By Rui Albuquerque, Carroll School of Management, Boston College, CEPR and ECGI, Yrjo Koskinen, Haskayne School of Business, University of Calgary, Shuai Yang, Haskayne School of Business, University of Calgary, and Chendi Zhang, University of Exeter Business School

Are firms’ environmental and social (ES) policies luxuries that are worthless during a time of crisis? On the contrary – according to our recent paper, those policies pay off especially when times are tough. Using US data, we show that stocks with high ES ratings fared much better during the COVID-19 market crash than other stocks.

COVID-19 – an unparalleled research opportunity

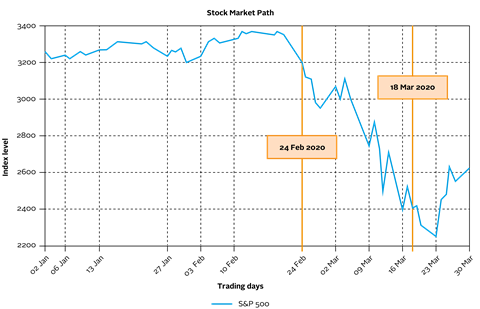

We argue that the COVID-19 pandemic presents an unparalleled opportunity to study the effects of ES policies on corporations’ financial performance. First, the COVID-19 crisis and subsequent economic lockdown was an unexpected shock to global stock markets. The US stock market peaked on 19 February, and a mere month later prices had declined by almost 30%.

Second, COVID-19 was a shock that originated because of public health concerns – it wasn’t caused by economic or business conditions. Its unexpected and non-economic origin and speed meant that firms had very limited ability to respond in a timely fashion to the unfolding crisis. Thus, the stock market reacted mostly to firms’ pre-existing conditions, which affected their ability to endure the crisis. Overall, these aspects create a rare opportunity to study the causal link between environmental, social and governance factors and firm value over a very narrow timeframe.

ES ratings have a positive impact on first-quarter stock returns

Our first result is that abnormal stock returns – returns adjusted for the market developments – between January to March were significantly positively correlated with ES ratings, even after controlling for firm characteristics, including asset size, cash to assets, end of 2019 valuation, dividend yield, volatility, leverage, and industry.

Next, we examine more closely the relationship between the returns for firms with high ES ratings and the COVID-19 pandemic, by using daily data and conducting more sophisticated analysis inside the first quarter of 2020.

We estimate a regression of daily firm-level abnormal returns with a COVID-19 event date of 24 February, when the stock market decline accelerated. We include a second event date of 18 March, when President Trump signed the second Coronavirus Emergency Aid Package, which was the start of an aggressive fiscal and monetary policy response to the pandemic.

We find that firms with high ES ratings earned an extra daily return of 0.45% from 24 February until 17 March, relative to firms with low ES ratings. The cumulative difference for the period was a massive 7.2%.

Cash increases returns too, leverage has the opposite effect

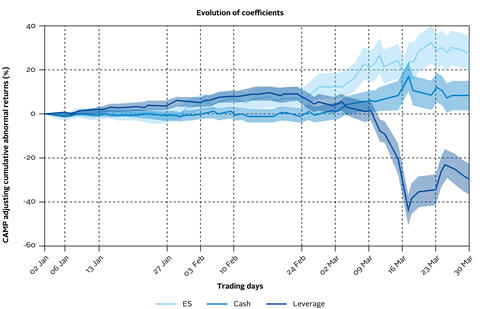

Following Ramelli and Wagner (2020), we also estimate daily cross-sectional regressions of cumulative abnormal returns of US-listed firms and inspect the evolution of the ES ratings effect on stock returns over time.

We find that the effect of ES ratings was flat from 1 January 2020 until the end of February, which suggests that there is no significant return difference between high- and low-ES firms prior to the COVID-19 shock. The effect of ES ratings then steadily increased until it plateaued around mid-March, consistent with ES stocks being more resilient during the COVID-19 market crash.

Similar to the findings from Ramelli and Wagner (2020), cash had a significantly positive effect on stock returns – much greater than ES ratings, and leverage contributed negatively to stock returns.

Corroborating evidence

In an analysis involving 56 countries, Ding, Levine, Lin, and Xie (2020) provide evidence that is consistent with our findings. Firms with stronger balance sheets – more cash, lower leverage – and better ES policies performed better during the first quarter of 2020. In addition, the drop in stock prices was larger among firms that were more exposed to the COVID-19 pandemic through their international supply chains and customer locations.

Cheema-Fox, LaPerla, Serafeim and Wang (2020) study the effects of employment and supplier policies on stock returns. They show that firms with more positive news around their employment practices experienced less negative stock returns during the market collapse. Similarly, those companies with well-managed logistics and procurement processes and transparent supply chains received a boost for their stock returns.

Pastor and Vorsatz (2020) show that US mutual funds with high sustainability ratings performed well during the COVID-19 crisis. The effect is driven by the environmental rating of the funds. Social ratings had the opposite effect: highly rated funds performed worse than those with low ratings. In our study of individual stocks, the results for environmental and social ratings were very similar – both highly rated environmental and social stocks outperformed their lower-rated counterparts.

ES policies increase corporate resiliency

The evidence from our study and others referenced is very clear: environmental and social policies pay off during a time of crisis. Thus, as in Albuquerque, Koskinen, and Zhang (2019), ES policies are best viewed as a risk management tool. They don’t necessarily do any good when the economy is booming, but they help companies to weather tough times, thus increasing corporate resiliency.

Read the full paper here.

This blog is written by academic guest contributors. Our goal is to contribute to the broader debate around topical issues and to help showcase research in support of our signatories and the wider community.

Please note that although you can expect to find some posts here that broadly accord with the PRI’s official views, the blog authors write in their individual capacity and there is no “house view”. Nor do the views and opinions expressed on this blog constitute financial or other professional advice.

If you have any questions, please contact us at [email protected].

References

Albuquerque, R., Koskinen, Y., Zhang, C. (2019). Corporate Social Responsibility and Firm Risk: Theory and Empirical Evidence, Management Science, 65 (10): 4451-4949.

Albuquerque, R., Koskinen, Y., Yang, S., Zhang, C. (2020). Resiliency of Environmental and Social Stocks: An Analysis of the Exogenous COVID-19 Market Crash, forthcoming in Review of Corporate Finance Studies.

Cheema-Fox, A., LaPerla, B.R., Serafeim, G., Wang, H. (2020). Corporate Resilience and Response During COVID-19, HBS Working Paper No. 20-108.

Ding, W., Levine, R., Lin, C., Xie, W. (2020). Corporate Immunity to the COVID-19 Pandemic, NBER Working Paper No. 27055.

Pastor, L., Vorsatz, B. (2020). Mutual Fund Performance and Flows During the COVID-19 Crisis, Chicago Booth Research Paper No. 20-18.

Ramelli, S., Wagner, A. F. (2020). Feverish Stock Price Reactions to COVID-19, forthcoming in Review of Corporate Finance Studies.