What is the PRI?

The PRI is the world’s leading proponent of responsible investment. It works:

- to understand the investment implications of environmental, social and governance (ESG) factors;

- to support its international network of investor signatories in incorporating these factors into their investment and ownership decisions.

The PRI acts in the long-term interests:

- of its signatories;

- of the financial markets and economies in which they operate;

- and ultimately of the environment and society as a whole.

The PRI is truly independent. It encourages investors to use responsible investment to enhance returns and better manage risks, but does not operate for its own profit; it engages with global policymakers but is not associated with any government; it is supported by, but not part of, the United Nations.

Read more about our work supporting responsible investors, to create sustainable markets that contribute to a more prosperous world for all:

What are the six Principles for Responsible Investment?

The six Principles for Responsible Investment offer a menu of possible actions for incorporating ESG issues into investment practice.

The Principles were developed by investors, for investors. In implementing them, signatories contribute to developing a more sustainable global financial system. They have attracted a global signatory base representing a majority of the world’s professionally managed investments.

- Principle 1: We will incorporate ESG issues into investment analysis and decision-making processes.

- Principle 2: We will be active owners and incorporate ESG issues into our ownership policies and practices.

- Principle 3: We will seek appropriate disclosure on ESG issues by the entities in which we invest.

- Principle 4: We will promote acceptance and implementation of the Principles within the investment industry.

- Principle 5: We will work together to enhance our effectiveness in implementing the Principles.

- Principle 6: We will each report on our activities and progress towards implementing the Principles.

What is the PRI’s mission?

“We believe that an economically efficient, sustainable global financial system is a necessity for long-term value creation. Such a system will reward long-term, responsible investment and benefit the environment and society as a whole.

The PRI will work to achieve this sustainable global financial system by encouraging adoption of the Principles and collaboration on their implementation; by fostering good governance, integrity and accountability; and by addressing obstacles to a sustainable financial system that lie within market practices, structures and regulation.”

How did the PRI start?

In early 2005, the then United Nations Secretary-General Kofi Annan invited a group of the world’s largest institutional investors to join a process to develop the Principles for Responsible Investment. A 20-person investor group drawn from institutions in 12 countries was supported by a 70-person group of experts from the investment industry, intergovernmental organisations and civil society.

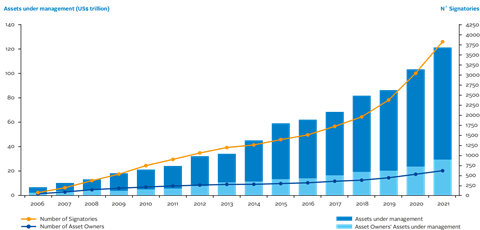

The PRI has grown consistently since it began in 2006. See our signatory directory to view a list of signatories.

PRI growth 2006-2021

Founding signatories

| A-Z | Organisation | |

|---|---|---|

| A |

ABN AMRO Asset Management |

Asset4 |

| B |

Banco |

BNP Paribas Asset Management |

| C |

Caisse de dépôt et placement du Québec |

Christian Super |

| D | Daiwa Asset Management Co. Ltd |

Domini Social Investments |

| E | Etablissement du Régime Additionnel de la Fonction Publique – ERAFP |

Ethix |

| F | F&C Asset Management2 Folksam1 |

Fonds de réserve pour les retraites – FRR1 |

| G | Generation Investment Management LLP GES Investment Services Government Pension Fund of Thailand1 |

Government Employees Pension Fund of South Africa |

| H | Henderson Global Investors | Hermes Pensions Management1 |

| I | Insight Investment |

International Finance Corporation1 |

| M | Macif Gestion Mennonite Mutual Aid Mercer Investment Consulting |

Mitsubishi UFJ Trust and Banking Corporation Munich Reinsurance AG1 |

| N | Nathan Cummings Foundation National Pensions Reserve Fund of Ireland New York City Employees Retirement System1 |

New York State Local Retirement System New Zealand Superannuation Fund Norwegian Government Pension Fund1 |

| O | onValues Ltd | |

| P | PGGM Investments1 Portfolio Partners Limited |

PREVI* Public Sector Superannuation Scheme1 |

| R | Reputex | |

| S | Storebrand Sumitomo Trust |

Stichting Pensioenfonds |

| T | Teachers’ Retirement System of the City of New York Threadneedle Asset Management Ltd |

TIAA – CREF1 Trucost |

| U | United Nations Joint Staff Pension Fund1 | Universities Superannuation Scheme – USS1 |

| V | Vigeo | |

| W | Wespath Investment Management (General Board of Pension and Health Benefits United Methodist Church) | |

What is the PRI’s relationship with the United Nations?

The United Nations (UN) has been supporting the Principles for Responsible Investment ever since its launch. The PRI has two UN partners, who play an important role in delivering the PRI’s strategy, including holding a seat each on the PRI Board, and providing additional avenues for signatories to learn, collaborate and take action towards responsible investment:

UN Environment Programme Finance Initiative

Founded in 1992, UNEP FI brings together a large network of banks, insurers and investors that catalyses action across the financial system to deliver more sustainable global economies.

Convened by a Geneva, Switzerland-based secretariat, more than 500 banks and insurers with assets exceeding US$170 trillion are individually implementing UNEP FI’s Principles for Responsible Banking and Principles for Sustainable Insurance. Financial institutions work with UNEP FI on a voluntary basis to help them to apply the industry frameworks and develop practical guidance and tools to position their businesses for the transition to a sustainable and inclusive economy.

Today, UNEP FI cultivates leadership and advances sustainable market practice while supporting the implementation of global programmes at a regional level across Africa and the Middle East, Asia Pacific, Europe, Latin America & the Caribbean and North America.

UN Global Compact

The ambition of the UN Global Compact is to accelerate and scale the global collective impact of business by upholding the Ten Principles and delivering the Sustainable Development Goals (SDGs) through accountable companies and ecosystems that enable change. With more than 20,000 participating companies, five Regional Hubs, 63 Country Networks covering 80 countries and 13 Country Managers establishing networks in 18 other countries, the UN Global Compact is the world’s largest corporate sustainability initiative — one Global Compact uniting business for a better world.

How is the PRI funded?

The PRI is funded primarily via an annual membership fee payable by all signatories. Additional funding comes from grants from governments, foundations and other international organisations. Corporate sponsorship and in-kind support is sought for standalone events and projects such as the annual PRI in Person conference and major publications/projects.

The PRI’s full financial details are available in the Annual Report.

The PRI Academy

In 2014, PRI launched the PRI Academy with the aim of equipping industry professionals with a common language of ESG, based on the latest thinking in responsible investment. The Academy’s mission is to support industry-wide fluency in ESG and address the well-recognised industry skills-gap in responsible investment, given the significant obstacles these issues present to successful ESG incorporation.

Since launching, we’ve transformed the careers of nearly 30,000 professionals across 90 countries, creating a global community of responsible investment leaders.

References

1 Drafting signatories

2 F&C Asset Management is now part of BMO Global Asset Management