Climate change, corporate scandals and the devastating effects of the global financial crisis are all stark reminders of why oversight, lack of transparency and accountability can negatively affect fixed income market pricing, volatility and, ultimately, financial stability.

The world is changing and ESG risks are becoming more visible. Some may already feature in traditional credit risk evaluation, but have not been labelled as such. No longer perceived as long-term, others have started to be incorporated only in recent years. Other risks are nascent or merely viewed as potential at this stage. Finally, investor awareness has increased following numerous examples of securities’ underperformance when ESG risks have been overlooked.

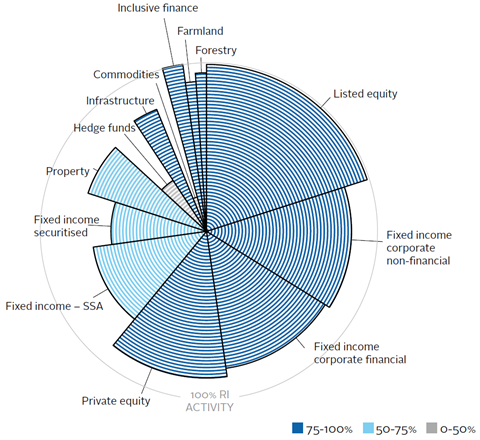

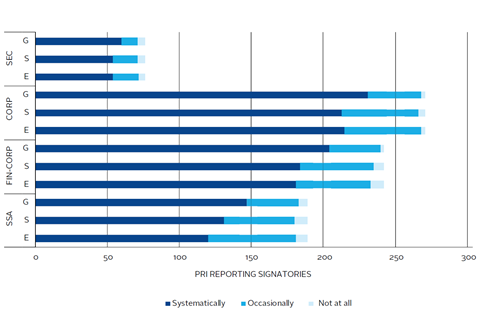

Investor demand for ESG-linked assets is growing and, correspondingly, the need to better understand related issues: the number of PRI signatories exceeded 1,700 this year with assets under management (AUM) totalling over US$70 trn. Of this total, FI assets represent almost US$30 trn (or 41% of AUM), with the majority invested in sovereign and non-financial corporate bonds. At present, systematic integration in the investment process is more advanced for the latter compared to other FI assets.

Beyond stewardship, the business case for a more environmentally sustainable and socially responsible society has come to the fore in recent years – from a risk management perspective as well as a way to spot market mispricing and opportunities.

Investors appreciate the need for a high-level view of which ESG issues might impact their portfolio, but need a clearer understanding of the implications across asset classes.

When it comes to FI instruments, market participants can learn from ESG integration practices in equity analysis. ESG integration in equities is more advanced despite the comparatively smaller size of the market (partly because shareholder voting rights has facilitated progress). However, FI as an asset class is different, with multiple stakeholders involved and different time horizons to consider (Ngo, 2016).

Ultimately, one of investors’ main objectives is to maximise returns while minimising risks, including those related to ESG factors. In the case of FI, investors buy bonds for reasons ranging from capital preservation or appreciation, income, portfolio diversification to a hedge against inflation or economic weakness.

The case for capital preservation is particularly pressing for insurers and pensions funds, which own large portions of FI securities for asset-liability management purposes and have a fiduciary duty towards their policyholders and/ or beneficiaries. This has gained further prominence since the start of the decade with the introduction of bail in regulations, which require that creditors bear some of the burden of a borrower’s default by having some of the debt that they are owed written off.

Incorporating ESG considerations into credit risk analysis is not a tick-box exercise due to the multi-faceted nature of credit risk is related to the likelihood of default by an issuer. However, there may also be ESG factors that affect creditworthiness indirectly (resource scarcity, for instance, might add to inflationary pressures, prompting a tightening of monetary policy and a rise in the cost of capital which, coupled with adverse market conditions and poor liquidity, could prompt a default).

Broadly speaking, ESG factors can affect the price performance of a bond and its credit risk at different levels:

Issuer/company level:

- These are risks that affect a specific bond issue or its issuer and not the market as a whole. They are generally related to factors such as the governance of an issuer, its regulatory compliance, the strength of its balance sheet and, at the corporate level, brand reputation. For example, the yield on the corporate debt of the car manufacturer Volkswagen rose and stayed high for a prolonged period of time in the aftermath of the emission scandal.

Industry/geographic level

- These risks stem from wider-ranging issues affecting the entire industry or region that the issuer belongs to. They can be related to regulatory factors, technological changes associated with the business activity the company is involved in, and/or the markets it sources or sells to. For example, utilities are relatively more exposed to climate change risks than financials.

History has also taught us that there can be ramifications if idiosyncratic risks affect an issuer’s industry peers. For example, the Volkswagen emissions scandal has marked a turning point in the future of diesel cars. Moreover, with adequate risk management even gblack swan h events (i.e. unexpected events with major impact that are extremely difficult to anticipate) can be mitigated. A case in point is the 2013 landslide at Rio Tinto’s Bingham Canyon mine in Utah, where nobody was injured because Rio Tinto’s laser scanning system sent early warning signals, enabling a prompt evacuation of the site.

Not all ESG factors which may affect bonds’ price performance influence an issuer’s creditworthiness . a point that will be explored further in the report. Nevertheless, with emerging evidence of a link between ESG factors and creditworthiness, it is critical that market participants ensure . where material . that these factors are systematically included in their assessment processes (see section with takeaways from existing research). Transparency is also key to delivering robust credit risk analysis, just as fostering a culture of awareness can help to eliminate blind spots in the process.

Download the full report

-

Shifting perceptions: ESG, credit risk and ratings (Part 1: The state of play)

July 2017

The ESG in Credit Ratings Initiative receives financial support from The Rockefeller Foundation

ESG, credit risk and ratings: part 1 - the state of play

- 1

- 2

Currently reading

Why ESG factors matter in credit risk analysis

- 3

- 4

- 5

- 6

- 7

- 8