- Signatory name: Robeco

- Signatory type: Investment manager

- Operating region: Europe

- Assets under management: US$205 billion (June 2019)

- Assets under advisory in passive/index strategies: US$5.6 billion (June 2019)

Delivering index solutions since 2015, Robeco believes that systematically assessing environmental, social and governance (ESG) factors and integrating them into investment processes leads to better informed investment decisions.

Why develop a sustainable multi-factor equity index?

The UK Pensions Regulator has recently required explicit reference to ESG integration as a fiduciary duty for pension funds, but many pension funds are unsure how best to approach ESG integration and how to balance it with their risk-return objectives. Our large UK defined contribution (DC) pension scheme client was looking for a cost-efficient and highly transparent smart beta investment strategy with a strong ESG focus, while wanting to avoid the pitfalls of generic approaches.

The solution we developed blended ESG aspects with well-documented factor premiums to achieve the predefined risk/return and ESG objectives. Moreover, the resulting Sustainable Multi-Factor Index offers full transparency to the client only, thus avoiding the well-documented risks of public index arbitrage and overcrowding.

How we developed the index

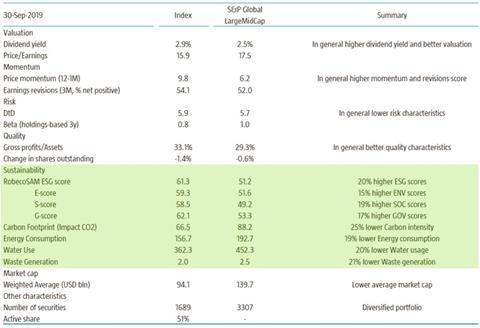

Early conversations with the client revolved around factor investing as a transparent and cost-efficient way to achieve attractive risk-adjusted returns over the long term. We built an index that would satisfy the risk-return objectives through the factor exposures, and that satisfied the ESG integration objectives by using the RobecoSAM Smart ESG score to tilt the index towards more sustainable companies – aiming for a 20% higher score compared to the parent index.

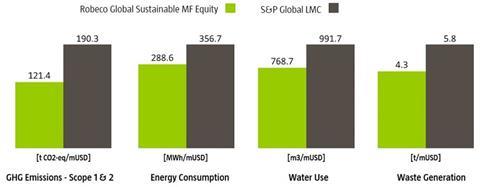

The index construction algorithm also aims for a 20% environmental footprint reduction at its quarterly index rebalancing, focusing on: greenhouse gas emissions, water use, energy consumption, and waste generation. With an initial investment of US$750m, this environmental footprint reduction equates to removing 6,251 cars from the streets, saving the energy consumption of 9,246 households, the water use of 2,522 households and the waste of 3,198 households (Figure 1).

Figure 1: Mainstream index versus global sustainable multi-factor equities index

We rebalance the index on a quarterly basis. A new quantitative stock ranking is created and implemented using an equal-weighted allocation to four signals: value, momentum, low risk and quality. The definitions of the factors are based on our research and aim to provide efficient factor exposure, while stripping out unrewarded risks such as financial distress and reversals. S&P Dow Jones Indices calculates the index and delivers it to our client and their asset manager. This results in a solution with efficient exposure to factors and a high capacity. There is also no arbitrage opportunity for other market participants as the index holdings, as well as additions and deletions from the index, are only known to the client and their asset manager.

Another important feature of our factor investing offering is our ability to report precisely and quickly on sustainability outcomes. We developed reporting tools that enable us to closely monitor a portfolio’s characteristics, in terms of ESG overall or in terms of environmental footprint specifically, and to compare them to the benchmark. In addition to the exposure to the four factors mentioned above, the index exhibits a size tilt (i.e. overweight in mid-caps) so that stocks’ factor characteristics drive the weight in the index and not their market capitalisation.

The result is an index with attractive factor characteristics and an advanced sustainability profile.

Figure 2: Index characteristics

References

This publication is intended for professional investors. Robeco Institutional Asset Management B.V. has a license as manager of UCITS and AIFs of the Netherlands Authority for the Financial Markets in Amsterdam and is subject to limited regulation in the UK by the Financial Conduct Authority. Details about the extent of our regulation by the Financial Conduct Authority are available from us on request