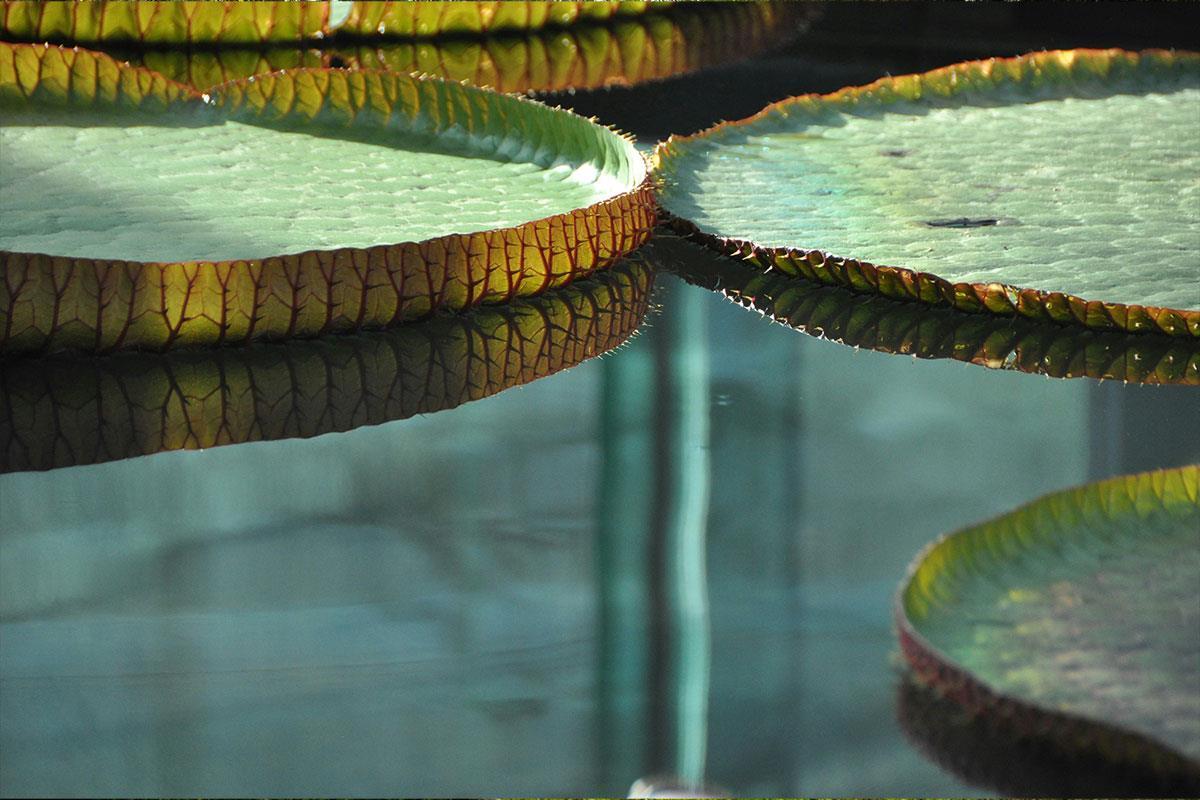

Forest loss and land degradation

Forest loss and land degradation has been identified as an important driver of biodiversity loss and is responsible for a significant share of global CO2 emissions. The Glasgow Leaders’ Declaration on Forests and Land Use (2021, adopted by 145 countries) highlighted the need to halt and reverse forest loss and land degradation by 2030 to meet global climate, biodiversity and sustainable development goals. This issue also presents reputational, legal, market and systemic risks for businesses, which may also present financial risks for investors. The initiative will therefore prioritise this driver of biodiversity loss in the first instance, with a focus on five geographies. Find out more about these in the company selection methodology.

Policy alignment

Multiple interventions are needed to successfully decouple economic activity from deforestation, conversion and associated human rights abuses. These interventions include, but are not limited to, the adoption and implementation of supportive public policies. Spring's engagement strategy focuses investor engagement with companies on their role in encouraging thorough, effective policymaking, in line with long-term investor expectations.

Responsible political engagement

Robust design and implementation of public policy is more likely to address nature loss at the pace and scale needed. Responsible political engagement from companies can help enable such public policies. Spring intends to engage companies that have an influential voice in public policies that shape the dynamics of land use in key geographies, either through their direct political engagement or indirectly through their membership in or association with trade associations, think tanks and similar bodies.

More detailed investor expectations of companies are available in the investor statement.

The worldwide deterioration of nature is a source of risk for institutional investors, as their ability to create long-term value is dependent on a wide range of ecosystem services through the issuers that they invest in. The investment value chain, and the ability to optimise overall risk-adjusted returns to end- clients and beneficiaries, depends on and may impact biodiversity and ecosystem services. As a result, planetary risks - encompassing climate change, biodiversity loss, and pollution - present a systemic and financially material risk to both issuers and institutional investors.

The World Bank estimates that loss of ecosystem services could result in a USD 2.7 trillion contraction of the world’s GDP in 2030, with USD 400 billion decline in crop outputs alone. Central banks and financial regulators are increasingly acknowledging the dependence of financial systems on nature. The Network for Greening the Financial System (NGFS) have noted that nature-related risks could have significant macroeconomic implications, and that failure to account for, mitigate, and adapt to these implications is a source of risks for financial stability.

For more information on investor-relevant nature risks and focus areas for investor action, please refer to the Navigating a new moment for investors on nature briefing pack.

Forest loss and land degradation

Forest loss and land degradation has been prioritised as the first driver of biodiversity loss to be addressed through PRI’s stewardship initiative. The IPBES found that land-use change is the main direct driver of negative impact on terrestrial ecosystems. Forest loss and land degradation also contributes to the climate crisis, being responsible for a significant share of global CO2 emissions, and often associated with violations of human rights.

Forest loss and land degradation can present material physical and transition risks for businesses, both in their operations and supply chains, which in turn can create financial risks for investors:

- Physical risks: chronic or acute risks resulting from the degradation of nature, often location-specific. Examples of physical risks linked to forest loss and land degradation include:

- lower agricultural revenues due to disruptions of rainfall patterns;

- loss of productive land and flooding, for instance due to land subsidence after the draining of peatland.

- Transition risks: misalignment of economic activities, prompted by changes in regulation and policy, legal precedent, technology, or investor sentiment and consumer preferences. Examples of transition risks linked to forest loss and land degradation include:

- reduced market access because of emerging due diligence regulations, such as the EU Regulation on Deforestation-free Products (EUDR);

- stranded assets following changes in land-use regulations in forest countries, for instance Indonesia’s Moratorium on Palm Oil Expansion from Natural Forests or Brazil’s removal of mining requests in indigenous lands;

- shifts in consumer demands, such as the potential decrease in the demand for ruminant meat foreseen by the Inevitable Policy Response nature scenario, with peak production by 2035 and knock-on effects on the production of animal feed;

- reputational risk from negative media attention.

For more information on the materiality of nature-related risks, please visit PRI’s Environmental Issues page.

Policy alignment

Mitigating the systemic risk of nature and biodiversity loss will require sound public policy as, similarly to climate risks, investors cannot diversify away from this risk and the impact of voluntary corporate action has been limited. For instance, CDP found in 2023 that only a small group of companies claim to be on track to eradicating deforestation from their supply chains.

Policy momentum is building, with the adoption of the Kunming-Montreal Global Biodiversity Framework (GBF) in December 2022 and the Glasgow Leaders’ Declaration on Forests and Land Use in 2021. The implementation of these political commitments is foreseen to result in increased land-use and due diligence regulations.

Responsible political engagement

Corporate engagement on environmental policy can play a critical role in helping governments create enabling policy solutions, but it can be a double-edged sword. Short term or narrow-sighted corporate political engagement, often represented by third-party organisations such as trade associations, can hinder policy action that aims to curtail biodiversity and natural capital loss. There are well documented examples of companies attempting to water-down climate policies that could impact their business models, while ignoring the long-term impact of doing so. Similar practices in biodiversity-related policies could delay a company or sector transitioning towards more sustainable patterns of production, thus impacting its long-term viability and risk-return profile. In addition, governance risks may be introduced for companies with policy engagement positions that conflict with their own sustainability commitments.

By disrupting efforts to halt and reverse biodiversity loss by 2030, companies risk imposing long-term costs on investors and beneficiaries as well as legal and reputational risks. These risks bring increased scrutiny from investors on the topic of responsible political engagement (RPE), in particular for policies related to forest loss and land degradation.

For more information on responsible political engagement, please visit PRI’s dedicated page.

The PRI executive is responsible for designing, coordinating and leading the initiative, and they are supported by two voluntary advisory bodies:

- Signatory advisory committee: a group of 18 PRI signatories with strong experience in stewardship and addressing nature-related issues. This group provides strategic advice about the initiative to the PRI.

- Technical advisory group: 10+ PRI stakeholders, such as civil society representatives and academics with deep expertise on nature. This group will provide technical and scientific advice related to nature to the PRI. The group also assists with the inclusion of stakeholder perspectives in the initiative.

The Investor Working Group of the initiative is formed from participants of the initiatives who are lead Investors, co-lead investors and/or collaborating investors.

A company engagement group is established for each focus company. Each engagement group generally consists of four to six members, made up of a lead or two co-lead investors plus collaborating investors.

Investors that join the initiative as an endorser publicly signal their support for the initiative’s objectives and strategy. Endorsers that do not participate in engagement activities within the initiative are not part of the Investor Working Group.

The PRI will publish annual progress reports to provide investors and other stakeholders with a regular update on the progress of the initiative against its stated objectives. Progress reports will include data on 1) company performance, 2) the investor-company engagement process, provided by each of Spring’s Company Engagement Groups, 3) proxy data on real-world outcomes, and 4) individual case studies to provide examples of concrete improvements against the objectives of Spring.

To track and report on company performance, PRI has developed a Company Assessment Framework (CAF). The CAF provides a set of standardised indicators for the high-level company expectations in Spring’s Investor Statement and will be applied to track progress for all of Spring’s focus companies on an annual basis. Through the CAF, the PRI intends to provide a list of common indicators that allow comparability over time.

The following principles have guided the design of the CAF:

- The CAF will be used to assess corporate performance against the company expectations in Spring’s Investor Statement

- The CAF includes standardised indicators that are applicable across all Spring focus companies, regardless of sector or geography

- The CAF avoids creating a new public benchmark, instead leveraging existing and publicly available frameworks

- The CAF includes best-in-class indicators on political engagement as a reflection of the importance of this topic in Spring’s engagement approach.

For more information, see the Company Assessment Framework and the accompanying Guidance Note

The list of participants (lead Investors, co-lead investors and collaborating Investors) forming the Investor Working Group is available to view on the Investors page. The engagements with the first batch of focus companies started in Q3 2024, whilst the engagements with the second batch started in Q1 2025.

The sign-up form remains open on a rolling basis for applications where opportunities are available. PRI signatories can endorse the initiative at any point in time. Please visit the Join Spring page for more information about how to sign up as a participant or an endorser. You can also join view the webinar “Apply to join Spring” to learn more about the joining requirements (link below).

The initiative is expected to run for a minimum of five years, until February 2029. Participants are invited to participate for the full duration of the initiative.