An overview of the PRI’s observations on the investor-CRA disconnect related to organisational approaches to ESG.

Key messages:

- Investors and CRAs acknowledge that they are in the early phase of formalising a systematic approach to ESG consideration.

- Senior management buy-in is key.

- Improving knowledge and expertise, as well as overcoming internal inertia, are big challenges.

What we observed:

Traditional CRAs are undergoing significant organisational changes. The responsibility and coordination of efforts to disclose and better reflect ESG consideration in research, ratings and analysis no longer rests with just one or a few people globally. Rather, it is firmly on the agenda of steering committees, working groups and dedicated analyst teams or departments. This development is not confined to the largest CRAs, which are moving fast, but is also being seen among some smaller players.

CRAs are boosting expertise on ESG. This includes training analysts on relevant ESG factors, which CRAs such as Japan Credit Rating Agency, Moody’s Investors Service and S&P Global Ratings have already started doing, hiring environmental, social or governance experts8, and acquiring specialist service providers9.

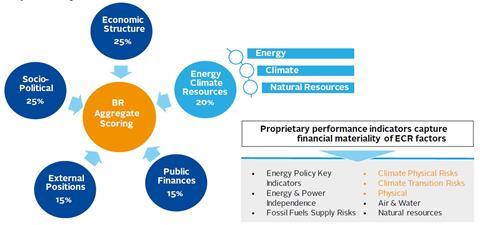

The CRA landscape is evolving. New actors are beginning to provide dedicated ESG risk assessments or enhanced analysis of creditworthiness. For example, Beyond Ratings, which focuses on sovereign credit risk, provides in-depth natural capital investigation. Spread Ratings specialises in medium-sized European corporate debt issuers and recently merged with EthiFinance to provide credit ratings based on financial as well as non-financial information.

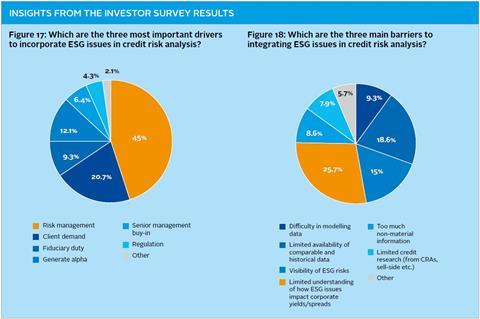

FI investors are channelling more resources to ESG consideration. The roundtables confirmed part one’s finding that resources are expanding, including on human capital. The level of interest that the roundtables generated showed that investors are keen to learn.

Mixed asset allocation appears to be an advantage. Investors with assets allocated to both equity and FI have made more progress. This is because 1) there are synergies; engagement with issuers may be easier and facilitated by the equity team, and 2) credit risk is considered as a counterparty risk.

Senior management buy-in is crucial. The level of CRA participation and backing of the roundtable events reinforce changes in this respect. At the investor level, it was noted that while individual credit analysts and FI portfolio managers may have different attitudes or sensitivities towards ESG topics, if changes are mandated from the top, the integration process is faster and more systematic.

Evolutionary process. Building capacity and establishing new policies can take a long time and be rolled out in stages. Some of the more advanced investors shared their experiences, which often started with rules-based investing or dictated by ethical values, but is now becoming holistic and integrated in mainstream investing.

| Challenges |

|---|

|

Equipping analysts with relevant skills. While expertise and resources are improving on the investor and CRA side, building competence to ensure that credit analysts systematically take into account ESG factors is still a work in progress. Different approaches were considered including developing expertise in-house, bringing in external expertise or outsourcing on an ad hoc basis. Overcoming inertia. Institutional investors that are relatively young (in terms of maturity and level of experience) may already come to the market with an ESG mandate, mission or product offering. For them, it may be easier to build pricing models afresh rather than modify existing, conventional methodologies. More mature organisations can rely on larger resources but, in the absence of senior management buy-in, may find it harder to break down barriers and overcome siloed work practices. Incentivising and rewarding analysts that are best at unlocking ESG value. It was observed that credit analysts are rewarded for ideas while portfolio managers are rewarded for performance. Both roles face challenges when it comes to ESG consideration because it can take decades for corporate strategies to produce tangible results (both positive and negative) or for blow-up events to materialise. In addition, good forward-looking practitioners are not always recognised immediately. Responding to burgeoning client demand: Another big challenge is how to respond to rapidly increasing client demand for ESG investment compliance. The task practitioners are facing is to meet this ask not only with broader product offerings but while demonstrating ESG integration in mainstream investment decisions. AMs must also present a framework that can serve as a differentiator and provide a competitive edge. |

Download the full report

-

Shifting perceptions: ESG, credit risk and ratings – part 2: exploring the disconnects

June 2018

ESG, credit risk and ratings: part 2 - exploring the disconnects

- 1

- 2

- 3

- 4

- 5

- 6

Currently reading

Currently readingDisconnect 3

- 7

- 8

- 9

- 10