By Lilya Mincheva, Relationship Manager, Canada, PRI; and Eduardo Atehortua Barrero, Head of Latin America (ex-Brazil), PRI

The new reporting framework and the 2021 outputs present a significant opportunity for signatories to benchmark themselves against peers, learn, and enhance their practices.

In the spirit of collaboration (Principle 5), it is also an opportunity to come together as a community of responsible investment professionals, and discuss common challenges, questions and solutions.

Earlier this year, we launched a pilot project called Community of Practice in Canada and Latin America (excluding Brazil), aiming to bring signatories together to discuss their responsible investment activities, in the context of the PRI Reporting Framework.

Below we highlight some of the key discussion points from the sessions we held in Canada, where almost two-thirds of the market is committed to investing responsibly, according to a recent report.

Canadian signatories focused on implementation and engagement

In Canada, we organised 16 webinars, each presenting data insights from different modules within the 2021 Reporting Framework, followed by a roundtable discussion between signatories and local Signatory Relations and Content team members.

Participants discussed their responsible investment practices in different asset classes, the challenges they face in relation to climate change, implementing the recommendations of the Taskforce on Climate-related Financial Disclosures, and asset manager selection, appointment, and monitoring. What we heard during the sessions largely aligned with the findings of our recent report, Inside PRI data: asset owner action.

The following three areas also featured prominently in the conversations:

1) Engagement with policy makers for a more sustainable financial system: Asset owners and investment managers are increasingly engaging with policy makers in some way. But challenges remain, from relationship building to team capacity issues. There is also the question of attribution: participants said that they struggle to attribute certain policy outcomes to their own engagement activities. The group discussed whether there should be individual attribution at all, or if investors should instead just focus on achievements that come from collective engagement, such as our recent sign-on letter to the Canadian Securities Administration on corporate climate-related disclosures.

2) Private assets: Participants highlighted ongoing ESG data challenges, around quality and availability of data, particularly in relation to climate and diversity. Some private equity investors have developed proprietary proxies, using publicly available Scope 1 and Scope 2 emissions data, to estimate the emissions of their investee companies. We recently launched a guide highlighting the resources and initiatives available for private market investors to help them incorporate climate change considerations into their investment process.

3) Sustainability outcomes: Smaller Canadian investment managers wanted to discuss how to implement the PRI’s five-part framework for investing in line with the Sustainable Development Goals and how to better articulate ESG integration and impact investing practices to align them with sustainability outcomes. Participants agreed that they need clearer definitions on this topic – we will build on the feedback received to provide further guidance supporting signatories’ reporting on sustainability outcomes in 2023.

How did Canadian signatories rate the pilot project?

Three-quarters of participating Canadian signatories said they made between one and five new connections, while 95% said they would recommend the sessions to their peers.

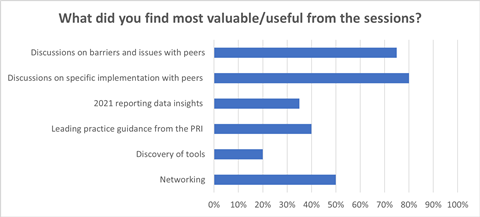

The graph below shows what participants found most valuable from the sessions:

A different approach in Latin America ex-Brazil

We also hosted some Community of Practice sessions for Latin American signatories (excluding Brazil).

They consisted of eight webinars where 19 signatories – that already implement some responsible investment best practices – shared their experiences with participants. The webinars covered topics related to ESG integration in listed equity, fixed income, private equity, real estate and infrastructure, alongside some in-depth discussion on climate change.

We hope that the Community of Practice pilot will promote more collaboration between signatories in the region, as this will be key to further improving responsible investment practices.

Next steps

Reflecting our blueprint commitment to convene and educate responsible investors, we will host further roundtable discussions for signatories in Canada and Latin America ex-Brazil.

We will also make the Community of Practice a more centralised PRI initiative, allowing more signatories to benefit from the deeper, structured, practice-based exchanges that such a project can provide.

Future sessions will likely focus on the recently released 2021 Reporting and Assessment Outputs in certain regions – look out for further announcements.

We would like to thank the organisations that have participated so far and encourage all signatories to contact their regional Relationship Manager to learn more about the project or express their interest in taking part.

The PRI blog aims to contribute to the debate around topical responsible investment issues. It is written by PRI staff members and occasionally guest contributors. Blog authors write in their individual capacity – posts do not necessarily represent a PRI view.