All Climate change articles – Page 30

-

News and press

Scaling up Chinese investor capacity for green finance – the PRI’s plans to meet the challenge

China has emerged as a driver of green finance and climate action.

-

Podcast

PodcastWhy migration is a material issue for investors

Sudip Hazra (Kepler-Cheuvreux) joins the PRI’s Bettina Reinboth to explore the issue of migration and why it is a material issue for investors. They explore the link to a number of other ESG issues, including labour skills, human rights and climate change.

-

News and press

Proxy season 2017: analysing the trends

With the 2017 proxy season now complete, it is time to take stock of the outcomes, analyse the voting trends and learn lessons for next year.

-

News and press

Five oil majors risk 30% of potential investments on projects ‘unneeded’ in a 2⁰C world

Five of the world’s six largest listed oil companies risk wasting more than 30% of possible spending on upstream projects that are high-cost and surplus to supply needs in a 2⁰C world, with ExxonMobil most exposed.

-

Engagement guide

Introduction to transition risk for oil and gas companies

The speed and scale of the energy transition is becoming more obvious every day, causing more investors to accept the need to improve their strategies to be well positioned as structural changes in the energy and related sectors occur.

-

Engagement guide

Engagement guideScenario analysis – degrees of warming

Scenarios are often misrepresented. Ultimately they are one version of the future, not a prediction or forecast.

-

Engagement guide

Engagement guide2 degrees of separation: Transition risk for oil and gas in a low carbon world

Are the oil majors aligned with a 2°C target? This new analysis provides a way of understanding whether the supply options of the largest publicly traded oil and gas producers are aligned with demand levels consistent with the agreed target for maximum global warming.

-

Engagement guide

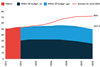

Engagement guideCalculating carbon supply cost curves in a 2°C scenario

In order to try and allocate the carbon budget at a company level, Carbon Tracker developed the carbon supply cost curve approach.

-

Engagement guide

Engagement guideCalculating a 2°C capex pathway for oil and gas companies

Having calculated the oil and gas production associated with a 2D scenario, we can then identify the level of capital expenditure required, and the delta to business-as-usual, (BAU).

-

Engagement guide

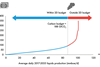

Oil and gas company/project exposure to a 2°C scenario

Companies that have a lower percentage of unneeded capex can be seen as more aligned with a 2D budget; companies with a greater percentage of unneeded capex warrant further attention from investors.

-

Engagement guide

Engagement guideNPV sensitivity of oil and gas companies to a 2°C scenario

The NPVs of a company’s 2D-compliant portfolio and its BAU portfolio can be compared to give an insight into the cost structures of the two and their relative values.

-

News and press

PRI perspective: investors must drive implementation of the FSB Task Force final report

The FSB Task Force on Climate-related Financial Disclosures (TCFD) marks a turning point on how companies, banks, insurers, investors and regulators understand and respond to climate risk and opportunity.

-

Webinar

WebinarClimate strategies for sovereign bond investors

The PRI, Global Footprint Network, MN, and Degroof Petercam discuss climate strategies for sovereign bond investors.

-

News and press

PRI releases briefing document on US regulation and climate change

In a move to bring clarity to proposed changes in the US around policy and regulation issues, the PRI has released a briefing document for both US and global signatories. Since President Trump took office in January this year and began to assemble his administration, the political tide has turned ...

-

News and press

Letter from global investors to governments of the G7 and G20 nations

This letter is signed by nearly 400 investors representing more than US$22 trillion in assets.

-

Blog post

Climate disclosure – what does this year’s ExxonMobil resolution tell us?

Examining climate disclosure through an in-depth look at the upcoming ExxonMobil climate disclosure resolution.

-

Engagement guide

An investor's guide to methane: Engaging with oil and gas companies to manage a rising risk

Methane, the primary component of natural gas, is a climate pollutant 84 times more powerful than carbon dioxide (CO2) over a 20-year period, and it is responsible for 25% of the global warming we are experiencing today.

-

Webinar

WebinarClimate strategies for corporate bond investors

The PRI, BNP Paribas IP and The 2° Investing Initiative discuss climate strategy methodologies for corporate bond investors

-

Blog post

Long walk to below 2 degrees – reflections on COP22

Canny investors recognise the need to understand climate risk and protect investments.

-