Why biodiversity matters to investors

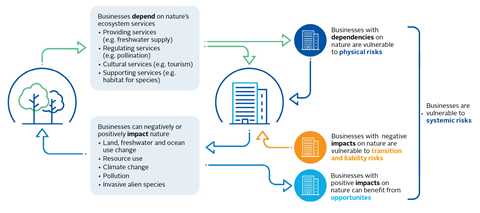

The world is facing biodiversity loss at an unprecedented scale. With around half of the world’s GDP dependent on the ecosystem services enabled by healthy natural systems, investors in all asset classes and sectors face physical risks from biodiversity loss, and transition risks from changes in policy, technology and consumer sentiment in response to the crisis. Conversely, addressing biodiversity loss also presents new opportunities for investors.

Growing public and political understanding of the need for action on biodiversity therefore places an onus on institutional investors to integrate biodiversity considerations into their responsible investment policies and investment processes. A first step in doing so is producing a biodiversity policy.

Figure 1: Nature and business: why it matters

Before writing a biodiversity policy

Investors should consider three elements as they prepare to produce a biodiversity policy:

Developing an organisational approach to biodiversity

This report offers a five-step process for developing an organisational approach to biodiversity, designed to guide organisations through a deliberate progression of understanding biodiversity considerations, integrating them into investment processes, and managing and disclosing the associated risks and opportunities.

Building an understanding of biodiversity

Investors should build an understanding of biodiversity to establish shared knowledge about the issue’s relevance to the organisation and ensure senior buy-in. This might involve internal discussions, training and learning from peers.

Establishing the type of policy to develop

Investors should understand the type of policy they plan to develop – whether a comprehensive biodiversity investment policy, a policy on a specific aspect of biodiversity, or a position statement. They should consider the purpose of the policy, its structure, scope and governance, how it will fit in with its existing approaches, and the resources required.

What to include in a biodiversity policy

A biodiversity policy should address the following elements:

Aims, scope and commitments

These establish: the investor’s motives for developing its biodiversity policy, and the beliefs, objectives and needs that underpin it; the biodiversity loss drivers, sectors and asset classes it covers, and any investment products, strategies or businesses that it does not; and any related regulatory requirements, responsibilities, commitments and disclosure obligations.

Governance

The policy should refer to related policies, guidelines and objectives, how it will be implemented and monitored, and how it will be reviewed.

Definitions

Given the complexities around the topic, the policy should include definitions of key terms and acronyms used.

Approach to biodiversity

A biodiversity policy can include information on how the investor assesses biodiversity-related physical and transition risks, how it identifies any opportunities, and how it integrates biodiversity considerations into investment decisions. It might also include how the investor collects related information.

Target setting and strategy

The policy should outline any organisational biodiversity objectives or targets and associated metrics, how they are determined, the organisation’s approach to achieving them, and how performance will be tracked over time.

Management of risks and opportunities

It should also outline how the investor intends to manage biodiversity risks and pursue biodiversity-related opportunities. This might detail how it plans to address drivers of biodiversity loss, including how it expects investees to manage biodiversity impacts.

The investor should also outline how it expects to direct funds towards investments that minimise biodiversity loss and promote positive environmental outcomes, such as nature-based solutions.

The policy should also set out the investor’s approach to stewardship related to biodiversity. This might reference any stewardship codes or guiding documents that it adheres to, as well as other sector- or issue-specific expectations or statements related to biodiversity. It should also detail the investors’ expectations of investees regarding biodiversity, and how it engages with them on the issue, its engagement with policy makers, standard setters and industry bodies, and any involvement with collaborative initiatives.

Monitoring and disclosure

Finally, the policy should outline the organisation’s approach to monitoring and reporting its biodiversity-related activities and specify any international disclosure or reporting standards with which the organisation is aligned.

Throughout, this report includes examples of investment managers and asset owners that have made biodiversity-related policy commitments. In addition, it directs readers to related PRI guidance and resources.

For more information on topics raised in this guide, or on biodiversity more broadly, please get in touch.

We would like to thank the following organisations for their insights given in interviews conducted to support the development of this guidance.

- abrdn

- Australian Council of Superannuation Investors

- All Weather Capital

- Allianz Investment Management

- AP2

- AXA Investment Management

- BB Asset Management

- Breckinridge Capital Advisors

- CalSTRS

- Climate Asset Management

- CVC

- Desjardins Global Asset Management

- Domini Impact Investments

- E Fund

- Fama re.capital

- Fidelity Investments

- First Sentier Investors

- Foresight Group

- FSD Africa

- Green Century Capital Management

- Groupe Caisse des Dépôts

- The Indonesian Biodiversity Foundation (Yayasan KEHATI)

- Ninety One

- Nomura Asset Management

- Nuveen Natural Capital

- Patria Investments

- PensionDanmark

- QBE Insurance

- QIC

- Resona Asset Management

- Riparian Capital Partners

- Rockefeller Asset Management

- Sanlam Investments

- Sierra Club Foundation

- Stafford Capital Partners

We would also like to thank members of the PRI’s Nature Reference Group for their feedback on initial drafts of the guidance.

About this guide

This guide outlines recommended steps for investors to take to develop a biodiversity investment policy. It includes:

- The case for investors to take action on biodiversity;

- Suggestions to help investors build an organisational approach to the issue;

- The different types of policies investors can develop; and

- The specific elements that a comprehensive policy commitment can include.

The content is based on desk research, including analysis of PRI signatories’ biodiversity policies, interviews with signatories and feedback from the PRI’s Nature Reference Group.

The guide should be read in conjunction with PRI guidance on Developing and updating a responsible investment policy: A technical guide, as well as other PRI resources on biodiversity, including An introduction to responsible investment: Biodiversity for asset owners.

Download the full report below.

CREDITS | Authors: Anna Shaikly, Daram Pandian, Bethany Davies, Sylvaine Rols, Simon Whistler | Editor: Mark Nicholls | Design: Christopher Perrins

Downloads

Developing a biodiversity policy: A technical guide for asset owners and investment managers

PDF, Size 0.78 mbÉlaborer une politique de biodiversité: guide technique pour les investisseurs institutionnels et les societés de gestion (French)

PDF, Size 0.75 mbComo elaborar uma política de biodiversidade (Portuguese)

PDF, Size 0.98 mb制定生物多样性政策 Developing a biodiversity policy (Chinese)

PDF, Size 1.64 mbFormulación de una política de biodiversidad (Spanish)

PDF, Size 1.35 mb生物多様性ポリシーの策定 アセット・オーナー・インベストメント・マネージャー向けテクニカルガイド Developing a biodiversity policy (Japanese)

PDF, Size 0.95 mb