By Bonnie Groves and Tom Lawton, Senior Specialist and Intern respectively at PRI Investor Initiatives and Collaboration

Proxy season has always been a landmark moment in the investment calendar. Specifically for responsible investors, it provides an invaluable opportunity to leverage their voting powers to engage with their portfolio companies on substantive environmental, social and governance issues.

This proxy season, we compiled over 850 ESG-related shareholder resolutions, management proposals and director votes on the PRI Resolution Database. Vote results have been published for 520 of those, and 210 have been withdrawn.[1]

We have highlighted some of the main trends from these filings, and what these trends reveal about investor action more broadly.

1. The bigger picture behind lower shareholder support

Average levels of support for shareholder resolutions have continued to trend downwards, from 28.3% in 2023 to 21.6% this year.[2] However, shareholder support is a complex picture and can be in part explained by:

- A general trend in the types of asks put to companies. Resolutions have become more demanding and prescriptive over the years, and are therefore associated with lower levels of support. This is particularly true as companies and filers negotiate, leading to many resolutions being withdrawn. This means the asks that stay on the ballot are often more challenging.

- The ongoing effects of anti-ESG sentiment and a growing number of shareholder resolutions filed by anti-ESG proponents, compounded by a decline in support of pro-ESG resolutions from some of the largest US asset managers. However, these anti-ESG proposals are not gaining traction in terms of overall levels of average shareholder support, falling from 5.1% in 2023 to 2.4% this year.

In contrast to the US, research finds that European asset managers are holding firm in their support for ESG resolutions.

Notably, the number of ‘near miss’ ESG-focused shareholder resolutions – those that gain just below 40% support – is growing. Even without support from some of the largest US asset managers, this growing support is happening across both sides of the Atlantic.

2. Successful engagement outcomes can lead to withdrawn resolutions

Companies can and do stick to the commitments they make in exchange for shareholder proposals being withdrawn. Recent research from Ceres, that tracked 66 corporate commitments since the 2021 proxy season found that 73% have been fully or mostly implemented, 23% partially implemented, and only two of the commitments were not yet met.

A vote at the Royal Bank of Canada demonstrates how engagement on an emerging topic on the proxy ballot can gain momentum and lead to a shareholder proposal being withdrawn and a commitment being made. In this case, following consistent engagement on Indigenous Rights, the bank has improved its Environment and Social Risk process (I-ESR), amended its human rights statement, and agreed to undergo a third-party review of its new I-ESR policies as part of its racial equity audit.

This action at the Royal Bank of Canada reflects a general trend of consistent shareholder support for resolutions filed on Indigenous Rights, with average levels of support equalling 24.8% in both 2023 and 2024.

The table below shows how shareholder support increased for action at the Royal Bank of Canada and resulted in a withdrawal this year.

| 2022 | 2023 | 2024 | |

|---|---|---|---|

|

Lead filer |

Investors for Paris Compliance |

B.C. General Employee’s Union |

B.C. General Employee’s Union |

|

Vote result |

3. An increasing focus on biodiversity issues

The adoption of the Kunming-Montreal Global Biodiversity Framework in December 2022 and an evolving regulatory landscape are building momentum for company action on nature.

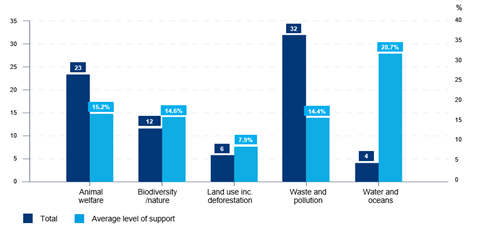

This year, in the US and Canada, 77 nature-related shareholder resolutions were filed, compared to 49 last year and 38 in 2022. Of this year’s resolutions, nine focused on biodiversity impact and dependency assessments, representing a significant increase from the one resolution at Costco in 2023.

Nature and biodiversity shareholder resolutions by subtopic in 2024

Source: PRI Resolution Database

4. New resolutions are exploring company use of AI

AI is developing faster than the laws that govern it. For the first time, filers are asking companies to report on ethical considerations regarding their use of AI. These resolutions received strong levels of support at Netflix (43.3%), Apple (37.5%) and Warner Brothers Discovery (24%) this season.

5. Asset owners are increasingly scrutinising their managers

Recent research has found that misalignment between asset owners and asset managers on climate-related votes has been more pronounced in recent years.

In response, earlier this year, a coalition of investors sent investor letters to the eight largest US asset managers. This was followed by the filing of 12 shareholder proposals asking the managers to review their voting policies and assess how their proxy records aligned with policies on topics such as climate change and workers’ welfare.

The four proposals that went to vote received an average of 7.6% shareholder support. It remains to be seen how this topic will feature at future AGMs, however we’re seeing increasingly clear expectations from asset owners regarding their managers’ responsible investment activity, and asset owners are prepared to voice their concerns on the issue. For example, until the 12 resolutions were filed this year, only two such proposals had been filed before, according to our records, in 2021.

6. Consistency and alignment in voting will be valuable for successful 2025 engagements

Thoughtful and considered voting remains a critical stewardship tool for investors to communicate their asks in a transparent way, affirm a company’s progress and highlight areas where ESG risks could be better managed. Consistency between voting positions and engagement asks can also maintain clarity and coherence for companies.

Alignment between asset owners and managers is crucial to achieving these aims. The months leading up to next year’s proxy season are an important time, not only for post-AGM engagement with companies but also for asset owners to engage with their managers.

PRI guidance and tools support investors to develop voting policies, file shareholder resolutions and find others to collaborate with. Access further resources and additional analysis shared in our proxy season 2024 webinar here:

The PRI blog aims to contribute to the debate around topical responsible investment issues. It should not be construed as advice, nor relied upon. The blog is written by PRI staff members and occasionally guest contributors. Blog authors write in their individual capacity – posts do not necessarily represent a PRI view. The inclusion of examples or case studies does not constitute an endorsement by PRI Association or PRI signatories.

References

1 Data was last updated 16 July 2024. Information on shareholder resolutions, management proposals and votes is obtained from sources that are believed to be reliable, but the PRI does not represent that it is accurate, complete, or up-to-date, including information provided in support of resolutions and proposals, vote pre-declarations (including voting rationales), and the current status of a resolution or proposal. Further detail can be found in the Resolution Database disclaimer.

2 Figures exclude anti-ESG vote results. Including anti-ESG results, the average level of support for shareholder resolutions in 2023 was 21%, and in 2024 was 18.9%. Anti-ESG results are identified as shareholder resolutions submitted by known anti-ESG proponents. Vote results are determined by dividing the number of votes in favour of a resolution by the total number of votes (for and against). This formula disregards abstentions and non-votes, which may be inconsistent with the methodology used by a particular company to determine whether a resolution has been approved.