel and tobacco stocks skews a portfolio away from income and value styles. In active portfolios, this need not automatically result in lower returns, but will need to be reflected in the asset managers’ approach and an understanding that short-term returns may diverge from a benchmark. Portfolio managers often screen universes to focus on stocks with a particular style characteristic (value, growth, etc.), so this is no different from established practice across the industry.

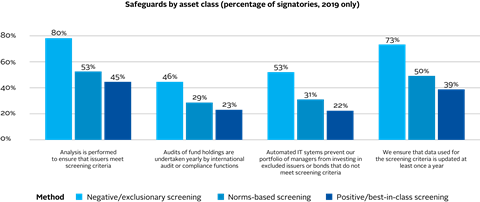

Monitoring and verifying the process is also key to establishing a client’s confidence in the process. The PRI’s reporting data shows that over a third of listed equity signatories have an independent internal body that reviews screening decisions and 46% of fixed income signatories using negative screening audit fund holdings every year.

Careful design of the screens is also important. In a previous role, I ran a set of segregated portfolios with a screen on fossil fuels – particularly coal mining. The screen was set as a percentage of revenue, which meant we could invest in one of the largest quoted global coal miners due to their diversified activities. This outcome was clearly not aligned with the client objectives – and a review of the criteria was necessary. Despite improving data on securities and increasing sophistication in approaches to screening, a last common-sense check is often a sensible step.

So, screening is not just all booze, guns and gambling. Like much within the sphere of responsible investment, it is continually evolving and will inevitably play a continued role in the implementation of responsible investment policies for many PRI signatories. We hope this introductory guide provides an easy-to-understand window into this process.

This blog is written by PRI staff members and guest contributors. Our goal is to contribute to the broader debate around topical issues and to help showcase some of our research and other work that we undertake in support of our signatories.

Please note that although you can expect to find some posts here that broadly accord with the PRI’s official views, the blog authors write in their individual capacity and there is no “house view”. Nor do the views and opinions expressed on this blog constitute financial or other professional advice.

If you have any questions, please contact us at [email protected].