Although companies’ corporate finance staff talk regularly to credit ratings agencies, they rarely have opportunities to meet with investors’ fixed income analysts. Investors are left unclear where they should get the information they need for ESG analysis.

This was one of the most important findings of the inaugural workshop in PRI’s ESG in credit risk and ratings series. Held in Paris in conjunction with the Societé Française des Analystes Financiers, this forum was held with four blue-chip French corporates: Danone, Klépierre, Sanofi and Total, all of whose debt is rated investment grade. Representatives of the firms’ corporate finance departments spoke with analysts from four credit ratings agencies, and delegates from around 20 investment firms and banks[1].

Workshop participants

|

Investment grade borrowers |

|||||

|

Credit rating agencies |

|||||

The Paris workshop was split into four discussion groups, each with one company, one rating agency, and about seven investor or bank representatives per table. The discussion findings are described below, grouped into four main areas.

Ahead of the roundtable, credit analysts also created a Discussion Guide aimed at facilitating conversations about ESG factors that can affect creditworthiness. Future PRI roundtables in this series can help to enrich and refine it. This can be found in the appendix.

Increasing communication

Companies’ corporate finance departments are more used to engaging with equity investors than with fixed income analysts, and are not used to this kind of direct engagement. So having investor relations staff present is useful for making them more comfortable with the discussions.

Investors’ analysts felt that as the way that companies communicate financial metrics (including ESG-relevant ones) is done primarily to fulfil duties to shareholders, the information is typically not geared towards fixed income investors’ needs. Similarly, they noted that there are inconsistencies between the information disclosed in bond prospectuses and the annual report, due to each being ruled by different regulations in most jurisdictions. Prospectus lists of the risks highlighted by legal teams often do not include ESG risks. Moreover, when bonds are part of a programme of issuance, the prospectus is not reviewed. Loan covenants are also not disclosed in the prospectus.

“There are inconsistencies between the information disclosed in bond prospectuses and the annual report.”

As a result, some investment analysts said that they rely on the information provided by CRAs for certain aspects of their analysis. They also voiced difficulties in accessing senior management, something which is easier for CRAs and already an established practice. As CRAs have regular access to company management, non-public information and forecasts, they can have more informed conversations with corporate management about strategy and plans. CRA analysts also typically have fewer companies to follow than their counterparts on the investor side.

Materiality: Connecting the dots

In the eyes of companies, investors and CRAs do not seem to view sustainability strategies as an integral part of long-term business models and operational resilience.

While it is clear that materiality varies across sectors, the overall links between ESG factors and credit quality need more work from companies and analysts to better understand which additional data and KPIs are needed, compared to the ones traditionally used for financial analysis. In the meantime, this could be contributing to the misalignment investors report sometimes seeing between analysts’ questions and companies’ answers.

Given the complexity involved in how ESG factors impact credit risk, investors and CRAs need to connect with several parts of a company to be effective. CRAs already meet a variety of corporate representatives, but it is not yet clear which ones investors’ credit analysts should prioritise.

While CRAs have done a lot of work recently to better map the materiality of ESG factors, investors and issuers are still not clear about exactly how these ESG factors are incorporated into the CRAs’ methodologies.The financial materiality of ESG factors was recognised as a critical component of risk assessment, though participants acknowledged that challenges remained in determining materiality.

“The overall links between ESG factors and credit quality need more work from companies and analysts.”

Data challenges

Companies were also unclear over the role and utility of ESG data vendors. They often find that the requests for data appear to be irrelevant and disconnected from the realities of the sector. The perennial issue of there being a plethora of reporting schemes around ESG data – making collection and transmission resource intensive – was also a concern. In general, companies do not understand the sense of many of the requests they receive from data vendors.

Credit analysts said that they do not widely use vendors’ data, preferring to use data provided directly by issuers and do their own proprietary analysis. Many observed that vendors’ data are more aligned to the needs of ESG analysts than credit analysts, and so are often not sufficiently focused on financial materiality to be used in credit analysis.

“Companies do not understand the sense of many of the requests they receive from data vendors.”

Overall, companies feel that they disclose a lot of ESG-relevant information through various reports, and that one way or another the information is out there for analysts to find and use. Analysts see the proliferation of information across various dissemination channels as an obstacle and would prefer already harmonised data to be a starting point for them to begin their analysis.

Sector-specific considerations

The discussions also highlighted several considerations specific, but not unique, to the industries of the companies represented – food (Danone), pharmaceuticals (Sanofi), oil and gas (Total) and real estate (Klépierre):

|

Food |

Pharmaceuticals |

| Re-designing packaging | Product quality and safety |

| Developing recycled plastics and bioplastics | Air and land pollution |

| Agro-ecology, e.g. soil regeneration | Medicine transport, including refrigeration |

| Greenhouse gas emissions | Reputation and litigation |

| B Corp certification - of which Danone is an early adopter | Sustainable procurement programmes for suppliers |

| Product quality and safety (notably baby food) | |

| Nutrition and health | |

|

Oil and gas |

Real estate |

| Quantitative, comparable data for analysts’ models | High proportion of renewal costs relate to meeting ESG standards |

| Stranded assets | Stress testing portfolios based on weather models |

| TCFD reporting | Difficulty counting Scope 3 emissions |

| Time horizon misalignments - issuers’ long-term focused investments create costs in the short-term relevant to analysts | BREEAM certification standardising assessment of energy consumption |

| Difficulty assessing impact of Scope 3 emissions | Energy efficiency affects asset value, but difficult to connect it to rental income or vacancy rates |

Appendix: Discussion guide

This guide was created by credit analysts ahead of the Paris roundtable. It is aimed at facilitating the discussion on the ESG factors that can affect a debt issuer’s creditworthiness. Future roundtables can help to enrich and refine it. We hope that it will enhance credit analysts’ desk-based research, data disclosure and engagement with issuer management, whatever the sector, to improve the understanding of the impact of ESG factors on the credit quality of borrowers.

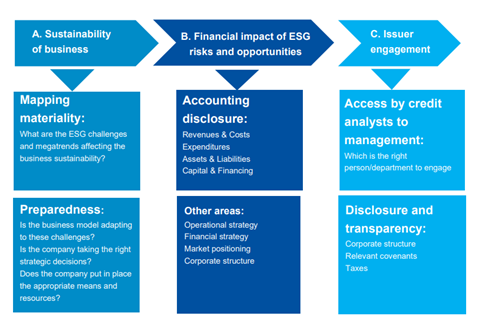

Analysts agreed to focus on three main relevant areas for credit risk analysis:

- The sustainability of business models (including the materiality map of ESG challenges and the isuer preparedness to address and mitigate them)

- The financial impact of ESG risks and opportunities on accounting disclosure, key strategies and corporate structure

- Issuer engagement (including not only how to establish channels of communication for the credit community, but also how to enhance disclosure and transparency)

Figure 1: Credit-relevant areas of focus when considering ESG factors

Analysts also discussed the new emphasis that should be put on credit risk analysis, particularly looking at:

- Longer time horizons (i.e. the analysis should be more dynamic and forward looking)

- Opportunities as well as risks (i.e. making issuers understand that their cost of capital can be affected positively as well as negatively)

For a description of how ESG factors have been embedded in credit risk analysis, see the PRI’s publication Shifting perceptions: ESG, credit risk and ratings: Part 1 - the state of play

Alongside considering corporate or issuer-specific issues, credit analysts also highlighted a series of macroeconomic trends that span across countries as well as sectors that should be integrated in the sustainability/ESG analysis via a top-down approach.

Table 1: Main macro trends with broad impact

|

Population-related issues |

Demographic shifts (e.g. ageing population), health trends (e.g. malnutrition, obesity), migration, social inequalities, millennial preferences |

|

Digitalisation |

Connectivity (Internet of Things), sources of business model disruption, cyber security, online businesses, automation and artificial intelligence, nanotechnologies, big data |

|

Energy and ecological transition |

Renewable energies, control of pollution, conservation of biodiversity, waste management, circular economy, resource management |

Source: EFFAS - CESGA / SFAF Credit Commission

Credit analysts also outlined a series of ESG issues that are potentially relevant. Environmental issues are explored in the greatest depth as these have become more prominent recently, not only because of the rise in the frequency and severity of physical risks, but also because of a rapidly changing regulatory environment. The narrowness of the discussion around social issues reflects the fact that more work needs to be done in this area by analysts and investors alike, while governance is an area that has long been an established part of credit analysis.

Environmental issues

The focus of environmental discussions should be on identifying disruptions that could materially affect a business or influence its main strategy.

Using a bottom-up approach, analysts should monitor the following material variables:

- Resource consumption: Use of raw materials, water, energy, recycled resources

- Environmental footprint:

- Process footprint: Waste, water pollution, recycling, biodiversity, carbon footprint

- Product and services footprint: Product lifecycle, carbon footprint

- Green innovaton: Eco-design of new products and services, circular economy

Table 2: Key risks and potential financial impact

| Risks | Potential financial impact |

|---|---|

|

Physical climate Acute:

Chronic:

|

|

|

Technology

|

|

Source: EFFAS - CESGA / SFAF Credit Commission

Table 3: Key opportunities and potential financial impact

| Opportunities | Potential financial impact |

|---|---|

|

Energy sources

|

|

|

Resource efficiency

|

|

Source: EFFAS - CESGA / SFAF Credit Commission

Analysts should link disclosure with how financial and non-financial variables will be impacted (positively or negatively). It is key to reconcile the existing disclosures with the potential financial impact of risks and opportunities. For example, declining water or electricity consumption expressed in volumes should be linked to the electricity or water costs registered in the income statement.

Engagement

One of the areas for engagement on environmental issues is to assess an issuer’s compliance with existing regulatory requirements and its capacity to adapt to prospective changes, especially as clear energy transition targets are beginning to emerge. For example, analysts could ask:

- How does your company intend to contribute to the call by the Intergovernmental Panel on Climate Change (IPCC) that, in order to keep global warming under the 2°C, greenhouse gas emission (GHG) should decrease by 40% to 70% in 2050?[2] What are the financial implications of the measures that you intend to adopt?

- How have you factored the current European Union climate and energy targets for 2030[3] into your business plan? What is the financial impact of complying with these requirements?

Also, one analyst suggested clarifying whether disclosed GHG figures are net or gross, as there is a lot of reporting confusion and inconsistency around these.

Social issues

Material social risks depend on the size of the company, the nature of its business and its value chain. Company-related issues (i.e. to be managed in-house) should be distinguished from external metrics and topics (i.e. more to do with stakeholders outside the company, such as suppliers, clients and local governments).

Company-related metrics and topics:

- Internal organisation: Innovation support (e.g. R&D spending, patents), workforce metrics (e.g. turnover, absenteeism rate), links with unions

- Talent management: Attractiveness, internal mobility, skill training

- Human resource efficiency: Productivity

- Diversity: Age distribution, gender balance, societal balance, international balance

- Health and safety: Injury rates, severity rates, site safety, safety training

- Business culture: Ethics, fairness

External metrics and topics:

- Suppliers: Outsourcing, typology of suppliers (complexity of the supply chain, degree of interdependence), balance of power, hidden costs, geographical risks

- Clients: Brand image, data security, product safety, new consumption practices

- Foreign market operations: Appropriate monitoring structures, especially if in emerging markets; possible exclusions

- Community and society: Relationship with local governments, regulators, unions, NGOs, trade or professional association, local communities

Engagement

One of the areas of engagement on social issues is to assess a company’s awareness of suppliers’ labour practices (e.g. respect of human rights) or of supply chain financing, and the use of agreements such as reverse factoring.

Governance issues

Governance metrics and topics for discussion are mostly, but not exclusively, related to transparency, especially the clarity of information and its timely disclosure.

- Board: Composition of the board; independent members’ profiles; separation of CEO/chairman roles; diversity; executive compensation structure (financial and non-financial elements)

- Corporate structure: Legal entities and, if it is a group, guarantees (disclosure should be simple and explicit)

- Respect of capital providers:

- Minority shareholders

- Creditors, including disclosures of the most relevant bank covenants (with definitions and calculation when appropriate), explicit debt ranking and guarantees/subordination

- Risk control:

- History of bribery, cartel, fraud, litigation

- Internal measures taken after emergence of controversies or litigation (remediations) and how these have led to an improvement of business or financial profile

- Audit:

- Audit Committee: composition, members’ background

- Auditors: Seniority of the mandate, remuneration

- Affiliations: Is the issuer a signatory of a business platform (e.g. the UN Global Compact; the World Business Council for Sustainable Finance; or other professional or industry standards such as the Equator principles for banks, for example)? If so, with what level of commitment?

- Reporting frameworks: Has the issuer adopted any reporting framework, such as the Global Reporting Initiative (GRI), Green Building Certification Institute (GRESB), Sustainability Accounting Standard Board (SASB), Task Force for Climate-Related Financial Disclosure (TFCD)?

- History and organization of corporate social responsibility (CSR):

- Existence of an individual or a team responsible for CSR

- Scope, appointment criteria and reporting line

- Integration into the corporate strategy: how are CSR guidelines decided

Engagement

Analysts could ask about:

- Management accessibility: Management approachability and openness can provide (positive/negative) signals about governance.

- Other questions:

- What has been the evolution of sustainability/ESG consideration for the issuer?

- Are developments monitored? What works well and what doesn’t?

- What means have been put in place to ensure that the group’s employees are involved?

Downloads

References

[1] To facilitate an open exchange and mutual learning, the discussion was held under the Chatham House Rule.

[2] For more information, visit the Intergovernmental Panel on Climate Change website.

[3] Currently the EU 2030 climate and energy framework key targets are: At least 40% cuts in greenhouse gas emissions from 1990 levels; at least a 32% share for renewable energy; and at least a 32.5% improvement in energy efficiency. The targets were approved in October 2014 and subsequently revised upwards for renewables and energy efficiency in 2018.