By Lasse Heje Pedersen, Principal at AQR Capital Management & Finance Professor at Copenhagen Business School and NYU; Shaun Fitzgibbons: Managing Director at AQR Capital Management; Lukasz Pomorski, Head of ESG Research and Managing Director at AQR Capital Management

Asset owners and portfolio managers overseeing trillions of dollars are increasingly seeking to incorporate environmental, social and governance (ESG) considerations into their investment processes. However, investors have little guidance on how to incorporate ESG into portfolio selection, and worse, opinions differ dramatically across academics and practitioners about whether ESG helps or hurts performance. Some argue that ESG considerations must necessarily lower expected returns (Hong and Kacperczyk, 2009) while others argue that the “outperformance of ESG strategies is beyond doubt”.

To reconcile these opposing views, we develop a theory that shows the potential costs and benefits of ESG-based investing. A key premise is that each stock’s ESG score plays two roles; providing information about firm fundamentals and affecting investor preferences. Our theory explains how the increasingly widespread adoption of ESG affects portfolio choice and equilibrium asset prices.

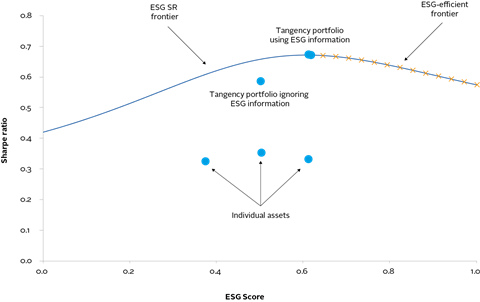

Our framework provides a useful way to conceptualise and quantify the costs and benefits of ESG investing. The ESG-efficient frontier, a graphical illustration of the investment opportunity set, demonstrates a responsible investor’s decisions. Specifically, it shows the highest attainable Sharpe ratio (SR) for each ESG level.

The benefit of ESG information can be quantified as the resulting increase in the maximum SR (relative to a frontier based on non-ESG information). The cost of ESG preferences can be quantified as the SR drop when choosing a portfolio with better ESG characteristics than those of the portfolio with a maximum SR.

The frontier and the corresponding set of optimal portfolios in the ESG-efficient frontier are explicitly based on a rigorous theoretical framework.

The optimal portfolios are spanned by four “funds,” one of which captures stocks’ ESG scores. This framework can be viewed as a theoretical foundation for what is called “ESG integration,” meaning that ESG characteristics are used directly in portfolio construction (rather than as screens).

When a governance measure is used as an ESG proxy, the maximum SR is achieved for a relatively high ESG score. Increasing the ESG level even further only leads to a small SR reduction, implying that ethical goals may be achieved at a small cost.

When we impose realistic constraints on the portfolio, we see a downward shift in the ESG-SR frontier. This is expected, because imposing constraints reduces the maximum Sharpe ratio that can be attained for any given ESG score.

Surprisingly, screens that remove the lowest-scoring ESG assets from the investment universe can lead investors who maximise their SR to choose a portfolio with lower ESG scores than those chosen by unconstrained investors who allow investments in low-scoring ESG assets. This highlights the nuances in optimally incorporating ESG into portfolio construction and suggests improvements may be needed to traditional approaches based on simple screening.

Turning to equilibrium asset prices, we derive a version of the Capital Asset Pricing Model that incorporates ESG-type information and that helps describe how ESG factors may predict investment returns in different market environments.

To our knowledge, this model is the first to explicitly model the varying ways investors use ESG information. It allows for investors to have ESG preferences and to find investment intelligence from ESG information. This is realistic because we not only observe large amounts of AUM deployed with ESG in mind, but also because ESG is increasingly discussed as a potential “alpha” signal.

The interplay of such factors influences how markets price in ESG information, and we show under what circumstances it may lead to ESG factors that earn expected returns that are positive, negative, or neutral.

We test the predictions of the theory using a range of ESG proxies that reflect different aspects of our model and that may represent different investor types.

Our governance proxy has historically offered ESG investors strong performance in addition to its favourable ESG characteristic, perhaps because good governance predicts strong future fundamentals, while attracting modest investor demand, leading to relatively cheap valuations and positive returns.

In contrast, our proxies for environmental, social and ESG factors overall are weaker predictors of future profits, and investor demand appears stronger for these, which may help explain the higher valuations of stocks that score well on these metrics, and their low or insignificant returns.

In conclusion, our model provides a useful framework for responsible investment that we hope will be useful for future research on the costs and benefits of ESG investing and for ESG applications in investments practice.

The full paper can be accessed here.

This blog is written by academic guest contributors. Our goal is to contribute to the broader debate around topical issues and to help showcase research in support of our signatories and the wider community.

Please note that although you can expect to find some posts here that broadly accord with the PRI’s official views, the blog authors write in their individual capacity and there is no “house view”. Nor do the views and opinions expressed on this blog constitute financial or other professional advice.

If you have any questions, please contact us at [email protected].