Notes from the COVID-19 webinars

Issuers’ crisis preparations and responses, and bondholder engagement, are two key areas of focus when considering the credit implications of the COVID-19 pandemic through an environmental, social and governance (ESG) lens.

As part of the ESG in Credit Risk and Ratings Initiative, the PRI organised three webinars in April and May 2020 to assess whether its work to enhance the transparent and systematic integration of ESG factors in credit risk analysis is helping market participants during the COVID-19 crisis.

The initiative initially nurtured a dialogue only between credit analysts from investors and credit rating agencies (CRAs) but is now broadening its outreach to debt issuers and other stakeholders.

This note summarises some of the key takeaways arising from this discussion with CRAs, bondholders and debt issuers.1

While it is still unclear how a recovery will unfold, important lessons that help shape future ESG factor integration in credit risk analyses are starting to emerge.

The following organisations participated in the webinars:

- Webinar 1 (CRAs) – Fitch Ratings, Moody’s Investors Service, S&P Global Ratings;

- Webinar 2 (credit analysts from asset managers) – APG Asset Management, MFS, Neuberger Berman; and

- Webinar 3 (debt issuers) – Skanska, Stora Enso and the World Business Council for Sustainable Development (WBCSD).

1. The COVID-19 crisis: An E, S or G factor?

The COVID-19 crisis is increasing the relevance of social factors and their materiality in credit risk analysis. Traditionally, these have been the hardest to measure and have sometimes been underestimated by analysts. However, given its nature and broad sector implications, the pandemic has helped to highlight the multiple connections between the ‘E’, ‘S’ and ‘G’ factors, which cannot be considered in isolation nor be strictly categorised.

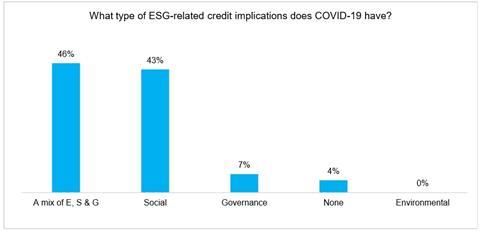

The webinar participants were divided on whether the credit implications of COVID-19 are purely social or should be considered through an overall ESG lens (see Figure 1).

Figure 1. COVID-19: Not just a social factor for credit risk

At first glance, it is regarded as a social risk because of its substantial implications for public health and safety, and employment. However, the crisis has other implications:

- environmental – since the marked drop in carbon emissions that accompanied the pandemic spread could present opportunities to reduce fossil fuel usage, change transport habits and preserve natural resources; and

- governance – because it exposes issuers with weak risk management, which were underprepared and lacking robust mitigation plans.

While the 2008-2009 crisis was a financial event, COVID-19 is both a financial and humanitarian crisis. Despite these differences, investors and issuers believe they share some commonalities – namely their devastating impact on employment and the need for government support they engender.

However, ESG integration is at a very different stage now, compared to a decade ago. ESG factors are more embedded in the analysis carried out by CRAs and investors as well as issuers’ activities. In many instances, detailed frameworks have been established to capture material ESG impacts and corporate disclosure around ESG issues has improved in recent years.

There are preliminary indications that markets are recognising companies with better integrated or more strategic approaches to ESG consideration. For instance, the WBCSD observed that the share price of its members outperformed major benchmark indices for the four months ending 30 April 20202. This is encouraging, although the results need to be taken with caution, as the outperformance cannot only be attributed to one factor, such as more advanced ESG practices.

2. A threat to ESG commitments?

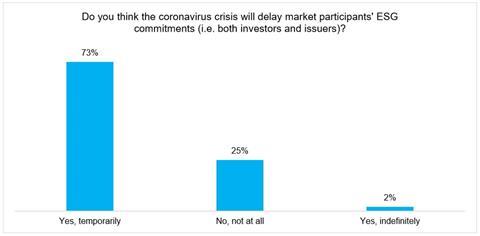

While investors and issuers expect that their ESG commitments could be temporarily delayed or reset, there is consensus that they will not be derailed, with most speakers and attendees expecting them to resume in the medium term (see Figure 2).

Figure 2. COVID-19: Delaying but not derailing ESG commitments

Some issuers might postpone current commitments due to liquidity issues but will restart their ESG activities once they stabilise their operations. Some companies might potentially communicate amended targets – especially environmental ones – which are more feasible in the short term and more compatible with the current conditions.

Some participants said they do not expect ESG commitments to decline at all in the short term and that they could increase in the long term, particularly where companies have already set targets to adjust their business models to climate change. Social factors might also become more relevant in the near term, given the pandemic’s impact on issues such as workplace safety and employment.

However, it is important to note that debt levels are higher now than before the financial crisis. While ESG commitments have increased in recent years, so have the number of companies with lower ratings, compared to the period preceding the 2008-2009 recession.

While a true picture of COVID-19’s impact on credit risk analysis will only emerge in time, these early implications are encouraging. Nonetheless, we acknowledge that not every issuer or investor is as advanced in their ESG incorporation as the webinar speakers.

3. The role of engagement

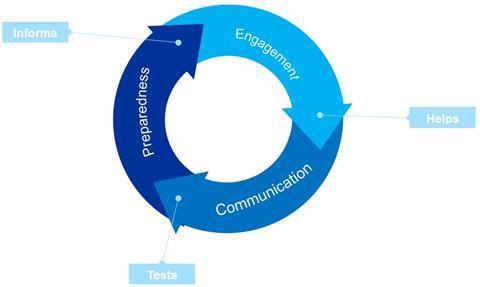

Even if broader investor-issuer engagement can prove challenging during the current crisis, communication is important, particularly as many companies are fighting for survival. It can help issuers demonstrate their crisis response and ensure investors do not make rushed divestment decisions. CRAs have a relative advantage, as issuers probably have an extra incentive to communicate with them to avoid downgrades (see Figure 3).

Figure 3. Engagement, communication and preparedness: a virtuous circle

A majority (92%) of the audience for Webinar 3 noted that sustainability discussions were a “must” for fixed income investors when engaging with issuers.

CRAs and investors noted that many issuers are still willing to maintain communication. Engagement on ESG factors remains a priority, albeit the focus of discussions has shifted to governance, since risk management and the strength of companies’ balance sheets are key to assessing the probability of default.

While equity investors have the upcoming Annual General Meeting season to ask questions around COVID-19 crisis plans; fixed income investors do not have this formal engagement method at their disposal and should, instead, make use of other communication channels, such as individual outreach.

The asset manager participants said issuer engagement was always important, not only during a crisis, because it is easier to maintain connections during times of stress where relationships are longstanding.

Having a dialogue with investors can also allow companies to understand best practices and how they rank against peers. Companies that routinely assess long-term and emerging risks as part of their risk management are better prepared to anticipate them, have contingency plans ready and remain resilient.

Skanska and Stora Enso, which have been engaging with their investors for many years through individual meetings, seminars and roadshows, have seen an increase in the number of questions asked by bondholders on ESG issues over time, and the relevance of these regarding their business and activities.

Admittedly, their engagement on ESG topics might have been facilitated by the sectors in which they operate – construction and paper and pulp respectively, where many ESG issues are highly relevant. Furthermore, as green finance already represents an important part of their funding, Skanska and Stora Enso may be more amenable to conversations with investors around environmental factors.

Nevertheless, both companies noted that bondholder scrutiny in general has increased.

More broadly, issuer communication and engagement with a variety of stakeholders (including employees, customers and suppliers, not just investors) is important.

Those that routinely engage with different stakeholders may be better positioned to survive the crisis – especially when difficult decisions need to be taken.

Laying off staff, for example, may be necessary from a credit perspective, but could cause reputational harm. This could be offset through clear communication and by implementing measures to support employees or reward loyal customers.

4. Better disclosure needed for fixed income investors

While credit analysts and portfolio managers welcome issuers’ increasing willingness to communicate around ESG issues, they often find that the data disclosed better matches equity investor requests. Issuers should adjust their communication and disclosures to better suit fixed income investors and make the data more usable and exploitable.

Indeed, 87% of the audience in Webinar 3 thought that issuers should adapt their existing ESG-related disclosures to better address the needs of fixed income investors. These findings echo the discussion of a recent workshop between credit analysts and four large French companies that the PRI organised in Paris.

The WBCSD highlighted that requests for better transparency and data disclosure are positive, because they help to convey the importance of ESG factors to corporate performance. However, its members face challenges deciding which types of requests are material.

5. The COVID-19 crisis: Room for improvement

While credit analysts and fixed income investors are primarily concerned about downside risks, COVID19 is helping to raise awareness among companies that they have an opportunity to consider ESG factors more systematically in their strategic planning, to accelerate the transition towards sustainable business models.

Skanska and Stora Enso are faring better than other companies in the current crisis, partly because of the sectors in which they operate, which have not directly been affected, but also because they started embedding sustainability criteria into their business models a long time ago. Furthermore, green bonds represent an important feature of both companies’ funding.

Issuing green bonds does not make a company’s business model more sustainable, nor are green bonds any different from mainstream bonds, from a credit perspective. Nonetheless, as one CRA noted, they may display less volatility, partly because of their scarcity and therefore, if investors hold on to these types of instruments to populate green funds or fulfil specific investment mandates. Furthermore, they could facilitate issuer access to markets during stressed periods,

Treasurers from both companies emphasised the importance of robust balance sheets and ensuring sufficient liquidity buffers as the key to survival for corporates.

Companies with a good credit rating will not be immune to tightening credit conditions going forward (depending on how deep the crisis will be), or even from default (depending on the sector they operate in). However, strong balance sheets provide liquidity buffers to weather the near-term fall-out. They could also put some companies in a relatively strong position after the crisis, allowing them to embrace new business opportunities.

While it is too early to know how long the recession triggered by the COVID-19 crisis will last, this is the time to start using scenario analysis and stress testing more regularly – something that both CRAs and investors emphasised during the webinars – to measure issuer resilience and prepare for different possible recovery paths.

Investors and issuers have a unique opportunity to drive change and prevent a return to business-asusual. The PRI encourages investors to act, engage with CRAs as well as issuers, and ask relevant questions that will inform their investment decisions. More than ever, conscious and timely thinking is instrumental in reallocating capital towards more sustainable sectors and companies. This crisis should be used to transform consumer, producer and investor approaches, as well as to influence policymakers.

Downloads

ESG in credit risk analysis - The implications of COVID-19

PDF, Size 0.3 mb