Case study by Nikko Asset Management

| Author | Akihiko Yoshino, Credit Research Group Manager |

|---|---|

|

Market participant |

Asset Manager |

|

Total AUM |

US$220.5 billion (JPY25.0 trillion – as at September 2018) |

|

FI AUM |

US$31.4 billion (JPY3.5 trillion – as at September 2018) |

|

Operating country |

Global |

Action area:

- Materiality of ESG factors

The investment approach

Nikko Asset Management (Nikko AM) believes that assessing creditworthiness requires considering quantitative factors such as debt service ability or financial strength, as well as qualitative factors. ESG-related risks are incorporated as important qualitative viewpoints in our investment process.

The investment process

We use 24 qualitative viewpoints across our coverage, comprising two environment-related factors, three social-related related factors and three governance-related factors. Our internal analysts, who are responsible for both fundamental analysis and ESG analysis, provide a comprehensive view on the creditworthiness of issuers to portfolio managers.

To integrate ESG viewpoints and fundamental analysis, our internal analysts communicate with issuers, and closely watch news flow and external ESG scores. All 24 qualitative viewpoints are updated monthly and shared with portfolio managers. The team discusses and implements necessary actions if any serious change is found.

The investment outcomes

The example below illustrates how Nikko AM has integrated a material social factor into fundamental credit risk analysis and investment decision making.

Nikko AM analysed a company that operates a restaurant chain in Japan with fast food, diner and sushi-go-round restaurants. It is the largest and fastest-growing company in the industry, with aggressive expansion plans. When we made our investment decision, it was rated as BBB by the Japan Credit Rating Agency (JCR) and downgraded to BBB- approximately one year later.

We identified a social factor related to human capital that could potentially increase this company’s credit risk; it was expanding too fast, with an irrational cost-cutting method that drastically increased employee workload and caused a mass exodus.

We decided not to purchase this company’s bond; while its financial performance looked better than its peers, we deemed it an unsustainable investment based on our analysis of traditional financial factors as well as non-financial views.

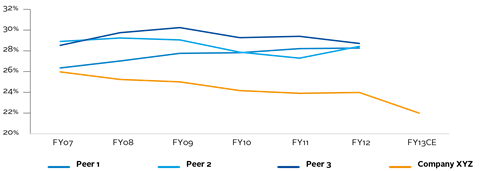

From traditional financial analysis, we found that the company’s profitability was due to lower labour expenses compared to peers (see below). But upon observing its stores, we saw that its low-cost operation relied on serious staff shortage, not driven by efforts to improve efficiency.

As industry competition stiffened, and food prices soared, the company had no choice but to rely on overworking staff. We concluded that the company could not maintain its growth and expansion without resolving the staff shortage problem.

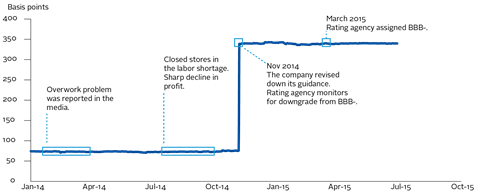

The issue of overworked employees caught the media’s attention in 2014. Meanwhile, because of the staff shortage, the company had to reduce its hours of business, and its financials weakened as a result. The company eventually suffered a sharp drop in profit and its bond spread over Japan government bonds (JGB) widened in November (see below) when JCR hinted at a possible downgrade from BBB-.

Key takeaways

The example above illustrates how we successfully protected our portfolio from serious bond price decline. Our investment process to incorporate non-financial ESG views proved to be effective.

Though social matters are generally difficult to factor into investment decisions, we feel it is one of the most encouraging examples of how ESG viewpoints can be successfully integrated with fundamental credit analysis. This supports the view that combining traditional financial analysis with non-financial factors and proprietary research can pay off.

Download the report

-

Shifting perceptions: ESG, credit risk and ratings: part 3 - from disconnects to action areas

January 2019

ESG, credit risk and ratings: part 3 - from disconnects to action areas

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

Currently reading

Currently readingCase study: Nikko Asset Management

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25