By Max Boucher, head of nature programmes at FAIRR, and Tim Steinweg, head of stewardship, nature, PRI

In November 2025, the milestone COP30 will be held in Brazil, home to some of the world’s most important ecosystems and one of the largest exporters of soy, beef, cotton, and maize globally.

With Brazilian agribusiness exports reaching US$164.4 billion in 2024, these soft commodities play a crucial role in global food supply chains and regional economies. At the same time, they contribute to deforestation in Brazil, with native vegetation loss reaching over 14,000 km2 in the Amazon and Cerrado biomes last year.

The months leading up to COP30 provide an important window for the investment community to ensure that commodity supply chains align with global sustainability goals and deforestation-free commitments.

This blog highlights some of the upcoming regulatory developments set to impact the trade of deforestation-risk commodities, why these may be financially material and how investors can navigate the associated risks in the build-up to COP30.

Regulatory and policy shifts impact commodity trade

Three recent and important developments are affecting Brazil and its trading partners when it comes to agriculture:

- The Amazon Soy Moratorium (ASM), which effectively bans soy cultivation on land deforested after 2008 and has received strong investor support, is under threat. In October 2024, the Mato Grosso state government removed tax incentives for companies complying with the ASM. Although Brazil’s Supreme Federal Court temporarily blocked this state action in December 2024, agribusiness lobbies continue to pressure regulators to dismantle the moratorium. If it is lifted, deforestation rates in the Amazon could accelerate and the share of Brazilian soy that does not comply with international due diligence requirements will likely increase.

- The EU Deforestation Regulation (EUDR), which aims to ensure that EU consumption does not contribute to deforestation or forest degradation worldwide, is set to be implemented in December 2025. Implementation was originally intended to be a year earlier, and this delay extends regulatory uncertainty and has created short-term market volatility. However, it provides companies additional preparation time and, once in effect, will require importers of deforestation-risk commodities from Brazil to meet stringent traceability and due diligence requirements.

- In October 2024, China signalled that it will soon require full traceability of the Brazilian cattle supply chain for its beef imports. Brazilian authorities announced a national beef traceability system by 2032, two years behind the Kunming-Montreal Global Biodiversity Framework 2030 target.

Why these developments matter to investors

The shifting regulatory context for Brazil’s agricultural exports can have direct financial implications for companies and their investors. Key risks include:

- Reduced market access for Brazilian exporters: The EUDR and traceability requirements in China may soon require proof that supply chains are deforestation-free. Companies unable to prove compliance may lose buyers and access to key demand-side markets. China is the largest importer of beef and soy from Brazil.

- Market volatility and rising costs for international importers: Firms sourcing from high-risk suppliers may experience loss of market share, higher operating and compliance costs, and higher capital costs if their borrowing or access to capital markets is tied to environmental performance.

- Reputational risks for consumer-facing companies: Brand name companies that fail to align their operations, supply chains and political engagement activities with deforestation-free goals may face consumer backlash and boycotts.

Opportunities for investors to mitigate risks

Investors play a key role in mitigating these company-level and systemic risks through portfolio screening and stewardship. Mitigating actions could include:

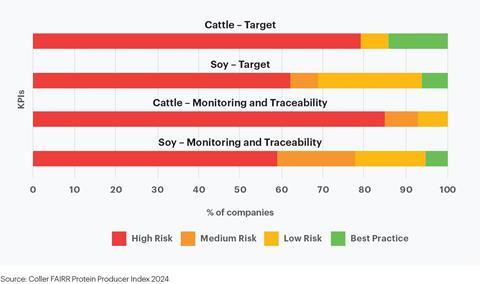

- Reviewing high-risk portfolio company commitments to ensure they clearly define which forest ecosystems, commodities and operating/sourcing regions are covered, and that cut-off dates for the use of deforestation-linked products are no later than 2020. The Coller-FAIRR Protein Producer Index assesses 60 of the largest global protein producers’ beef and soy sourcing policies, deforestation commitments, and strategies to meet those commitments. The index shows that most producers still fail to fully recognise the risks and opportunities tied to deforestation, with a lack of clear commitments, and a lack of monitoring and traceability systems.

Figure 1: Company ratings on deforestation risk commodity targets, monitoring, and traceability

- Engaging with portfolio companies to signal the urgency of complying with sustainability commitments and due diligence regulations. Initiatives such as the PRI’s Spring provide an efficient and effective avenue for investors to conduct outcome-oriented collaborative engagements. Spring’s investor statement outlines a set of high-level expectations that broadly align with the recommendations of FAIRR’s deforestation research briefing. Companies can:

a) adopt public commitments and set time-bound targets as part of business operations, strategies and risk management;

b) execute credible strategies to ensure deforestation- and conversion-free supply chains, with full-chain, digital and interoperable traceability systems central to achieving them;

c) conduct political engagements in a responsible manner.

- Supporting government initiatives that work to enforce environmental protections and counter corporate lobbying that undermines sustainability policies.

Nature loss drives system-level risks

Recent data indicates a 30.6% annual decrease in deforestation rates in the Brazilian Amazon, with 2024 seeing the lowest rates since 2015. However, 2024 also witnessed extreme drought and rampant wildfires, marking the worst year for fires since 2005. Wildfires and drought increase agricultural commodity volatility.

COP30 provides crucial momentum for investors to drive meaningful corporate change. Geopolitical dynamics may shift and global ambition may weaken before the following climate summit in 2026, even if deforestation and other root causes of climate-related financial risks are not successfully addressed. Indeed, recent trade-related tensions have raised fears that deforestation might accelerate, making it even more crucial that investors and companies act swiftly.

Why the time to act is now

With less than seven months until COP30, investors can ask investee companies to:

- publicly commit to align their political activities with the objectives of the Paris Agreement and the Kunming-Montreal Global Biodiversity Framework;

- review and disclose memberships of trade associations, think tanks and other lobby groups, and take corrective action when engagements of such groups are not aligned with their own positions;

- disclose policy positions ahead of the COP30 summit.

Swift investor action could increase the likelihood of a successful outcome at COP30. It could also reduce the risk of holding stranded assets and investments in companies facing increasing regulatory scrutiny, market penalties, and consumer distrust. The time to act is now – before regulatory deadlines hit and market consequences escalate.

The PRI blog aims to contribute to the debate around topical responsible investment issues. It should not be construed as advice, nor relied upon. The blog is written by PRI staff members and occasionally guest contributors. Blog authors write in their individual capacity – posts do not necessarily represent a PRI view. The inclusion of examples or case studies does not constitute an endorsement by PRI Association or PRI signatories.