By Eduardo Atehortua (@eatehort), Head of Latin America (ex Brazil), PRI

In 2020, the global and Latin American financial ecosystem faced unprecedented challenges and uncertainties. However, in the midst of a global pandemic – and in many cases in response to the gaps in societies exposed by COVID-19 – more and more investors in Latin America have advanced in their understanding of environmental, social and governance (ESG) investing. Against this backdrop, the evolution and growth of responsible investment in the region is increasingly a reality.

Since March 2020, more investors in the region have been working on contingency management planning, as well as re-evaluating their organisational strategies and operations, in response to the pandemic. While survival strategies aimed at addressing the emergency were foremost in investors’ minds, ESG issues more broadly also gained greater prominence.

ESG momentum

COVID-19 has served to accelerate interest in responsible investment in Latin America because investors want to:

- recover from the pandemic with a clear vision of how protecting human and natural resources will allow for more resilient and faster growth;

- promote the development of solutions that help to generate a positive impact, both socially and environmentally, to mitigate the effects of the current crisis, as well as prevent future ones.

Interest in responsible investment in the region began in Brazil in 2006 with the creation of the Sustainability Index (ISE), promoted by BM&F Bovespa, which gave a great boost to responsible investment in the Brazilian market. But it was not until 2017 that interest from organisations in countries such as Colombia, Mexico, Chile and Peru began to take off.

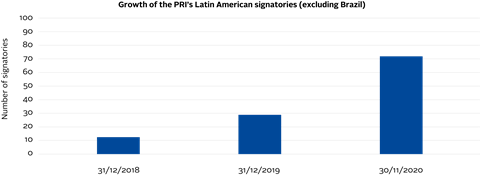

In these markets, more than 20 pension funds have become members of the Principles for Responsible Investment (PRI), something which has marked a “before” and “after” for the growth of responsible investment in the region.

Challenges and opportunities do remain to fully embedding responsible investment in the Latin American market:

- Ensuring that investors who have made commitments to implementing responsible investment really do progress in incorporating ESG factors in all the asset classes in which they invest. Otherwise, the region could fall foul of greenwashing, reducing the legitimacy of the work that has already been carried out.

- Helping PRI signatories advance in the implementation of ESG strategies in their investment processes. That is why events such as the recent PRI Digital Forum: Americas are essential to strengthening the knowledge and capacity of organisations to integrate ESG factors in their investments.

- Working with the region’s stock exchanges, supervisors and central banks so that investors in Latin America have access to better ESG information, allowing them to incorporate these factors into investment decision making. Initiatives such as those led by the Green Finance Advisory Council in Mexico to ensure that issuers report ESG information in line with globally recognised standards provide a good example for the entire region.

Key moment

This is a key moment for investors in Latin America. COVID-19 has made it clear that, although achieving economic results is fundamental (and will continue to be), ESG factors can positively or negatively influence the companies and projects in which investors are putting their capital. As PRI CEO Fiona Reynolds has noted, “We’re now seeing a shift from investors thinking purely from a risk-and-return standpoint to also considering their role in driving real-world outcomes.”

Therefore, investors in the region will be able to demonstrate through their decisions how they are helping to establish a COVID recovery plan that prioritises social and environmental sustainability. In fact, it is a unique opportunity that provides a turning point to guiding capital flows towards sustainable development. The decisions and actions that are taken now can define the nature of the lives that Latin Americans will lead and retire into in the years and decades to come.

This blog is written by PRI staff members and guest contributors. Our goal is to contribute to the broader debate around topical issues and to help showcase some of our research and other work that we undertake in support of our signatories.

Please note that although you can expect to find some posts here that broadly accord with the PRI’s official views, the blog authors write in their individual capacity and there is no “house view”. Nor do the views and opinions expressed on this blog constitute financial or other professional advice.

If you have any questions, please contact us at [email protected].