By Davidson Heath and Matthew Ringgenberg, University of Utah Eccles School of Business; Daniele Macciocchi, University of Miami Herbert Business School and Roni Michaely, Hong Kong University and ECGI.

Over the last three decades, the rise of passively managed index funds has transformed how Americans invest. In 1990, index funds held less than 1% of all mutual fund assets – by 2018 this had grown to more than 30% (worth over US$6 trillion) – and they now represent the largest shareholders of many US corporations.

This vast investment shift continues as investors heed the call of lower fees and better average performance, and its potential implications are significant. The rise of passive investing may change the way investors monitor corporate managers – with important consequences for corporate governance, regulation, and the future of the US stock market.

In theory, investors with large positions (like many index funds) should have strong incentives to monitor their portfolio firms (Grossman and Hart, 1980, Shleifer and Vishny 1986). However, the economics of index investing – low expense ratios and the objective of replicating a benchmark index – suggests that these funds have limited incentives and resources to do so (as discussed in a paper by Bebchuk, Cohen and Hirst, 2017).

Our paper, Do Index Funds Monitor?, forthcoming in the Review of Financial Studies, examines this idea, exploring whether index funds monitor the firms in their portfolios and hold corporate managers accountable to the same extent that actively managed funds do. We find that compared to active funds, index funds are weak monitors that cede power to firm management. This leads to negative consequences for corporate governance and firm value.

Holding corporate management to account

If a shareholder disagrees with a firm’s management, they have three main options:

- voicing their opinion by voting against management proposals and in favour of their proposals or those of their peers;

- engaging with management and convincing them to change corporate policy;

- selling their shares (the Wall Street walk), which expresses a lack of confidence in the firm’s future value, and possibly drives the share price down.

We examine each of these monitoring channels using comprehensive data on US equity mutual and exchange traded funds from 2004 to 2018.

Option 1: Voting

We find that the voting behaviour of index funds differs sharply from that of active funds. For many votes, a third-party advisor called Institutional Shareholder Services (ISS) provides voting recommendations. On agenda items where there is agreement between firm management and ISS, index funds and active funds vote identically. However, on agenda items where the two disagree, index funds vote with firm management 54.3% of the time, while active funds do so only 47.3% of the time.

We observe the same voting pattern when we examine important individual voting items pertaining to board of directors’ elections, executive compensation, corporate governance and disclosure. In all cases, index funds are between 5 and 11 percentage points more likely than active funds to vote in agreement with firm management. In other words, the alignment of index funds with firm management is not only about inconsequential or unimportant agenda items.

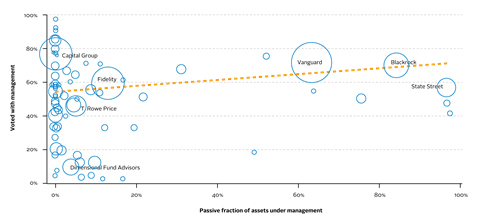

Our findings are not driven by the behaviour of small, less dominant funds – when we aggregate our data and examine the voting behaviour of fund families (i.e. Fidelity, BlackRock, T. Rowe Price, etc.) we observe the same pattern. As shown in Figure 1, the fund families on the right, which are predominantly composed of index funds, vote with firm management more frequently than fund families on the left, whose assets are more concentrated in active funds. For example, BlackRock, which has more than 80% of its assets under management in passive funds, voted in agreement with management substantially more than T. Rowe Price, which has less than 10% of its assets in passive funds.

Option 2: Engagement

We examine the possibility that index funds engage with their portfolio firms publicly or behind the scenes.

Publicly, shareholders with more than 5% company ownership can file a Schedule 13D with the Securities and Exchange Commission to indicate that they intend to actively engage with firm management and affect firm policy. We find that index funds never file a Schedule 13D, whereas active funds do.

If index funds engage with their portfolio firms behind the scenes to implement governance changes, we would expect to see fewer contentious proposals tabled by firm management. Successful behind-the-scenes engagement would reduce the conflict between management and shareholders, and would lead management to propose positive governance policies that are more likely to win the support of proxy advisors and therefore, would be more likely to pass.

Conversely, we find that when index funds hold more of a firm’s stock, the number or type of proposals that are tabled at annual shareholder meetings do not change, and we observe a decrease in the proportion of approved shareholder proposals.

In other words, we find no evidence that index funds engage publicly or privately with their portfolio firms in an effective manner.

Option 3: Divestment

Unsurprisingly, index funds do not divest from a firm to express dissatisfaction with its management either. We find that they do not exit a position even after losing a shareholder vote, whereas active funds do.

Index funds are weak corporate monitors

These results consistently suggest that index funds are weaker monitors than active funds. Moreover, when we look for the consequences of weaker monitoring, the data consistently shows that corporate governance does not improve and in fact deteriorates along several dimensions when index funds replace active funds.

We observe that when index funds hold more of a firm’s stock, board independence worsens and executive compensation is less aligned to firm performance. Taken together, our findings point to the same conclusion: relative to the active funds they are replacing, index funds have limited incentives and resources to invest in costly monitoring, and consequently, they monitor less than active funds do.

Across a wide variety of tests and specifications, the data uniformly indicates that index funds cede power to firm management. As a result, when index fund ownership increases, corporate governance worsens.

Doubts about the role of index funds in corporate governance have prompted a flurry of media discussions. Top executives from BlackRock and Vanguard have publicly affirmed their commitment to good governance – indeed, they claim that index funds can be better stewards than active funds.

At the same time, Vanguard’s official voting policy states: “We will give substantial weight to the recommendations of the company’s board, absent guidelines or other specific facts that would support a vote against management.”

Richard Weil, a prominent active-fund manager, recently made the case that because index funds are doomed to be poor monitors, they should voluntarily disenfranchise themselves by committing not to vote. On the other hand, some academics have proposed tenure voting systems in which voting rights increase with the length of time that the investor holds their shares (e.g., Bolton and Samama 2013). Since index funds exit much less frequently than active funds do, such a system would tilt voting power even more towards index funds.

Our findings speak to this controversy and show that the governance of public corporations is changing. As the rise of passive investing continues, we are moving from a world in which investment funds provide a check on managerial power to one in which they defer to it, and where the alignment between beneficial owners and firm management is decreasing.

This blog is written by academic guest contributors. Our goal is to contribute to the broader debate around topical issues and to help showcase research in support of our signatories and the wider community.

Please note that although you can expect to find some posts here that broadly accord with the PRI’s official views, the blog authors write in their individual capacity and there is no “house view”. Nor do the views and opinions expressed on this blog constitute financial or other professional advice.

If you have any questions, please contact us at [email protected]