The sustainable bond market is growing rapidly. We explain some of the market dynamics and provide a starting point for enhanced scrutiny.

Overview

As responsible investment has matured across asset classes, the market has responded with a variety of products and approaches aimed at investors considering environmental, social and governance (ESG) factors. These have allowed investors to intentionally channel capital towards environmental and/or social areas or to target specific outcomes. Fixed income investors have benefitted from this expansion in sustainable products, however they also face a confusing array of choices that require careful review to ensure alignment with investment strategies.

The PRI’s introductory guide to fixed income addresses three approaches to incorporating ESG factors into existing portfolio construction practices: integration, screening and thematic. Thematic ESG investing refers to the allocation of capital to themes or assets related to certain environmental or social outcomes, such as clean energy, energy efficiency, community regeneration, supported housing, financial inclusion, or sustainable agriculture. Thematic investors seek to combine attractive risk/return profiles with an intention to contribute to a specific environmental or social outcome or impact.

Within fixed income, investors are increasingly investing thematically through the purchase of debt instruments (bonds or loan issuances) that differ from conventional instruments in their explicit linkage to ESG or sustainability parameters (read more in this blog by three PRI signatories). The range and size of this ESG-labelled or sustainable finance market continues to develop rapidly, including bonds that carry green, social or sustainability (GSS) labels, with clear use of proceeds. Also growing in popularity are sustainability-linked bonds, with coupon payments linked to specific ESG/sustainability performance targets. For the purposes of this article we will use the terms sustainable and thematic interchangeably and use bonds or issuances to refer to both bonds and loans.

The benefits to sustainable bond issuers are becoming more apparent given strong and persistent demand from responsible investors. Issuer benefits include:

- investor diversification across regions and types

- investor engagement and “stickiness”

- strong oversubscription, tighter yields

- strengthened reputation

- alignment of CSR (or core business where pure play) with funding scheme

Investors in sustainable bonds also enjoy a range of benefits:

- well-understood projects reduce risk exposure

- well-managed projects reduce risk exposure

- trading at a premium in secondary markets

- strengthened reputation

- deeper engagement with company management on green outcomes

It is important to note that buying these instruments does not necessarily exempt responsible investors from conducting appropriate due diligence. Investors should assess the veracity of the bond’s funding purpose or how the bond fits into the issuer’s sustainability strategy. More broadly, investors should ensure that they understand the characteristics of thematic bonds (which may or may not carry a formal label) to determine whether they fit the investors’ investment policies, strategies, and goals.

This article offers an overview of the sustainable bond market and seeks to address confusion surrounding standards for sustainable bonds and providers of assessment services. The PRI hopes that this initial mapping can inform investors and provide a starting point for enhanced scrutiny. The following areas are covered:

- Sustainable bonds

- Use-of-proceeds bonds vs. sustainability-linked bonds

- Labelled bonds vs. unlabelled bonds

- The labelling process

- Bond standard organisations

- Verifying organisations

- Sustainable bond databases

Sustainable bonds

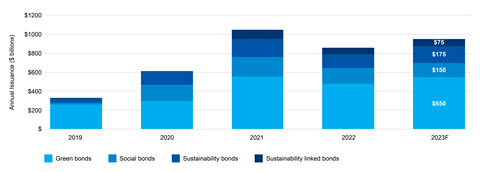

Lenders of capital can follow a thematic approach by deploying sustainable bonds, which are debt securities issued by both public and private entities. The funds obtained must be used to finance specific projects with positive social and/or environmental impacts or with pre-selected performance targets. Sustainable bonds have grown rapidly in recent years, reaching US$4 trillion in June 2023.1 Sustainable bonds can help investors and issuers focus on specific environmental or societal outcomes. Investors can use these bonds to direct capital toward sustainable goals and ensure that issuers meet sustainability criteria set out in the bonds.

Figure 1: Growth in sustainable bond issuance (Sources: Moody’s Investors Service and Environmental Finance Data)

The first sustainable bond

The European Investment Bank (EIB) issued its Climate Awareness Bond (CAB) in 2007, the world’s first sustainable bond. The CAB, which follows the use-of-proceeds model, provided a pool of funding for projects that met the climate mitigation criteria set by the EIB, which, in turn, reported on the climate impact of those projects. CABs introduced the notion that it is possible to report on the impact an investment makes on sustainability goals, linking finance closer to the real economy.

Subsequently, the World Bank issued another sustainable bond in 2008, a use-of-proceeds green bond that was created in response to large institutional investors looking for an investment product that explicitly supported climate-related projects, in this case climate mitigation and climate adaptation. The issuance was the first to define eligibility criteria for green bond projects, and the first in which investors received assurance, through a second-party opinion provider, that eligible projects would address climate change.

Through its own issuance and its support of other issuers and investors, the World Bank has led the development of the market for sustainable bonds. Since 2008, it has issued approximately US$18 billion equivalent in green bonds through over 200 securities in 25 currencies.2 It was also the first to commit to reporting to investors on the use of green bond proceeds and expected project impacts, setting a market standard and forming the basis for the green bond principles later coordinated by the International Capital Markets Association (ICMA ).

Structures of sustainable bonds

There are different ways sustainable bonds are structured to address ESG themes. These include: use of proceeds, sustainability-linked, transition (which could be either of the former two), debt-for-nature swaps, as well as other hybrid issuances (that are project based with targets).

For the purposes of this introductory article, we will be focusing on the structures of use-of-proceeds bonds and sustainability-linked bonds. It is important to note that the market was largely limited to use-of-proceeds issuances in the beginning, but that is now expanding to include the various structures mentioned.

Use-of-proceeds bonds (UoPs):

- Bond proceeds are used for designated projects to provide environmental benefits, positive social outcomes and/or sustainability outcomes. Outcomes are material targets and are regularly monitored, but not necessarily quantitative or pre-determined.

- Green bonds, transition bonds, social bonds and / or sustainability bonds belong to this category.

- Sovereign, sub-sovereign and corporate entities have issued these bonds.

Sustainability-linked bonds (SLBs):

- The financial and / or structural characteristics can vary depending on whether the issuer achieves pre-defined sustainability / ESG objectives.3

- Proceeds are intended to be used for general purposes, but issuers commit explicitly to future improvements in sustainability outcome(s) within a pre-defined timeline.

- Sustainability / ESG objectives are measured by quantifiable key performance indicators (KPIs) which are linked to pre-defined Sustainability Performance Targets.

- Corporates, a municipality (Helsingborg4) and two sovereigns (Chile5 and Uruguay6) have issued SLBs to date.

When corporations or public sector issuers (such as sovereign and sub-sovereign entities) consider issuing sustainable bonds, their choice between UoPs and SLBs will be influenced by factors such as the degree of flexibility provided to the issuer.

Labelled versus unlabelled

Labelled bonds are the gold standard for thematic investors, with a mandatory certification process, external review, and reporting requirements, as explored further below. But there are significant thematic investing opportunities beyond this category. In 2020, the Climate Bonds Initiative (CBI) identified over US$913 billion in unlabelled sustainable bonds from 420 climate-aligned issuers based in 45 countries. China and North America alone are home to a high volume of unlabelled climate-aligned green bonds (excluding social or sustainable bonds) of potential interest to responsible investors.7 The types of issuances include bonds in sectors such as agriculture, buildings, energy, information and communication technologies, land use, transport, water and waste.

Unlabelled bonds are often in sectors that are inherently environmentally friendly or of social benefit, however, may not perform well in the certification process if the issuer is part of a larger entity involved in controversial themes (e.g. nuclear). Other issuers choose to self-label to avoid the burdens of the labelling process.

Investors considering unlabelled bonds face a lack of harmonisation of green definitions and reporting standards across countries and regions. In addition, corporate reporting may omit information that is important to investors. For instance, it can be difficult to evaluate corporate revenues that are specifically linked to green business lines for companies with diversified business activities.

Despite these hurdles, unlabelled bonds may still be attractive to investors building portfolios aimed at specific environmental or social outcomes. Investors can always engage with issuers to seek certification or collect data to ensure that bonds meet the sustainability goals laid out in the prospectus.

Labelled sustainable bonds

Labelled sustainable bonds typically adhere to recognised standards and have gone through a certification process.

The ICMA, the CBI, the European Green Bond Standards (EUGBS) and the ASEAN green, social and sustainability bond standards are among those providing guidance. They are all voluntary while the EUGBS has gradually moved toward regulation.[8] As of February 2023, a provisional agreement on European green bonds (EuGB) has been reached. While it imposes requirements on issuers that choose to use this new EuGB label – there are no obligations for those who do not use the label.9

Bond standards support issuers by providing guidelines on how to structure a labelled bond, along with associated disclosures and reporting. These guidelines are also meant to help investors by enhancing the transparency and comparability of such instruments. Relying on well-established ESG definitions and market guidelines minimises the risk of greenwashing.

Figure 2: Sustainable bonds at a glance. Source: PRI

|

Use-of-proceeds bonds |

Bonds linked to performance / target / outcomes |

||||

|

Green bonds

|

Transition bonds |

Sustainability (SDG) bonds

|

Sustainability-linked bonds (SLBs)

|

Transition bonds |

|

|

Scope of ESG focus |

Narrow – environmental, often related to climate and mitigation actions

|

Narrow – climate related |

Broad – can be any combination of environmental/climate and social sustainability objectives |

Narrow – climate related |

|

|

Area of focus |

Project/asset focused |

Issuer/entity-level focused |

|||

|

Ringfencing of funds |

Yes – the green purpose specified |

No – general purpose |

|||

|

Coupon payment tied to performance |

No |

Potentially. Typically the coupon rate steps up if climate metric is not met. |

|||

|

Nature of framework |

Focus on project eligibility criteria |

Focus on outcome/performance |

|||

|

Framework documentation |

In a standalone document; not in prospectus |

Contained in prospectus |

|||

|

Reporting |

Yes – voluntary (annually or less frequently)

|

||||

|

Independent opinion |

Not mandatory – voluntary Second Party Opinions sought |

||||

|

Standards available |

ICMA Green Bond Principles |

ICMA Transition Bond Principles |

ICMA Sustainability Bond Guidelines |

ICMA Sustainability-linked Bond Principles |

ICMA Transition Bond Principles |

The labelling process

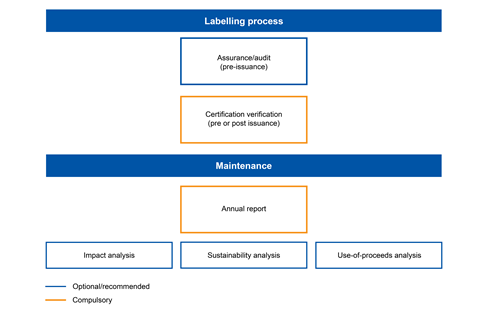

An ecosystem has evolved around the labelling, or certification, of bonds. This includes organisations that set standards for thematic bonds and providers that confirm whether bonds meet the relevant standards, enabling certification. The steps in the process include:

1. Bond standard organisations (BSOs) such as ICMA, CBI and EUGBS, set out guidelines to define the characteristics of a thematic bond. Those by EUGBS are linked to the EU Taxonomy.

2. Verifying organisations evaluate bonds against the BSO guidelines to assess whether they qualify as labelled sustainable bonds.

3. If eligibility is confirmed, the BSO issues an opinion on eligibility or compliance confirmation, allowing the bond to be listed in a database of similar thematic bonds (see Figure 5).

4. These verifying organisations also verify thematic investments against relevant sustainability criteria post issuance, confirming to bondholders that proceeds are being used in line with the BSO criteria. However, it is important to note that ICMA guidelines, unlike CBI and EUGBS, provide broadly recommended (as opposed to necessary) principles that are not entirely fulfilled by all sustainable bond issuers.

Most issuers of thematic bonds have their bond products labelled before issuing. Others may wait until after issuance, when a verifying organisation can confirm the bond is compliant with BSO guidelines.

For example, the EIB’s Climate Awareness Bond (CAB) became a labelled bond in 2016 through the appointment of an external auditor as the external reviewer. KPMG, EIB’s external auditor, confirmed alignment of EIB’s green bond activities in 2015 with the requirements of ICMA’s Green Bond Principles as well as the EUGBS. Prior to its external review, the CAB would have been considered a self-labelled bond, especially given that it was launched in 2007, whilst ICMA’s Green Bond Principles were first issued in 2014.

Below we provide more detail on the steps involved in the certification process.

Bond standard organisations

A bond issuer begins by selecting an appropriate thematic bond framework that captures the purpose of the bond. The issuer identifies and compiles supporting information to meet that standard.

There are many BSOs that set out guidelines using a variety of factors and bond characteristics. Some focus on sectors or themes while others have a regional focus.

CBI Climate Bonds Standard and Certification Scheme

GRESB-ICMA Guidelines for Real Estate

ICMA Green Bond Principles

ICMA Social Bond Principles

ICMA Sustainability Bond Guidelines

ICMA Sustainability-Linked Bond Principles

Asean Bond Standards

EU Green Bond Standard

Febelfin label (Belgium)

FNG-Siegel Ecolabel (Austrian, German & Swiss)

Greenfin label (France)

Le label ISR (France)

LuxFLAG

Nordic Swan Ecolabel

People’s Bank of China green bond guidelines

Responsible Investment Association Australasia

Towards Sustainability label (Belgium)

The two most accepted frameworks, detailed below, are CBI’s Climate Bonds Standard and Certification Scheme (CBSC Scheme) and ICMA’s Green Bond Principles (GBPs). It is important to note that ICMA’s is a voluntary standard based on best market practices whilst CBI’s uses a scientific framework to define which projects and assets are consistent with achieving the goals of the Paris Agreement and therefore eligible for inclusion in a Certified Climate Bond, Certified Climate Loan or Certified Climate Debt Instrument. The CBI certification scheme includes robust approaches for monitoring, reporting and assurance of conformance with the Climate Bonds Standard.

The CBSC Scheme was produced in 2010 by the CBI. It is used by bond issuers, governments, investors, and the financial markets globally to prioritise investments aimed at addressing climate change.

The Scheme incorporates ICMA’s Green Bond Principles and other global thematic bond certifications (listed in Figure 3 above). Independent verification (based on the four components shown at right) is performed by approved verifiers. The Climate Bonds Standard Board has oversight of the approved verifiers, which are under management by the Climate Bonds Secretariat.

The Climate Bonds Standard, which details management of proceeds and reporting processes, is an assurance framework with consistent procedures.

This differs from the Second-Party Opinion (SPO) model, where different external reviewers produce reviews based on their individual methodologies, which vary across reviewers.

Annual reporting is required of the issuer through the term of the bond.

The GBPs were produced in 2014 collaboratively by capital market intermediaries, issuers, investors, and environmental organisations under the ICMA leadership.

The GBPs are updated annually by the ICMA to promote integrity in the thematic bond market by emphasizing more transparency, accuracy and integrity, as well as uniform disclosure from issuers. GBPs have four components:

1. Use of proceeds

Proceeds from issuance must be used to finance or refinance green projects.

2. Process for project evaluation and selection:

For the specific green projects to be financed, issuers are encouraged to disclose:

- overarching environmental objectives and policies

- environmental sustainability objectives

3. Management of proceeds

Issuers are encouraged to use an internal control system to monitor money movement from the issuance and to engage a third party (e.g., auditor, internal control consultant) to verify and track usage of net proceeds.

4. Reporting

For as long as green bonds are outstanding, issuers are required to disclose on an annual basis up-to-date information on:

- proportions of allocated and unallocated net proceeds

- any green projects which have been financed and/or will be financed with the proceeds of the green bond issuance

- development progress and impact of the funded green projects

The GBPs encourage issuers to apply both qualitative and quantitative performance measures to describe the status of green projects and estimated performance when fully operational.

Types of reviews

To have bonds certified as meeting the relevant BSO standard, issuers need to carry out internal reviews and/or obtain external reviews by verifying organisations.

Internal

Some BSOs allow for two types of reviews conducted internally by the issuer.

Impact reports: Issuer provides insights into what the thematic bond will help finance and its associated environmental, social or sustainability benefits. The objective is to quantify changes in the performance of an asset, project, or portfolio with respect to a set of relevant indicators and benchmarks. Sometimes, these internal impact reports carry the assurance of company management.

Sustainability reports: Issuer provides disclosure and communication of ESG goals – as well as a company’s progress towards them.

External

It is more common for issuers to seek a second-party opinion or certification via an external organisation, which assesses the bond product for alignment with BSO guidelines. Once bonds are certified as thematic bonds, issuers can obtain a range of research products and services to monitor the performance of the bonds to maintain certification.

BSOs generally recommend, but do not require, that issuers use a detailed taxonomy that addresses local climate change and environmental needs when seeking a sustainable label. However, since 2020, the EUGBS has required European issuers to use only the criteria set by the EU taxonomy regulation. In China, the Green Bond Endorsed Project Catalogue has been in use by regulators to guide the sustainable bond market since 2015.

A variety of organisations either provide a certification for a thematic bond or confirm the bond’s adherence to an ESG framework post issuance:

Third-party assurances: Assurance reports assess an issuer’s proposed allocation of fund proceeds to confirm whether the bond is aligned with a specific bond standard. Third-party assurances are generally provided by accounting or audit firms and are the basis for certification by the BSO.

Second-party opinions (SPOs): SPOs assess the feasibility of the project in relation to the relevant ESG goals laid out by the BSO framework. Some provide qualitative input on the framework chosen by the issuer and on the allocation of proceeds.

Approved verifiers/external reviewers: These organisations provide specialised services, such as scientific analysis or forensic accounting, for SPOs and/or third-party assurances. Lists of approved verifiers and/or external reviewers are available from CBI and from ICMA.

Figure 3: Documents needed for sustainable bond certification and maintenance

| Type of providers | ||||

|---|---|---|---|---|

|

Type of reporting |

Third-party assurances |

Second-party opinions |

Approved verifiers/external reviewers |

|

|

Pre- or post-issuance |

Assurance/audit (optional) |

X |

||

|

Certificate verification (mandatory) |

X |

X |

X |

|

|

Sustainable bond scoring/rating (optional) |

X |

|||

|

BSO reviews the documents listed above and below |

||||

|

Post-issuance/ maintenance |

Impact analysis (recommended) |

X |

X |

|

|

Sustainability analysis (recommended) |

X |

X |

||

|

Use-of-proceeds analysis (recommended) |

X |

X |

||

Issuers may pay for the services of either third-party assurance providers or SPOs to obtain a report verifying that the information laid out in the bond prospectus meets sustainability criteria set out by the BSO (grey area in Figure 3). The BSO certifies the debt instrument as a thematic bond if the report confirms alignment with BSO standards (blue area). An issuer maintains certification by providing annual reports confirming continuous compliance and updating any changes to bond characteristics after issuance. Issuers can either publish their own impact reports to quantify the positive thematic impacts of a project/asset, or they can seek the assistance of SPOs or third-party assurances, which may provide more scientific rigour and objectivity (light blue area).

Figure 4: Labelled bond certification process. Source: PRI based on publicly available information

Collecting data post-issuance

Once a thematic bond is in the portfolio, analysis by investors is required to ensure it remains aligned with its ESG purposes. Access to relevant data is not always straightforward, as issuers may be late in providing investors with impact or sustainability reports, sometimes because their financial calendar cycle is different from that of investors. Two options are available to analysts:

Engagement: In cases where information is insufficient to make informed investment decisions or justify existing holdings, an investor may choose to engage with the bond issuer directly to request the necessary information and documentation, which may take the form of emails, phone calls and/or meetings.

Research: Investors also can access a range of databases that target different types of thematic bonds. Below is a list of resources for investors seeking additional information about specific thematic bond issues.

Sustainability-linked bonds

The processes above are used for green, social and sustainability bonds. The unique features of sustainability-linked bonds necessitate a different process. The ICMA proposed the Sustainability-linked Bond (SLB) Principles, which state that verification of SLBs takes place post-issuance, and that issuers are expected to seek independent and external verification against each Sustainability Performance Target for each KPI at least once a year. The principles include an appendix with a non-exhaustive data checklist to help SLB issuers align their disclosure with the needs of market practitioners (pages 7-9).

The CBI has launched the fourth version of the Climate Bond Standard, which now includes an SLB certification process and allows the Climate Bonds Standard and Certification Scheme to certify SLBs issued by non-financial corporates.

Sustainable bond databases

To help investors make informed decisions, we have assembled a list of industry standards spanning multiple investment themes, as well as links to the relevant databases.

Figure 5: Sustainable bond resources

| Bonds | Industry Standard(s) | Purpose, use and focus | Databases |

|

Green/ Climate |

EU Green Bond Standard

ICMA Green Bond Principles

African Development Bank’s Green and Blue Bonds Framework

CBI Climate Bonds Standard and Certification Scheme |

Green bonds are used to finance projects linked to energy efficiency, renewable energy, clean transportation and green buildings, among others. Proceeds must be applied to finance or refinance, in part or in full, new or existing projects that promote progress on environmentally sustainable activities.

|

Environmental Finance Bond Database

ICMA Sustainability Bonds Database

CBI Labelled Green Bonds Database

LuxFLAG list of labelled ESG Products

Luxembourg Green Exchange DataHub

|

|

Social |

ICMA Social Bond Principles

ASEAN Social Bond Standards |

Social bonds are issued to carry out social development projects. The funds raised by social bonds are used to support pandemic responses; increase access to education, health care and affordable housing; or address social inclusion and gender equality. |

Environmental Finance Bond Database

ICMA Sustainability Bonds Database

|

|

Blue |

CBI The Marine Renewable Energy Criteria

EU Commission - Sustainable blue economy finance principles

ADB’s Green and Blue Bonds Framework |

Marine and ocean-based projects. |

|

|

Gender |

ICMA Social Bond Principles

ASEAN Social Bond Standards

UN Women’s Empowerment Principles

UN’s Sustainable Development Goals |

Gender equality and opportunities. |

|

|

Transition |

ICMA Green Bond Principles

CBI’s whitepaper on financing credible transitions

For issuers: ICMA Transition Bond Guidelines (as part of Climate Transition Finance Handbook) |

Helping companies transition to a low carbon economy. |

|

|

Rhino |

EU Green Bond Standard

ICMA Green Bond Principles |

Improve funding for black rhinos and other threatened species. |

|

|

Social/ Development impact |

ICMA Social Bond Principles |

Align financial returns with social and environmental impact. |

Social Finance Impact Bond Database

|

|

SDGs |

UNDP - SDG Impact Standards

EU Green Bond Standard

ICMA Green Bond Principles

ICMA Social Bond Principles |

Access funds for innovative projects aligned to making a positive contribution to achieving the SDGs and creating long term value for the issuer and its stakeholders. |

Green Bond Transparency Platform

|

|

Sustainable/ Sustainability |

ICMA Sustainability Bond Guidelines |

Sustainable bonds are used to finance projects with both environmental and social impacts. |

Environmental Finance Bond Database

ICMA Sustainability Bonds Database

Nasdaq Sustainable Bond Network

|

|

Sustainability linked |

ICMA Sustainability-Linked Bond Principles |

Bonds’ financial or structural characteristics (such as the coupon rate) are adjusted depending on the achievement of pre-defined sustainability targets. |

Further reading

Climate Bonds Initiative and ICMA Principles were the main sources for global thematic bond market data for this report.

SIFMA (June 2022) Research Quarterly: Fixed Income – Outstanding

Moody’s Investor Services (4 February, 2021, subscription only), Sector In-depth Research Sustainable Finance – Global: Sustainable bond volumes to top $650billion in 2021

OECD (29th September, 2020) Growing momentum for sovereign green bonds

CBI (January 2021) Sovereign Green, Social, and Sustainability Bond Survey – The ultimate power to transform the market

CBI (May 2023) Q1 2023 Market Update: Sustainable debt shows recovery

Environmental Finance (2023, subscription only) Sustainable Bonds Insight 2023

References

1 Environmental Finance (June 2023; subscription only) Sustainable bond issuance reaches $4trn milestone

2 World Bank (December 2022) IBRD Funding Program

3 Definition from the International Capital Markets Association

4 Nasdaq (March 2022) Helsingborg Becomes First City to List a Sustainability-Linked Bond, Supporting Efforts to Reach Net-Zero Emissions by 2035

5 Ministry of Finance, Chile (March 2022) EN: Sustainability-linked Bonds; ES: Chile realiza histórica emisión por US$ 2.000 millones y se convierte en el primer país en emitir un Bono Vinculado a la Sostenibilidad

6 Ministry of Economy and Finance of Uruguay (October 2022) Sovereign Sustainability-Linked Bonds (SSLB)

7 CBI (2020) Climate Investment Opportunities: Climate-Aligned Bonds & Issuers

8 News European Parliament (May 2022) European Green Bond Standard: new measures to reduce green washing

9 Council of the EU (Feb 2023) Sustainable finance: Provisional agreement reached on European green bonds