Credit ratings and ESG ratings are distinct but complementary products. This page aims at providing clarity on the difference between the two, as well as the current offering landscape.

Credit ratings have been used for decades by fixed income investors as an input to their investment decisions, to assess the creditworthiness of an entity issuing debt instruments or of a particular financial obligation. With the expansion of responsible investment practices, fixed income investors have also started to use ESG ratings to inform their analysis and often to complement their in-house ESG frameworks.

Credit ratings

Assess the credit risk of an issuer or of one of its debt instruments

Credit ratings are computed by credit rating agencies (CRAs) and assess the credit risk of an issuer of debt instruments or of a specific issue.

ESG indicators enhancing credit ratings transparency

Highlight how ESG factors affect credit ratings

Selected CRAs have published indicators or scores with various denominations to better signpost how ESG factors affect diverse analytical components in the credit rating analysis enhance transparency. These are neither credit ratings nor ESG ratings.

ESG ratings

Provide a synthetic indicator of an issuer’s ESG characteristics or exposure to ESG risks

ESG ratings are typically produced by ESG information providers and are non-credit products. They are synthetic indicators of the ESG characteristics or exposure to ESG risks of an issuer of equity or debt instruments.

ESG ratings were originally created to address the needs of shareholders. However, with more types of investors currently using them, they are often confused with credit ratings by market participants because:

- the rating terminology is used for both;

- some CRAs have set up separate non-credit departments or have acquired ESG information providers and now produce credit and ESG ratings.

Table 1: Examples of credit and non-credit focused ratings, indicators and of theirproviders[1]

| Credit-focused | Non-credit focused | |||

|---|---|---|---|---|

| Credit ratings | ESG indicators enhancing credit ratings transparency | ESG ratings | ||

| Examples of providers of credit and ESG (non-credit) ratings | ||||

| Cerved Rating Agency | Credit ratings | – |

ESG Solutions

Solicited ESG Rating Unsolicited ESG rating ESG Assessment ESG Assessment Platform |

|

| Fitch Group | Credit ratings Fitch Ratings | ESG Relevance Scores Fitch Ratings |

ESG Ratings

ESG Scores Sustainable Fitch |

|

| KBRA | Credit ratings KBRA | – | – | |

| Moody’s Corporation |

Credit ratings

Moody’s Investors Service |

ESG Issuer Profile Scores & Credit Impact Scores

Moody’s Investors Service |

ESG Scores & Assessments

Moody’s ESG Solutions |

|

| Morningstar | Credit ratings DBRS Morningstar | – |

ESG Risks & Risk Ratings

Sustainalytics |

|

| RAM Holdings Berhad (RAM Group) | Credit ratings RAM Ratings | – |

Sustainability Ratings R1ESGo

TM

RAM Sustainability |

|

| S&P Global | Credit ratings S&P Global Ratings | ESG Credit Indicators S&P Global Ratings |

ESG Evaluation

S&P Global Ratings ESG Scores S&P Global Sustainable1 |

|

| Scope Ratings | Credit ratings | – |

ESG Impact Ratings

ESG Impact Scores ESG Analysis Climate Risk Solution Second Party Opinions |

|

| Examples of providers of non-credit ratings | ||||

| FTSE Russell (inc. Beyond Ratings) | – | – |

ESG Ratings

ESG Factor-In Model |

|

| ISS | – | – | ESG Ratings & Rankings | |

| MSCI | – | – | ESG Ratings | |

| Refinitiv | – | – | ESG Scores | |

| RepRisk | – | – | RepRisk Index (RRI) RepRisk Rating (RRR) UNGC Violator Flag UNGC Violator Index | |

| Verisk Maplecroft | – | – | Sovereign ESG Ratings | |

Table 2 compares the salient features of credit ratings and ESG ratings, highlighting the range of approaches taken in developing the latter. Each of the ESG information providers also offers a range of other issue-specific ratings or metrics that can be used for more specific ESG analysis of fixed income instruments or portfolios.

Table 2: Comparison of credit ratings’ and ESG ratings’ features

| Key aspects | Credit ratings | ESG ratings |

|---|---|---|

| Definition | Consistent across providers | Varies between providers |

| Materiality test | Consistent across providers, and focused on factors that impact credit risk. i.e. the probability of default of an issuer or of a single issue | Varies between providers, considering ESG risks and/or opportunities |

| Coverage of credit instruments | Covers issuers and issuances across all main credit instruments:

|

|

| Assessment of subsidiaries or issuances | Yes, specific assessment using relevant financially material data | Typically not assessed separately |

| Rating system |

|

|

| Public availability of ratings | Publicly available, with public notification of change or outcomes of review | Varies between providers |

| Frequency of review | At least annually and on material change | Generally annually and on material change |

| Relationship with assessed entity | Typically solicited | Typically unsolicited |

| Review of rating by entity | Issuer can review for factual errors | Varies between providers |

| Types of data used |

|

|

| Regulatory coverage | Regulated | Not regulated |

| Transparency of methodology | Detailed and publicly available on website | Varies between providers |

| Approach to changes in methodology | Public consultation | Varies considerably between providers |

| Ability to deconstruct and reconstruct rating | Key issues or factors underpinning a rating, or change of rating, are disclosed, though credit ratings are not designed to be deconstructed and reconstructed | Usually available to clients at the ESG factor level |

Understanding ESG in credit ratings

1. What are credit ratings?

Definition

CRAs are financial services firms that issue credit ratings. The definitions of such ratings and their underlying methodologies vary between CRAs[2]. However, the credit ratings they produce are all forward-looking opinions on the relative ability of an entity or obligation to meet financial commitments, which is typically the ability to pay interests and repayments of principal, as applicable, in full, at stipulated time periods.

CRAs can signal a potential change in a credit rating by identifying it is “Under Review”, for example, as a result of changed economic circumstances or a particular event. The potential direction may be:

- Positive – a credit rating may be upgraded

- Negative – a credit rating may be downgraded

- Stable – a credit rating is unlikely to change

- Developing – a credit rating may be upgraded, downgraded, or affirmed

In the remainder of this page, the focus will be on long-term credit ratings.

Regulation and transparency

CRAs are regulated entities, which are certified by the appropriate regulatory bodies in the markets they are present in. They commit to running their activities in accordance with the relevant set principles of conduct.

Regulatory environment

While there are differences in the regulatory requirements of CRAs between jurisdictions, there are similar requirements on the rigour, transparency and public disclosure of the methodologies used by CRAs in determining credit ratings. However, these requirements do not provide grounds for the competent authorities to interfere with the content of credit ratings and methodologies, which remain independent.

The approach taken is broadly similar across CRAs, which is why credit ratings are comparable between agencies. All CRAs use both material quantitative and qualitative factors relevant to assessing credit risk for issuers or individual debt issues.

Time horizons

Credit ratings are not dependent on specific fixed time horizons as they are CRAs’ best assessment of foreseeable credit risks. As a general principle, with lengthening time horizons, CRAs are less certain of how risks, including ESG risks, can impact issuers’ cash flow generating ability and on other credit metrics. Therefore, they focus on issues where there is more clarity, which tend to be short to medium term.

Credit ratings are subject to annual surveillance and reviewed whenever there are significant changes in performance or environment. CRAs will change a rating when there is greater certainty of a relevant event or circumstance arising.

Operating model

A credit rating assessment is an independent opinion typically initiated and paid for by the issuer. The majority of ratings are solicited by the rated entity. However, CRAs can also produce unsolicited ratings. For example, sovereign ratings are typically unsolicited.

While issuers are given an opportunity to review a rating, the review is limited to correcting factual errors and should not affect the opinion expressed in the credit risk assessment.

Methodology

CRAs’ credit rating methodologies are publicly available. CRAs also provide the key drivers or issues that underlie the rationale for a specific credit rating, or change in credit rating, in ratings’ reports. The relative weighting of the issues considered in the determination of a credit rating is sometimes disclosed to investors.

Rating methodologies may be reviewed, and changes may occur from time to time, with CRAs providing disclosure on such changes.

2. How do credit ratings consider ESG factors?

CRAs consider the E, S and G factors that are material for their analysis in their credit risk assessments, i.e. factors that may affect the relative ranking of risk for an issuer or single issue.

For example, carbon intensity is credit-relevant only if it financially affects the issuer’s ability to meet its obligations including operating costs and debt service in the foreseeable future. In jurisdictions where there is a carbon price or tight regulation, an issuer’s carbon intensity would be credit-relevant as it would imply additional costs. Credit relevance would also depend on the sector in which the rated entity operates and on its credit profile, including its ability to absorb the impact of such costs.

CRA quarterly updates

To enhance the transparency of the impact of ESG factors on credit ratings, some CRAs have started to produce scores highlighting how such factors are credit-relevant. These scores are proposed by the credit analyst, who assesses the impact of E, S and G issues separately, then they are reviewed by the ratings’ committee before being communicated alongside the credit rating. It is important to recognise that these scores are not ESG assessments of the issue or issuer but are used to communicate to investors the extent to which ESG factors are a driver of the final credit rating.

The three largest CRAs use a five-level scoring system for the E, S and G categories, to communicate the impact of ESG factors on the rating. Moody’s Investors Service and S&P Global Ratings scoring systems reflect the impact of ESG factors on the credit rating, while Fitch Ratings scoring system reflects their relevance for the rating. Please click below for more details on each score/indicator:

- Moody’s Investors Service Credit Impact Scores and Issuer Profile Scores

- S&P Global Ratings ESG Credit Indicators

- Fitch Ratings ESG Relevance Scores

Other CRAs have not developed a separate ESG scoring system to supplement their credit analysis. Instead, they provide credit-relevant ESG commentaries in their rating reports, detailing current or potential specific ESG information that can affect issuers’ risk of default over the long term (e.g. KBRA).

Understanding ESG ratings and fixed income

Definition

ESG ratings definitions vary by provider and by underlying metrics.[6]

The term “ESG ratings” can refer to the broad spectrum of rating products in sustainable finance and include ESG scorings and ESG rankings. ESG ratings, whether or not these are explicitly labelled as “ESG ratings”[7] refer to the broad spectrum of ratings products, including those that are marketed as providing an opinion on the ESG risks and opportunities, profile, characteristics or exposure of an entity, financial instrument or product. The ESG factors considered in the ratings may include: 1) climate or other environmental issues; 2) impacts on society, including employees, customers and suppliers and specific groups within society, e.g., local communities and indigenous peoples and 3) assessment of entity governance structures and systems, both formal and informal. These are assessed using a defined ranking system or rating process, which varies between providers.

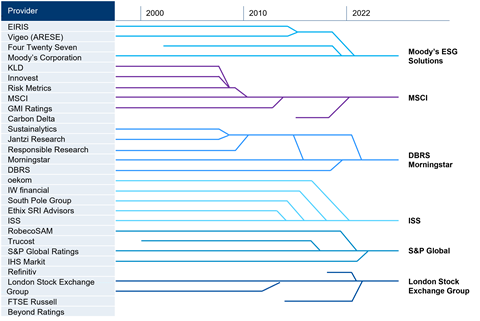

They are produced by ESG information providers, i.e. third-party providers of ESG data, services, opinions and/or assessments. Different providers use different approaches to develop ESG ratings and there is a variety of ways in which ratings are presented. ESG ratings are usually not defined in absolute terms (although some are[8]) but are generally assessments relative to a peer group. Some providers are also now owned by CRAs, although they remain separate from the credit rating division. The landscape of ESG information providers has undergone significant restructuring and consolidation in recent years (Figure 1).

Figure 1: Evolution of the landscape of ESG information providers 2000 – 2022. Source: See footnote[9]

Not all ESG ratings prioritise financial materiality in their assessments. They vary based on what they measure, including:

- their coverage (specific vs. aggregate ESG issues);

- the scope of the issuer’s environmental and social impact (positive vs. negative, and on which stakeholders, e.g customers, communities, workers);

- the time frames and weights considered; and

- their nature (absolute or relative).

Regulation and transparency

ESG information providers are not regulated entities, unlike the CRAs. However, there has been increasing regulatory scrutiny to enhance standardisation, consistency and transparency of their offerings and methodologies.[10]

It is up to the providers what information, e.g. methodology, coverage, is in the public domain and this does vary significantly between ESG information providers. Most give a high-level overview of such methodologies and provide limited information about the ESG factors considered and the weightings of different factors or issues in an aggregate ESG rating. This can be supported by an ESG report containing links to the data sources. Typically, more information is available to clients of the providers.

Time horizons

The time horizon considered in an ESG rating depends on the type of assessment. It can be short-, medium- or long-term. In general, ESG ratings are based on the relevant E, S and G issues weighted on their timeliness and potential impact on the issuer.

Operating model

ESG ratings are usually not solicited by the entities assessed and are computed using varying methodologies.

Depending on the provider, rated entities may be approached to complement missing data or are given an opportunity to review to assess the accuracy of the underlying information of their ESG rating.

Methodology

Most of the ESG information providers’ offering has been originally developed for listed equities. As a result, the coverage is satisfactory for corporate issuers, but becomes limited when it comes to other types of issuers (e.g. sovereigns, sub-sovereigns, supranationals, private companies, subsidiaries of a parent company).[11] In addition, coverage of corporate issuers in emerging markets can also be limited depending on the provider.

Moreover, the lack of consistent data disclosure by issuers implies that providers sometimes resort to estimations (e.g. using industry proxies).

Finally, the variety of ESG rating methodologies often leads to very different assessments of the same entity. ESG ratings by various providers are not comparable, because they cover different ESG topics, and use different metrics and weights to measure ESG performance.

Such a plurality is not problematic, as long as ESG information providers are transparent about the underlying methodology, but it has been subject to criticism, because it creates confusion, if ESG ratings send mixed signals, and poses reputational problems for rated entities.[12]

Finally, when making changes to the ESG ratings and/or methodologies, the notification process for clients varies between providers.

Comparison of CRAs and ESG information providers

Comparison between providers

Access the spreadsheet “Comparison between providers” below for a comparison of the key aspects of six main CRAs and ten ESG information providers. Read the “File instructions” tab with explanatory notes.

The comparison highlights that most of the ESG information providers do not cover the full range of issuers and debt instruments.

The information presented in the table is based on publicly available information and reviewed by CRAs and ESG providers. It is correct as of January 2023, though it should be noted that CRAs and ESG information providers do periodically update their methodologies and information available in the public domain. See also the disclaimer below.

Comparison between issuers

Access the spreadsheet “Comparison between issuers” below for the credit ratings and ESG ratings of approximately 120 corporate entities (anonymised), across a range of sectors and industries. They have been selected because both metrics are publicly available for such entities.

This spreadsheet is for illustrative purposes only. Read the “File instructions” tab with explanatory notes first. The adjacent tabs contain:

- a list of selected credit ratings and ESG ratings for each corporate entity (they can be filtered by sector, industry, credit rating quality or ESG rating ranking); and

- a comparison that shows when entities with high/low credit quality also have high/low ESG ratings, or when the signals from the credit rating and ESG ratings are mixed. The ratings of each CRA and ESG information providers have been grouped into five colour-coded categories (top; high; medium; low and bottom) to facilitate the comparison.

The information presented in the table as of July 2022. See also the disclaimer below.

Additional information and acknowledgements

This webpage contains information based on a desk top review of content in the public domain and one-to-one interviews. CRAs and ESG information providers were given an opportunity to review the information published in the spreadsheet “Comparison between providers”.

Comparisons should be made carefully as time horizons underpinning both credit and ESG ratings may vary.

This research was led by Carmen Nuzzo and Sixtine Dubost of the PRI with the support of Dr Ian Woods and Dr Rory Sullivan of Chronos Sustainability.

This page is part of the ESG in credit risk and ratings initiative, which is funded by the Gordon and Betty Moore Foundation through the Finance Hub.

Downloads

Comparison between providers

Excel, Size 67.65 kbComparison between issuers

Excel, Size 49.34 kb

References

[1]Some areas are empty because the indicators are not produced.

[2]Moody’s credit ratings also reflect the expected financial loss suffered in the event of default.

[3]The principal legislation is Regulation No 462/2013 (see here) and Directive 2013/14/EU (see here

[4]The Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”), amended Section 15E of the Securities Exchange Act of 1934 and enhanced the regulation, accountability, and transparency of CRA’s.

[5]IOSCO’s Committee 6 on Credit Ratings role is to: develop principles and standards; coordinate discussions between the CRA industry and regulators; interpret IOSCO Cross Border Principles and IOSCO Code of Conduct for CRAs; and revise the IOSCO Code of Conduct for CRAs (see here)

[6]The Board of the International Organization of Securities Commission – IOSCO – (2021) Environmental, Social and Governance (ESG) Ratings and Data Products Providers – FR09/21

[7]IOSCO Ibid.

[8]https://www.sustainalytics.com/esg-data

[9]PRI (2022) and Andreas Dimmelmeier (2020). Mergers and Acquisitions of ESG Firms: Towards a New Financial Infrastructure?

[10]European Commission (2022). Summary Report – Targeted consultation on the functioning of the ESG ratings market in the EU and on the consideration of ESG factors in credit ratings and Iosco (2022) Ibid.

[11]PRI (2021). Do ESG information providers meet the needs of fixed income investors?

[12]MIT Sloan, University of Zurich (2022). Aggregate Confusion: The Divergence of ESG Ratings