By Rui Dai, Wharton Research Data Services; Rui Duan, Vienna University of Economics and Business; Hao Liang, Singapore Management University and Lilian Ng, York University.

Climate change is driving new political and economic realities for countries and businesses worldwide. Many large US corporations are integrating climate change into their business strategies in response to pressures from regulatory authorities, environmental activists, and climate-conscious investors and consumers.

But do their public commitments reflect marketing ploys or genuine efforts to reduce their carbon footprints?

While their efforts seem progressive, a closer look reveals that firms are committed only to greenhouse gas (GHG) emissions from their production and energy consumption (Scope 1 and 2 emissions respectively).

They largely ignore indirect (Scope 3) emissions produced along their supply chains and in the use of their products, which form the bulk of their total GHG emissions.

For example, the Natural Resources Defense Council (NRDC) reports that P&G’s commitments to halve pollution by 2030 only apply to its Scope 1 and 2 emissions. NRDC alleges that this target only represents 2% of P&G’s total GHG emissions (about 215 million metric tonnes per year) if Scope 3 emissions considered.

Our paper examines whether and how US firms reduce their carbon footprints to tackle global climate change and evaluates the real and financial implications of their actions.

We find robust evidence that they actively outsource their carbon emissions to overseas suppliers as domestic pressure to reduce emissions intensifies, leading to greater risks and lower valuations.

How do firms reduce their carbon footprints?

We examine the relationship between a firm’s Scope 1 and its upstream Scope 3 emissions and investigate how imports play a role in this relationship.

We use newly available firm-level data on US firms’ self-generated Scope 1 emissions and supplier-produced upstream Scope 3 emissions from Trucost and transaction-level import information from Panjiva to analyse their actions to combat climate change and curb carbon emissions.

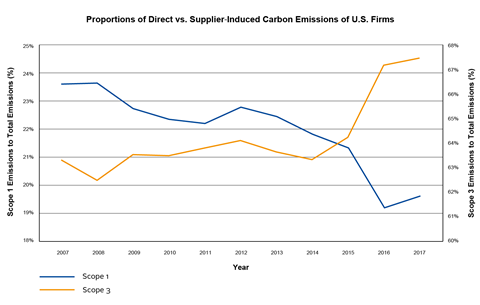

As illustrated by Figure 1, the proportion of Scope 1 emissions has fallen as the proportion of Scope 3 emissions has increased.

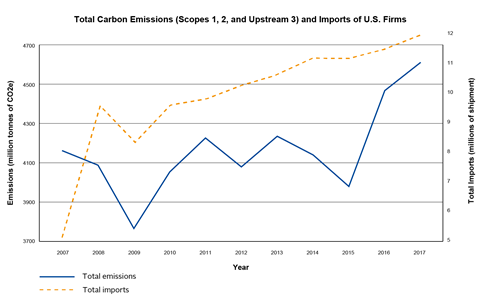

Figure 2 shows that both the aggregate carbon footprint (Scopes 1, 2, and 3) and total imports of US firms are trending upward, suggesting that their carbon emissions and imports are highly correlated.

Our results suggest that a one-standard-deviation increase in tonnes of a firm’s average Scope 1 emissions would generate an approximately 19% increase in tonnes of its upstream Scope 3 emissions.

The relative share of Scope 1 emissions in a firm’s total emissions falls at the expense of the rising proportion of its supplier-generated Scope 3 emissions.

We find that a firm’s imports further augment the substitutional relationship between its Scope 1 and Scope 3 emissions - demonstrating that US firms outsource part of their pollution to global suppliers to evade their emissions responsibilities.

We also look at the impact of several demand shocks on US firms’ emission outsourcing activities.

Specifically, when domestic state-level legislative pressure and regulatory stringency increase, imports are more likely to drive the substitutional relationship between Scope 1 and Scope 3 emissions.

Furthermore, we find that firms in highly emitting industries or industries requiring abundant polluting inputs have more substantial incentives to outsource their emission needs.

Firms tend to outsource emissions to supplier countries with laxer environmental regulations. These findings support our view that firms’ outsourcing behaviour is related to their domestic emission curbing practices.

Explaining firms’ pollution management and outsourcing activities

Possible internal reasons driving US firms’ pollution management and outsourcing decisions may stem from the desire of management and board members to maintain their domestic reputations for being socially conscientious and to attract more customers and investors.

In maintaining these benefits, greener firms, CEOs, and directors face more significant internal pressure to uphold their domestic reputations by shifting pollution-intensive production overseas through the upstream supply chain.

In contrast, greener corporate customers and institutional blockholders should exert significant external pressure to curb such conduct, as they are usually international and hence are more concerned about the overall ESG performance of their global supply chains and investee portfolios.

They are also incentivised to reduce the overall carbon footprint of their portfolios to minimise the adverse impacts of climate change on their investments.

Similarly, government customers would also discourage firms’ outsourcing behaviour as they act in the public interest and emphasise global emissions reduction to effectively combat climate change. Our results support these internal and external mechanisms behind corporate environmental policies.

Real and financial implications of emission outsourcing

Finally, we explore the real and financial implications of firms’ emission outsourcing. We construct a measure of a firm’s import-generated emissions (imported emissions) based on the industry classification of goods in each container and the average GHG emission amounts for specific industries.

Using this measure, we find that a firm’s likelihood of investing in pollution abatement activity decreases as its carbon export grows.

We also find that firms that outsource more emissions tend to have fewer environment-related patents, suggesting that they are less incentivised to develop green technologies that require significant capital investment and long development timelines.

Therefore, emission outsourcing appears to be a substitute for pollution abatement and innovation in green technology.

A firm’s operating performance (measured by ROA, EBIT margin, or asset turnover) is uncorrelated with its own emissions (Scope 1) and imported emissions but is positively and significantly related to its suppliers’ emissions (Scope 3).

This suggests that firms can produce significantly higher profits when they shift their emissions to foreign suppliers, thereby allowing them to adopt a lean production process to reduce direct emissions domestically.

However, such a link is not observed in imported emissions, implying that the benefits may stem mainly from operating a leaner production using foreign suppliers.

We also find that increased Scope 3 and imported emissions – which might raise a firm’s risk – are associated with the increased cost of equity capital and reduced firm value. These firms also have higher reputational risk (measured using the RepRisk data) and higher future stock returns.

These pricing results suggest that investors may attach a carbon premium to Scope 3 and imported emissions, and thus care about the outsourcing risk of their firms.

Policy implications

We believe our findings have important policy implications. We show that despite significant efforts globally to reduce GHG emissions, corporations have strong incentives to evade their responsibility by playing whack-a-mole.

Therefore, when making environmental policies to regulate corporate behaviour, it is important to consider a firm’s carbon footprint across its whole value chain, especially the suppliers’ carbon emissions that are attributed to it.

They also suggest that divesting polluting businesses may not be as effective in reducing pollution as typically expected, because it might induce more pollutions in countries with laxer environmental regulations.

Combating climate change demands international cooperation. A single country cannot solve its own climate problem, even if it can achieve a carbon-neutral economy.

Our results call for international engagements between policy makers and other stakeholders to support cost-effective policy measures to mitigate global climate risks and support low-carbon investments.

They might also be useful for countries to revise their climate action plans as set out under the 2015 Paris Climate Agreement and close the gap between what they have pledged and what is needed.

The full paper is available for download here.

This paper was presented at the PRI Academic Network Week 2021. Please access the recording here.

Global, collaborative initiatives are needed to address real-world emissions, which are not constrained by borders. Climate Action 100+ is an investor-led initiative that targets 166 of the world’s largest emitters. The Net Zero Company Benchmark asks companies to set targets for scope 1, 2 and 3 emissions, so companies are responsible for emissions throughout their domestic and global supply chains.

It is essential for institutional investors to exert influence and engage with investee firms to minimise the adverse impacts of climate change on their investments. Forests play an important role in climate change mitigation and the PRI has been involved in investor engagement on deforestation risk. Please see below for resources:

- Deforestation commitment letter for COP26 demonstrates how investors are using engagement on deforestation risk to ensure deforestation-free portfolios by 2025

- Deforestation as a systemic risk video illustrates the link between GHG emissions and deforestation

To find out more about how investors can reduce scope 3 emissions by supporting a circular economy for plastics, please refer to PRI’s plastic packaging engagement guides.

This blog is written by academic guest contributors. Our goal is to contribute to the broader debate around topical issues and to help showcase research in support of our signatories and the wider community.

Please note that although you can expect to find some posts here that broadly accord with the PRI’s official views, the blog authors write in their individual capacity and there is no “house view”. Nor do the views and opinions expressed on this blog constitute financial or other professional advice.

If you have any questions, please contact us at [email protected].