Case study by Templeton Global Macro

| Author | Vivian Guo, Research Analyst and ESG Coordinator |

|---|---|

|

Market participant |

Asset Manager |

|

Total AUM |

US$118 billion (as at June 2018) |

|

FI AUM |

US$118 billion (as at June 2018) |

|

Operating country |

US |

Action area:

- Materiality of ESG factors

The investment approach

ESG issues have always been central to Templeton Global Macro’s (TGM) analysis of macroeconomic dynamics at the country level as government policy, social conditions and environmental challenges can directly affect economic performance and asset values. For this reason, TGM believes ESG is most effective when fully integrated into the research process, to identify both opportunities and risks. While we have always considered ESG factors, TGM recognised the need to establish a formalised, quantitative framework to enhance ESG discussions internally. Defining and assigning quantitative metrics to various ESG factors has promoted healthy debate within the team and allowed for greater cross-country comparison, contributing to greater precision in the investment process.

The investment process

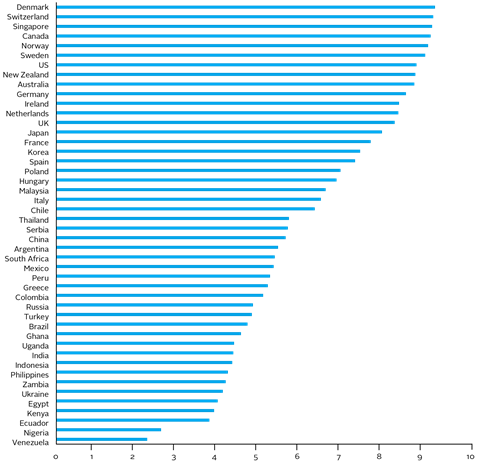

TGM’s ESG philosophy centres on the conviction that ESG change, or momentum, is a more effective tool for analysing economic and investment performance than level scores, particularly in emerging and frontier markets. The current industry focus on ESG level, which is closely related to income, results in a negative screen that locks capital away from low-income countries in need of it and pushes investment towards low-yielding markets. Shifting the emphasis to change in ESG allows investors to direct capital towards countries with improving fundamentals without sacrificing returns.

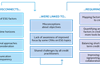

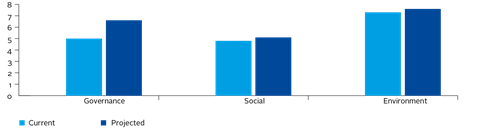

Combining and quantifying inherently fluid ESG factors is a complex challenge, but TGM has developed a propriety index, the TGM-ESGI. The team scores countries from 0 to 100 in 13 ESG sub-categories determined to have significant impact on macroeconomic conditions for current and projected categories (see below).

The scoring metric is constructed by overlaying the view of TGM’s research team onto a benchmark created by global indices. Analysts then adjust those benchmark scores based on their proprietary research and assign projected scores in anticipation of how they think these conditions are likely to evolve in the medium term. The change in score is simply the projected score minus the current score (see below).

The investment outcomes

TGM’s ESG process has not fundamentally changed the way the team conducts research, but has allowed for greater precision in identifying these issues. One case study in which there are numerous ESG factors at play is Argentina. Argentina was once among the wealthiest countries in Latin America, with a highly educated labour force and abundant natural resources. More than a decade of management under the previous administrations, however, resulted in isolationism, unsustainable economic policies and rampant corruption.

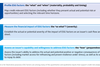

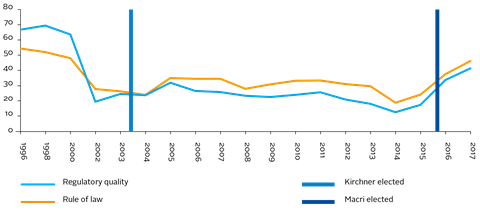

Under President Macri, elected in 2015, Argentina embarked on the tough road of restoring economic viability and re-establishing the country’s credibility among foreign institutions. The government has focused on improving transparency, strengthening the rule of law and working in a bipartisan manner with opposition politicians. This has allowed the country to produce reliable statistics, spur foreign direct investment and enact politically-controversial reforms like subsidy removal (see below).

The Argentinian people have also shown social cohesion in support of the government’s policies, despite the short-term economic hardships that must be endured. It is for these reasons that Argentina displays significant improvement on the TGM-ESGI and why TGM chose to invest in 2016, working with the central bank to build out the country’s long-term yield curve.

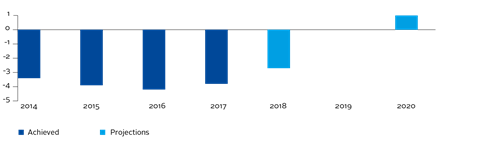

Argentina’s resolve has been tested; in the face of intense pressures starting from mid-2018, the central bank has maintained its independence to hike rates and the administration has managed to work with Congress to approve a balanced primary budget for 2019 (see below).

TGM believes CRAs and the investment community have become overly bearish on Argentina in the last six months, with S&P Global Ratings downgrading the country’s long-term credit and US dollar spreads widening by approximately 300 bps since April. We have continued to hold local bonds despite this sell-off, as, in our opinion, market participants have overlooked improving fundamentals in the face of temporary volatility. What our ESG process shows is that Argentina remains dedicated to orthodox policy and committed to restoring economic sustainability (see below).

Key takeaways

TGM believes ESG issues are fundamentally intertwined with sovereign economic performance in the medium to long term, and that a robust research process must include consideration of ESG factors. But rather than focusing on an absolute level, a forward-looking approach that focuses on momentum provides greater insight on economic development and potential financial return. Most importantly, ESG analysis requires patience. Investors must be able to endure periods of volatility and a sufficiently long time horizon to see ESG performance translate into economic conditions and asset price performance.

Download the report

-

Shifting perceptions: ESG, credit risk and ratings: part 3 - from disconnects to action areas

January 2019

ESG, credit risk and ratings: part 3 - from disconnects to action areas

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

Currently reading

Currently readingCase study: Templeton Global Macro