This paper clarifies how and why investors should contribute towards the transition to a circular economy, what actions they are taking, the relevant emerging metrics and standards for investors, and how they can start to scale up their action.

Executive summary

A circular economy is a model of production and consumption that tackles global challenges, such as climate change, biodiversity loss, waste, and pollution. It is based on three design-driven principles[1]:

- eliminate waste and pollution

- circulate products and materials (at their highest value[2])

- regenerate nature.

Why should investors take action?

Investors should incorporate the transition to a circular economy into their investment and ownership decisions because:

- the principles of a circular economy affect nearly all industries and their global value chains. Addressing sectors that have a high environmental impact and high potential for circularity[3] can provide opportunities for investment and economic growth;

- doing so can help mitigate the physical, transition and systemic risks[4] and negative outcomes associated with a linear economy (including climate change and nature and biodiversity loss);

- shifts in regulation, technology and consumer demand are rapidly evolving and fuelling the transition to a circular economy;

- there is growing expectation from society, governments and beneficiaries that investors embed sustainability outcomes associated with the Paris Agreement and the Sustainable Development Goals (SDGs) into their investment approaches.

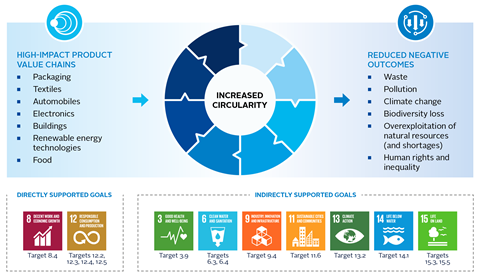

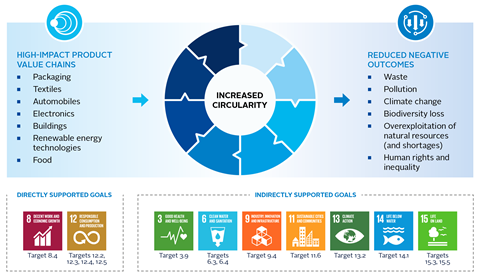

Removing barriers to circularity for high-impact product value chains can reduce negative outcomes and support several SDGs:

Investor action on circular economy

Commitments and initiatives

Although nascent, investors are increasingly aware of the circular economy. Some investors are working to embed circular economy principles into their commitments and responsible investment policies, by referencing them explicitly, or by using them to achieve related environmental, social and governance (ESG) goals (e.g. mitigating climate change and nature loss).

ESG incorporation

Investors can support the transition to a circular economy through various ESG incorporation approaches – integration, screening, or thematic investing (or a combination thereof). ESG integration and thematic approaches are most common among interviewees, who assess linear risks and circular opportunities using in-house and third-party ESG methodologies and research.

Stewardship

Stewardship can play a significant role in supporting companies and assets in the circular economy transition, and in influencing policy makers and other stakeholders to ensure public policy supports this. Some investors are already engaging on a circular economy. For example, by focusing on the circular economy thematically across multiple sectors and in relation to relevant sub-topics (such as plastic packaging), either through discussions with companies or by voting on shareholder resolutions. Others are considering corporate circularity as part of their stewardship approaches to systemic issues, such as climate change and nature and biodiversity loss.

Reporting and disclosure

Several voluntary reporting metrics and standards exist to support corporate disclosure on circularity at a product and company level: the Ellen MacArthur Foundation’s Global Commitment (focused on the plastic packaging value chain) and measuring tool Circulytics; and the World Business Council for Sustainable Development’s Circular Transition Indicators, for example.

Reporting standards, such as the European Sustainability Reporting Standards and ISO’s circular economy standards, are also under development. Alongside regulations such as the EU taxonomy and the Corporate Sustainability Reporting Directive, these will play an important role in helping investors better understand how to measure company circularity.

Quantifiable targets regarding planetary thresholds – such as the degree of overall circularity we should aim for and its related outcomes – are still evolving. This is crucial for investors wishing to shape sustainability outcomes in relation to a circular economy.

Recommendations

Although some investors have already started supporting the transition to a circular economy through their investment and ownership decisions, these actions need to be scaled up significantly. Investors should:

- identify sectors with high linear material use and environmental impact as part of their investment process, and allocate capital to sectors or business models that support circularity and present financial opportunities;

- engage with holdings on implementing circularity (e.g. greater use of re-use, and product lifetime extension models, increased use of recycled content, increased recyclability or composability of products) to address systemic environmental issues, adopting a value chain approach where possible;

- engage with stakeholders more widely to address some of the underlying barriers to a circular economy transition, including policy makers, data service providers, and standard setters and disclosure bodies.

The PRI will continue to support investors to scale up action on the circular economy, building on our previous work to help them address plastic waste and pollution. The PRI will support investors to consider risks and opportunities across a wider range of relevant value chains (beyond plastic), as well as integrate circularity into their existing work on climate and nature issues. We encourage signatories that wish to contribute to the development of further technical guidance to get in touch and share their views at [email protected].

About this paper

This paper clarifies how and why investors should contribute towards the transition to a circular economy, what actions they are taking, the relevant emerging metrics and standards for investors, and how they can start to scale up their action.

We encourage asset owners and investment managers to use this paper to develop their ESG incorporation and stewardship approaches in a way that supports the circular economy transition. Where asset owners outsource their investment decision making to external managers, they can use it to inform their due diligence and guide the manager expectations that they set.

Increased circularity has the potential to mitigate systemic issues, such as climate change and nature loss, as well as create new investment opportunities. As such, this paper is particularly relevant to:

- Universal owners and long-term investors wanting to address their exposure to systemic issues.

- European investors, given that the circular economy is a key environmental objective of the EU taxonomy.

It has been developed through interviews with 17 institutional investors – selected based on their existing activities to support a transition to a circular economy – and other stakeholders; analysis of the PRI’s 2020 and 2021 reporting data; and supplementary desk research. The interviewees represent a range of asset-class specialisms (primarily listed equity alongside fixed income and private markets).

The PRI’s work on plastics

The PRI has previously explored the circular economy as a way to address plastic waste and pollution through its plastics landscape series and engagement guidance focused on the plastics packaging value chain, led by the PRI’s Plastics Investor Working Group. This paper expands on this work across materials and value chains.

What is the circular economy?

This section outlines the circular economy and circularity concepts.

A circular economy is a model of production and consumption.[5] In contrast to the current, linear, take-make-waste model, it is designed to decouple economic growth from the consumption of finite resources, based on three design-driven principles[6]:

- Eliminate waste and pollution

- Circulate products and materials (at their highest value[7]),

- Regenerate nature

Its purpose is to:

- slow the depletion of scarce natural resources;

- reduce environmental damage from the extraction and processing of virgin materials;

- reduce pollution from the processing, use and disposal of materials.[8]

Consequently, a circular economy can be thought of as a framework that tackles global challenges like climate change, biodiversity loss, waste, and pollution.[9]

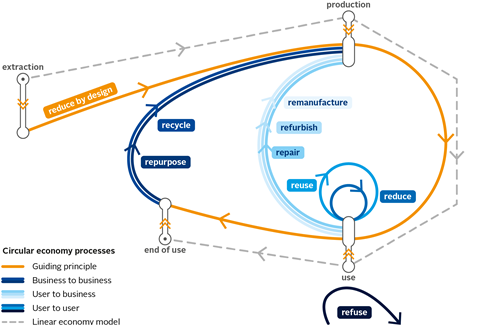

Circularity, as defined by the United Nations Environment Programme (UNEP), is a concept underpinned by a set of processes (refuse, reduce, redesign, repurpose, remanufacture, repair, refurbish and recycle) that contribute to transforming our economic model towards a sustainable future – see Figure 1. This paper uses the terms circular economy and circularity interchangeably.

Figure 1: An approach to circularity. Source: UNEP circularity platform

Why investors should take action

This section outlines:

- why investors should support the transition to a circular economy;

- the risks associated with the linear economy;

- how a circular economy can mitigate these risks and create investment opportunities.

Investors should incorporate supporting a transition to a circular economy into their investment and ownership decisions because:

- the principles of a circular economy affect nearly all industries and their global value chains. Addressing sectors that have a high environmental impact and high potential for circularity can provide opportunities for investment and economic growth;

- doing so can help mitigate the physical, transition and systemic risks[10] and negative outcomes associated with a linear economy (including climate change and nature and biodiversity loss);

- shifts in regulation, technology and consumer demand are rapidly evolving and fuelling the transition to a circular economy;

- there is growing expectation from society, governments and beneficiaries that investors embed sustainability outcomes associated with the Paris Agreement and the Sustainable Development Goals (SDGs) into their investment approaches.

Removing barriers to circularity for high-impact product value chains can reduce negative outcomes and contribute to meeting several SDGs.

Figure 2: Addressing high-impact product value chains to reduce negative sustainability outcomes

The risks of take-make-waste

Transition risks

- Increasing policies and laws to mitigate waste and support the circular economy transition in the real economy (e.g. single-use plastic and waste exportation bans and taxes, increased extended producer responsibility schemes, right-to-repair policies) and sustainable finance policy (e.g. the EU taxonomy)

→ increase costs for highly linear businesses, increase litigation risk (e.g. US and European Right to Repair movement law suits[11], plastic pollution lawsuits against companies and governments[12])

→ increase the need for investors to consider the circular economy. See more in Appendix: Regulatory drivers. - Growing consumer awareness of environmental issues (e.g. climate change, waste and hazardous chemicals) → scrutiny of companies, reputational risk, customer losses.

- Technological innovation → circular business models are increasingly cost effective.

Physical risks

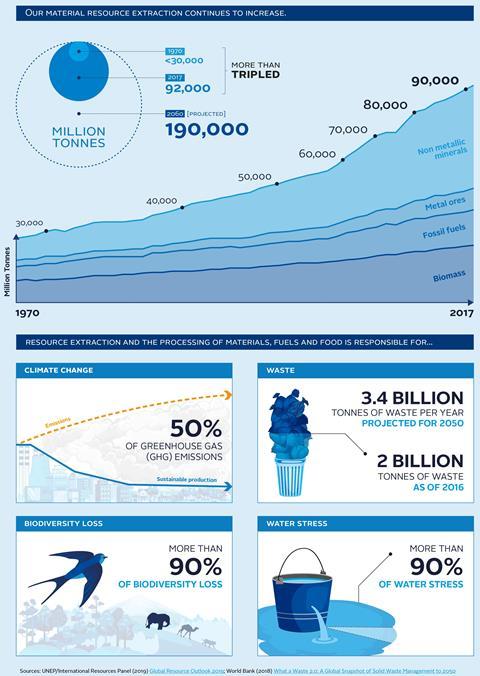

- Resource extraction and waste → pollution and environmental degradation, raw material shortages, supply chain issues (e.g. resource shortages in food and agriculture[13] and renewable energy sectors[14]).

Systemic risks

- Virgin raw materials that are extracted and wasted as part of the linear economy → exacerbate systemic issues (e.g. climate change, biodiversity loss, pollution) that threaten planetary boundaries.

Circular economy is a solution

Transitioning to a circular economy can address these linear risks, while supporting new growth opportunities and sustainability outcomes[15], as we highlight below.

Investment opportunities and economic growth

- According to Accenture, decoupling growth from finite resources could avoid a supply gap worth US$4.5 trillion by 2030, while at a regional level, the EU estimates that GDP may increase by 0.5% by 2030.[16]

- The circular economy could reduce companies’ need for primary raw materials and their associated costs, leading to greater cost efficiency and profitability for investors and investees. The Ellen MacArthur Foundation estimates that in China, a circular economy for five key sectors could save businesses and households US$10 trillion.

- Skills for a greener future, a study by the International Labour Organization (ILO), estimates that the circular economy could create 6 million net new jobs by 2030, of which 4.8 million would be in Latin America and the Caribbean. It will also be key to ensure that these jobs are decent and support the decent work agenda, with respect to the ILO and the UN Guiding Principles on Business and Human Rights (UNGPs) (see A circular economy and a just transition).

Addressing climate change

- Investing in sectors or companies that support a circular economy transition can:

- reduce emissions generated from waste and raw material extraction and manufacture (e.g. through product life extension or re-use);

- help ensure critical raw materials are available for the energy transition (e.g. recycling batteries creates a cost-effective supply for electric vehicles or energy storage), as well as ensuring these technologies require less virgin material extraction overall.

- According to the Ellen MacArthur Foundation, adopting a circular approach in just five sectors (steel, aluminium, cement, plastic and food) would reduce GHG emissions by 9.3 billion tonnes (the equivalent of eliminating all transport emissions globally).

Reaching net zero by 2050

Transitioning to a circular economy is among the steps needed to comply with the International Energy Agency’s Net Zero by 2050 framework, which requires:

- steel to be re-used and recycled;

- increasing plastics recycling rates to 50%;

- more material efficiency through improved vehicle and building design and construction.

Addressing biodiversity loss and pollution

- Research is emerging that demonstrates how circular economy approaches in sectors such as food, the built environment, plastics, textiles and forestry can address biodiversity loss. For example, Sitra has sought to quantify how circular levers (e.g. regenerative production and business models that increase product lifetime and use rates) address the drivers of biodiversity loss and how such approaches can reduce the need for agricultural land and help preserve natural forests, among others.

A circular economy and a just transition

The social dimensions of a circular economy need more consideration – by academics, policy makers and investors – to truly drive SDG-aligned real-world outcomes. The Chatham House report, Promoting a Just Transition to an Inclusive Circular Economy, notes that these have so far been neglected and highlights the importance of:

- identifying the specific employment impacts that digitisation and industrial restructuring will have;

- considering the likely negative transition impacts on low- and middle-income countries whose economies rely on linear sectors;

- ensuring international co-operation to create effective and fair governance mechanisms, and policy coordination at regional, national and local levels.

Providing guidance to investors on how to ensure a just transition as part of a circular economy is beyond the scope of this report. The UNGPs and ILO Just Transition Guidelines provide a good starting point for considering the importance of social dialogue and community principles in the just transition process. Such dialogue should include workers’ organisations, governments, and employers, according to the ILO. The PRI report, Closing the funding gap: The case for ESG incorporation and sustainability outcomes in emerging markets, also explores the just transition.

Looking across the value chain

A sector’s position in the value chain may pose different levels of risk and opportunity. For example, according to a study by Accenture and WWF, waste management companies have high circularity opportunities; plastic producers are exposed to higher risk; while plastic users are exposed to high opportunities and risks (including in relation to redesigning products and business models). This is also explored in the PRI report, Risks and opportunities along the plastics value chain.

Sector prioritisation

Investors can choose to prioritise sectors based on:

- linear risks and circular opportunities, including emerging policy (see Appendix: Regulatory drivers)

- portfolio relevance and strategy

- the potential for circularity to shape sustainability outcomes

Investors interviewed for this paper highlighted a range of sectors across the value chain as most relevant for a circular economy:

- Raw material and product producers: metals and mining, paper and forest products, agricultural products, containers and packaging, and chemicals

- Product users: automobiles, apparel and textiles, construction, IT (and electronics), renewable energy technologies (including batteries), and food and beverage

- Collection, sorting and recycling: waste management (and utilities)

How investors can support the circular economy transition

This section outlines the actions investors can take to support a circular economy transition, including approaches to ESG incorporation and stewardship, across a range of asset classes.

Commitments and initiatives

Investors cited a mix of reasons to focus on the circular economy, including needing to manage environmental and transition risks (see The risks of take-make-waste); and to pursue financial opportunities (e.g. because of first-mover advantage or cost savings associated with new business models).

Additionally, increased client demand for ESG-compliant products is driving a focus on new thematic investments (including circular economy as a thematic opportunity), while some European investors want to better understand the circular economy to align with the EU taxonomy in the future.

Some investors are already working to embed circular economy principles into their commitments and responsible investment policies through various approaches, including:

- explicitly highlighting circular economy commitments and strategies in responsible investment and issue-specific policies (e.g. climate policies);

- defining related ESG goals where circular economy approaches are implied as a way of delivering these.

For example, private equity manager Astorg has committed to supporting a circular economy in its ESG policy, which informs its investment process and mission. Dutch investment manager ACTIAM has set a target to move towards a zero-waste economy by 2050, as part of its Sustainable Investment Framework. It outlines the organisation’s expectation that companies will adapt to use circular business models and approaches to achieve this goal.

Savings and insurance provider Storebrand highlights circular economy in its sustainable investment and climate policies. Its sustainable investment policy integrates sustainability through different tools, such as solution funds that include circular economy as an investment theme, while its climate policy states that “low carbon and climate resilient” investments should adhere to the EU taxonomy’s environmental objectives (which include doing no significant harm to a circular economy).

Where investors have defined commitments and strategies for related ESG issues that they already address, supporting a transition to a circular economy is described as a cross-cutting theme or approach to deliver on these, particularly for biodiversity commitments and strategies.

Some investors cited initiatives for relevant sub-topics (e.g. plastic pollution), as well as those focused on related broader objectives (e.g. addressing climate change and biodiversity loss given that a circular economy can support these): Examples include:

- The Plastic Solutions Investor Alliance, whose members have signed a public declaration on engaging publicly traded companies on the threat caused by plastic pollution;

- The PRI’s Plastics Investor Working Group, whose members contributed to developing the plastics landscape series, and engagement guidance on plastic packaging;

- The Finance for Biodiversity Pledge (including the anticipated Nature Action 100+ initiative), whose signatories aim to protect and restore biodiversity through their finance activities and investments.

Reporting on circularity

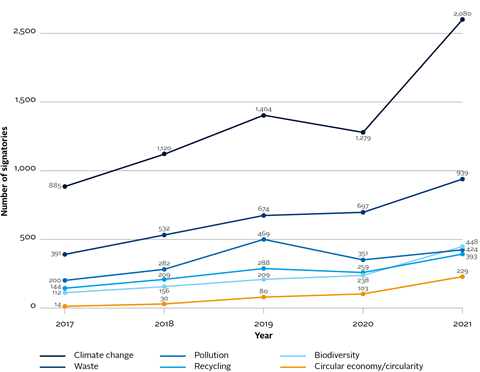

The PRI’s reporting and assessment data shows that the transition to a circular economy is growing in importance for signatories. Between 2017 and 2021, the number of investors mentioning circularity or circular economy increased from 14 to 229.[17] For context, biodiversity was mentioned by 448 investors, and climate change by 2,080 investors, in their submissions to the 2021 Reporting Framework.

However, signatories may be using related terms such as waste management, pollution, and recycling to refer to investment activities that impact or consider the circular economy. Total mentions of these terms were significantly higher – see Figure 3. Similarly, the PRI’s Listed equity snapshot 2017-2020 shows several signatories reported engaging on relevant topics for the circular economy – such as plastics (61 investors), pollution (181 investors) and climate (447 investors).[18]

Furthermore, in their 2021 reporting on climate change, which is aligned with the recommendations set by the Taskforce on Climate-related Financial Disclosures (TCFD), signatories disclosed circular economy as a climate-related opportunity 144 times, citing opportunities such as recycling and eco-design.

Figure 3: Unique signatories that mentioned each word by reporting year

ESG incorporation

Investors can support a transition to a circular economy through various ESG incorporation approaches – integration, screening or thematic investing (or a combination thereof). Definitions of these can be found in the PRI’s Reporting Framework glossary.

Many interviewees are incorporating circularity as part of thematic approaches, and to some extent through ESG integration, as we explore below.

We draw on specific practices where our interviewees discussed them – across listed equity, private markets and fixed income – but do not cover all asset classes or instruments, reflecting the nascent nature of circular economy as a topic for investors.

We encourage investors to consider how they might apply or adapt the practices and considerations outlined to other asset classes and strategies.

ESG integration

Investors can assess the risks of the linear economy, and opportunities of a circular economy, through a combination of in-house ESG methodologies and research and information from third-party data providers.

Some interviewees highlighted the Ellen MacArthur Foundation’s New Plastics Economy Global Commitment (led in collaboration with UNEP) as a useful resource for supplementary information regarding corporate circularity, but only in the context of plastic packaging.

Some investors use the SASB materiality map to identify sectors where linear risks or circularity (e.g. managing linear risks through product design and lifecycle strategies, and effective material sourcing) may be financially material, and supplement this with qualitative insights from in-house ESG and sector specialists.

Private equity and venture capital

The controlling or minority positions that private equity investors often take in their portfolio companies can give them greater influence and access to management than public market investors. They can use these positions to:

- engage with their holdings on why it is important to track relevant data;

- help increase the circularity of holdings, including by setting relevant circular economy KPIs; and

- help develop relevant reporting processes to disclose and measure company progress against these and against related sustainability outcomes, such as reduced climate emissions).

Data collection is resource intensive and time consuming. A company’s willingness to collect and monitor circularity information can depend on its maturity, resources and – crucially – the material relevance of circularity to its business. Interviewees stressed that close collaboration was required to do this effectively and that such efforts often took several years.

Interviewees noted that improvements in circular economy practices during ownership can potentially improve long-term profitability, particularly as the concept of circularity complements the private equity industry’s focus on resource efficiency. For example, one investor pointed to a chemical company in its portfolio that produces hazardous waste, noting it could make significant savings in its annual disposal costs if it could transform this into by-products for sale.

Companies that are positioned to benefit from a circular economy transition, such as recycling companies or alternative material producers, present an attractive investment proposition in their own right, with some interviewees noting that they consider this when making an investment decision. Others have dedicated strategies focused on finding such opportunities – see Thematic investments.

Infrastructure

The infrastructure changes needed to enable a circular economy transition require significant funding, creating new investment opportunities:

- The European Commission and European Investment Bank have identified projects that avoid and reduce the pollution of oceans and seas, with a particular focus on circular economy approaches.

- Macquarie Asset Management acquired Beauparc Utilities, a company that supplies utilities and recycling services, in 2021, highlighting that it wanted to “support the growth of the circular economy” through such investments.

- 3i Infrastructure invested €201 million in Attero, a Netherlands-headquartered waste treatment and disposal company, in 2018, highlighting it was well positioned to benefit from trends driven by EU directives targeting more recycling.

Our research indicates that investors focused primarily on ESG integration for risk mitigation purposes can look to increase the circularity of existing real assets. For example, ensuring that renewable energy infrastructure assets, such as solar panels and wind turbines, can be recycled to reduce lifecycle emissions.

The Global Infrastructure Hub

Founded by the G20, the Global Infrastructure Hub has identified several opportunities for sustainable infrastructure to contribute to a circular economy (below). Such a framework can be used by institutional investors to incorporate a transition to a circular economy in their investment and ownership decisions.

1. Circularity of infrastructure

- Reduce the need of finite materials – e.g. via efficient design and planning

- Use more renewable materials in infrastructure[19]

2. Infrastructure for circularity

- Enable waste recovery/re-use/recycling – includes sharing networks and marketplaces

The Global Infrastructure Hub aims to collaborate with the public and private sectors to produce data, insights, tools and programmes that inform sustainable, resilient, and inclusive infrastructure policy and delivery. It can be a useful resource for infrastructure investors looking to support the transition to a circular economy and other sustainable outcomes with their investment and ownership decisions.

Real estate

A circular economy can significantly contribute to reducing the carbon emissions of buildings and the waste generated through construction.[20] Measures that substantially reduce the production of high-volume energy-intensive materials for buildings and infrastructure have the highest impact, followed by enhancing the use of buildings, according to research by design consultancy Arup, the University of Leeds and C40 Cities.

In terms of new buildings, one European investor highlighted that their future value is likely to be higher for several reasons:

- compliance with the EU taxonomy (and its do no significant harm criteria for circular economy when pursuing climate objectives);

- a stronger environmental focus (particularly on climate change) from investors; and

- more stringent regulation making it harder to dispose of waste and build only with new materials.

Key challenges include understanding the material composition of buildings – investors are collaborating to improve this, as highlighted in the Madaster example below – and the policy changes that need to occur to implement a circular economy in practice. A lack of buildings designed for disassembly also limits the supply of re-used and recycled materials for new buildings.

Opportunities for circularity within existing real estate – which typically attracts more investment – are largely limited to renovation and maintenance.

Example

Madaster – an online registry of materials

- Madaster is an online registry for materials and products, where buildings are documented, registered and archived, including the materials and products that were used in their construction. It aims to make their re-use easier, encourage smart design and eliminate waste.

- Organisations that are part of the Norwegian Madaster Pioneer programme include Statsbygg, Entra, COWI, Ratio Architects, Rambøll, Henning Larsen, Storebrand and Sweco. These organisations have started to use the digital platform for circular design among participating architects and to register the composition of existing and renovated buildings.

Fixed income

Interview discussions and available research on addressing circularity through ESG integration in fixed income were limited. Nonetheless, we encourage readers to consider how their corporate, sovereign, sub-sovereign or private debt investments might address circularity, or the impact of risks associated with the linear economy.

The relevance of the circular economy to an issuer will depend on many factors, including the sector (in the case of corporate or private debt), capital structure and income profile, and the maturity of the instruments. In the case of sovereign and sub-sovereign issuers, their economic characteristics (for instance the dependence on agricultural, manufacturing or services industries or the composition of their taxable base) also matter.

Investors could assess whether linear economy risks affect the ability of issuers to repay their debts, for example:

- if their expenditure increases due to production or import cost rises driven by regulation;

- if revenues fall for corporate issuers, because certain business lines face falling demand in the circular economy transition;

- if sectors that are heavily reliant on natural resource extraction decline, sovereign and sub-sovereign issuers whose economies are exposed to these[21] may face reduced corporate tax revenue and wider economic problems.

More broadly, investors could also assess whether linear economy risks would affect other, more traditionally considered factors that may be material to a bond’s credit quality or price, such as economic growth, policy, interest rates or inflation.

Screening

Our interviews indicate that investors are not screening investments systematically using circular economy criteria, largely due to a lack of data.

Some combine screening with thematic investment approaches for related topics where circularity can potentially play a role, such as biodiversity. For example, as highlighted in the PRI report, Investor action on biodiversity, the Sycomore Eco Solutions fund focuses on companies with business models that contribute to the environmental and energy transition across five key areas, and excludes companies that destroy natural capital.

But investors are not necessarily applying such screens across their entire portfolios, they use them only for dedicated responsible investment or thematic funds, according to research by ShareAction.

One interviewee explained how their norms-based and negative screening policies, although not explicitly focused on the circular economy, can potentially exclude companies with poor circularity:

- They use the 9th principle of the UN Global Compact, which focuses on waste, to identify companies with poor waste management. Companies whose business practices are controversial and do not adhere to the UN Global Compact’s principles are placed on a watch list and monitored to decide whether they engage or exclude them.

- Companies may be excluded if the investor determines that they have seriously breached its ESG strategy, which includes sustainable management of natural resources as a key pillar.

The investor largely uses these types of exclusions in the context of biodiversity-related controversies but notes that they could arise due to waste damaging nature, or inadequate resources management caused by poor circularity.

Thematic investments

Many interviewees highlighted using a thematic investment approach to support the transition to a circular economy, either by selecting individual holdings or opportunities, or by managing or selecting dedicated funds (in the case of asset owners).

Thematic equity funds

Although thematic equity funds represented only 2.7% of all listed equity investments, this share has tripled from 0.8% in 2011, with assets under management (AuM) growing significantly during the COVID-19 pandemic, reaching US$800 billion by the end of 2021.[22]

Thematic circular economy investments have also grown recently (including impact investment funds). According to research by Sustainalytics, assets in 10 circular economy-themed funds almost tripled over the course of 2020 – from US$4 billion to US$11.4 billion.[23] Some of these funds are purely dedicated to the circular economy, while others pursue circular economy as part of a broader environmental theme.

Some funds are focused on solutions – they invest in companies that are directly providing solutions to enable a circular economy, such as alternative materials to support product redesign. Others include companies that are transitioning their operations to support increased circularity.

However, building and qualifying thematic funds can be problematic. Interviewee opinion differs on whether companies transitioning from highly linear to more circular models can be legitimately included in thematic investments, as it is not always clear what proportion of their revenue is derived from circular activities or processes. For example, some large fashion companies are adopting circular practices (such as garment repair and rental services) but only obtain a small proportion of revenue from such activities.

There are no standards defining what an acceptable level of circularity is, and what would make a company eligible for thematic portfolio inclusion. Similar challenges exist for measuring outcomes in relation to sustainability (see Reporting and disclosure).

Thematic listed equity examples

- Robeco’s RobecoSAM Circular Economy Equities fund invests in companies that address the opportunities created by the circular economy transition. It focuses on innovative solutions, such as those redesigning inputs to make them more recyclable or reusable and that manage circular logistics and waste management systems.

- Aviva’s Natural Capital Transition Fund focuses on four investment themes, including a circular economy and SDG 12 (responsible consumption and production).

Thematic private equity examples

- Circularity Capital only invests in companies accelerating the transition to circular economy. It focuses on five circular economy models: product to product, product as service, product from waste, circular design and enabling solutions.

- The European Circular Bioeconomy Fund prioritises investments in opportunities that convert biological resources and waste streams into value-added products, targeting sectors including new agricultural technologies and business models; blue economy; and bio-based chemicals, specialities and materials.

- Closed Loop Partners provides private equity and project finance capital to companies leading the development and expansion of the circular economy, with the aim of reducing waste and GHG emissions through materials innovation, advanced recycling technologies, supply chain optimisation and landfill diversion.

Thematic bond investing

The circular economy can present opportunities for fixed income investors that invest thematically or target specific environmental and/or social objectives.

The issuance of ESG-labelled (green, blue or sustainability) bonds with clear use-of-proceeds or performance targets has grown significantly in recent years, with some frameworks referencing the circular economy in their eligibility criteria:

- The International Capital Market Association’s Green Bond Principles include “circular economy adapted products, production technologies and processes and/or certified eco-efficient products” as one of eight eligible project categories that green bond proceeds can finance.

- The Asian Development Bank’s Blue Bond Framework includes a focus on the circular economy as part of investments targeting marine pollution control projects. Qualifying projects include those focused on waste exchange; new business models that remove plastic waste by design; green supply chain management programmes to reduce plastic waste; and innovative technologies or approaches that reduce single-use plastic production and consumption.

Total volumes of labelled green, social and sustainability, sustainability-linked and transition bonds reached US$3 trillion as of 31 March 2022, according to the Climate Bonds Initiative’s Sustainable Debt Market Summary Q1 2022.

Fixed income investors can also buy bonds that do not carry an ESG label but still contribute to the circular economy transition, such as:

- sovereign bonds issued by countries that have set or implemented policies that seek to meet climate-related targets or address relevant SDGs;

- corporate, sovereign or sub-sovereign bonds that fund purposeful projects, particularly infrastructure with positive environmental and societal outcomes.

Waste management – a circular economy opportunity

Waste management infrastructure and techniques will need extensive improvement – and significant capital financing – to deal with current and forecasted levels of waste generation.

Total investments in waste management remain small but examples of issuance across the world show that capital markets can be further utilised to finance assets and projects contributing to resource efficiency and circular solutions across many sectors.[24]

However, these projects tend to include waste to energy, alongside projects that recover and recycle waste. Waste to energy was not classified as a sustainable activity in the technical screening criteria proposed by the Platform on Sustainable Finance, which advises the European Commission on the development of the EU taxonomy. Not having waste incineration included in the list of EU taxonomy-eligible activities would raise the quality and recognition of green bonds issued under the European green bond standard as instruments contributing to circular economy transition.[25]

Stewardship

PRI signatories are expected to be active owners that use their influence to maximise overall long-term value, including the value of common economic, social and environmental assets, on which returns and clients’ and beneficiaries’ interests depend.

As such, stewardship can play a significant role in supporting companies and assets in the circular economy transition, and in influencing policy makers and other stakeholders to ensure public policy supports this. Circularity considerations can also be integrated to support engagements on climate change and nature.

Corporate engagement

There are a small number of engagements focused on supporting companies to adopt circular economy principles across multiple value chains, while other collaborative engagements focus on plastic waste only:

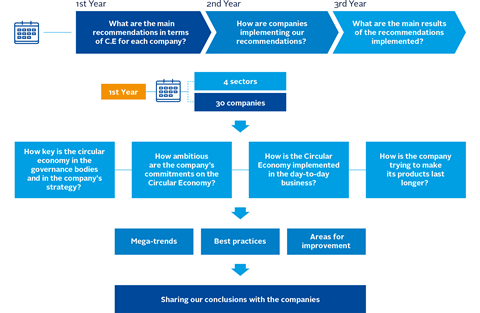

- Amundi started a three-year engagement campaign in 2020 to promote the adoption of circular economy principles by companies across the electronics and IT, batteries and vehicles, textiles, and construction and building sectors (see Figure 4).

- Hermes EOS has started discussing a circular economy with companies, clarifying that greater recycling and less waste are only the first steps towards adopting a more circular business model.

- Strathclyde, Nomura Asset Management, OP Asset Management and NN Investment Partners have participated in Sustainalytics’ Plastics and Circular Economy Engagement, launched in 2019. They have engaged with the majority of the 21 target companies representing the automotive, electronics, and packaging and consumer goods sectors.

- The Plastic Solutions Investor Alliance, co-ordinated by US NGO As you Sow and bringing together 25 institutional investors with a combined US$1 trillion in AuM, has targeted fast-moving consumer goods companies such as Unilever, Pepsico, P&G and Nestlé. The engagement aims to find solutions to plastic pollution through commitments, programmes and policies.

Some investors consider a circular economy as part of their engagement on systemic issues. For example, Climate Action 100+ includes the circular economy within its global engagement strategies for the steel and food and beverage sectors, recommending that investors consider the use of recycled steel and plastic packaging respectively.

According to one interviewee, biodiversity and circular economy will likely be a greater focus in the coming years once data is more readily available, given the increasing investor momentum on this topic.

Example

Amundi’s engagement to promote a circular economy

In 2020, Amundi launched a three-year engagement with four of the seven most resource-intensive sectors identified by the EU, according to its 2021 report, The time of Circular Economy has come. These sectors include:

- Batteries and vehicles

- Construction and buildings

- Electronics and ICT

- Textiles

Amundi noted that 30 companies (mainly headquartered in the US, Europe and Asia) responded positively to its engagement proposal.

To assess companies, it developed an evaluation tool based on four questions (see Figure 4 below). The tool allowed it to compare companies within their sector to “highlight mega trends, define best practices and identify areas of improvement.”

It shared the first-year engagement result, along with its recommendations, with the companies and will use the recommendations to inform the remainder of the engagement.

Figure 4: A three-year engagement campaign on circular economy. Source: Amundi Asset Management

Engagement in a sovereign bond context

Bondholders can engage with sovereign issuers on their progress towards the SDGs and related policies and reforms, as highlighted in the PRI report, ESG engagement for sovereign debt investors. This can ensure a more comprehensive assessment of their credit risks and allows them to contribute to driving broader societal change.

Given the close links between the circular economy and waste reduction, sustainable resource management, and in turn mitigating climate change and biodiversity loss, fixed income investors should consider the role and responsibilities of sovereign issuers in relation to circular economy.

Discussion topics could include how prepared a country is to transition to a circular economy – for example, determining how much they have invested in effective recycling facilities or assessing how much this would cost and the impact it might have on their debt repayment abilities.

According to one interviewee, investments that provide financing to conserve common goods, such as forests and oceans, can provide scope for engaging with governments and non-sovereign market participants (e.g. civil society organisations) on how they do so.

Voting on shareholder resolutions is an effective way for listed equity investors to communicate their views to company management and complements engagement.

Support for environmental and social shareholder resolutions has grown in recent years, and several of the resolutions filed in 2021 touched on the circular economy or related issues:

- As You Sow, a non-profit organisation that promotes corporate social responsibility, filed several resolutions focused on plastics and electronics.

- One of them, targeting DuPont de Nemours, passed, requiring DuPont to publish information on how many plastic pellets are released into the environment in its annual sustainability report. The resolution received 81% support – the highest-ever vote for a shareholder resolution on an environmental issue that was opposed by management.[26]

- Another asked Microsoft to analyse the benefits of making its devices fixable. Microsoft then stated that it was committed to making devices with increasing repairability.[27]

As of April 2022, 16 plastics-related shareholder resolutions had been filed (with some withdrawn due to agreements reached with companies, according to Morningstar).

The number of ESG proposals at shareholder meetings is rising[28] but they are less common in relation to the circular economy. Some investors are also working on including circular economy within their voting principles, according to our interviews.

Voting principles

Voting principles are high-level statements that explain an investor’s position on ESG issues and how they vote to effect progress on those issues. They enable investors to consider, consult and gain buy-in for the positions they will take (or that they expect their external investment managers or proxies to take) and communicate clearly with companies and resolution-filers on what kind of resolutions an investor will vote for. For example, Mercy Investment Services states in its proxy voting guidelines that it “supports resolutions addressing plastic pollution including development of policy, reports, and reduction targets”. More guidance can be found in the PRI report, Making voting count: principle-based voting on shareholder resolutions.

Policy engagement

In 2022, ahead of the UN Environment Assembly (UNEA 5.2), 29 global investors supported a statement for an ambitious UN Treaty based on a global circular economy approach to address plastic pollution.

The statement called for:

- upstream and downstream policies to manage plastic pollution;

- a common understanding and enabling conditions to make a circular economy work in practice and at scale; and

- robust governance to ensure countries’ compliance.

When it met in March, UNEA 5.2 passed a resolution to create a legally binding agreement by 2024, creating further opportunities for investors to engage with this process.

There is a significant opportunity for investors to increase their engagement with policy makers to support a circular economy – with only one interviewee noting that they had engaged with policy makers on the development of the EU taxonomy. See Recommendations for more detail on the steps investors can take to increase action.

Reporting and disclosure

This section highlights the emerging metrics and standards that investors can use to start understanding how their investments contribute to a circular economy.

Reporting metrics and standards to help companies measure circularity are nascent but developing. They can play an important role in helping investors to understand to what extent their potential or existing investments significantly contribute to a circular economy.

- The Global Commitment: Led by the Ellen MacArthur Foundation in collaboration with UNEP, the commitment aims to unite organisations behind a common vision of a circular economy for plastics – attracting more than 500 signatories already. Companies in the plastic packaging value chain have committed to ambitious 2025 targets so far and report annually and publicly on progress.

- The Ellen MacArthur Foundation’s Circulytics, and the World Business Council for Sustainable Development’s Circular Transition Indicators: These pilot reporting tools encourage companies to disclose performance indicators (e.g. raw material input, outputs (proportion of waste recycled or re-used), and water use) and process indicators (strategies and innovation). However, providing the data – which is not yet publicly available for investors – is resource-intensive for companies and it is not certain whether the tools can be easily scaled up or disseminated.

- Corporate Sustainability Reporting Directive: The EU Commission’s proposal would see all large companies adopt EU Sustainability Reporting Standards. These will be developed by the European Financial Reporting Advisory Group and will include circular economy considerations.

- ISO/TC323: The International Organization for Standardization’s circular economy technical committee has been established to develop frameworks, guidance, supporting tools and requirements that organisations can use to maximise their contribution to sustainable development. This will include creating standards to define a circular economy, measure circularity performance, and guidelines to transform business models from linear to circular.

- GRI 306: Waste 2020: In effect since January 2022, this is the first globally applicable reporting standard for companies to provide a complete picture of waste impacts (including waste prevention measures taken) along their value chains. It does not, however, consider circularity measures beyond waste management.

Measuring corporate progress on circularity is particularly challenging for investors due to the range of metrics they could use. For example, the Global Commitment explains that plastic packaging manufacturers can support circularity by:

- eliminating problematic or unnecessary plastic packaging;

- using more re-use models;

- ensuring plastic packaging is 100% re-usable, recyclable or compostable; and

- using more recycled content.

More frameworks are needed to help investors benchmark progress on achieving circularity and related outcomes at an entity and economic activity level. The World Benchmarking Alliance is developing a nature benchmark, which includes circularity indicators and measurement, that could help to fill this gap in the future.

Recent and upcoming regulations – for example, the EU taxonomy and the Sustainable Finance Disclosure Regulation (SFDR) – will also require greater reporting and disclosure in relation to the circular economy by investors. See Appendix: Regulatory drivers for more detail.

Measuring sustainability outcomes

For a circular economy, quantifiable targets in relation to planetary thresholds – such as the degree of overall circularity we should aim for and its related outcomes – are still evolving. This is crucial for investors wishing to shape sustainability outcomes in relation to a circular economy.

Global, regional and national targets are beginning to develop, focused primarily on material efficiency, waste reduction, and circular material use. Further work is needed to link these targets to wider planetary thresholds for issues such as climate change and biodiversity loss.

Scaling up investor action: Recommendations

Although some investors have already started supporting the transition to a circular economy through their investment and ownership decisions, these actions need to be scaled up significantly. The PRI has several recommendations for how investors can do so, which can apply to asset owners and investment managers.

Where asset owners invest in external managers, they have a role to play in setting clear expectations and priorities in relation to these recommendations. As part of their dialogues with investment managers on systemic environmental issues (such as climate change and biodiversity loss), asset owners can discuss circular economy considerations that can help address these. They can also require their managers to act on these recommendations where relevant.

Investment managers should also be proactive in highlighting to asset owners where they see opportunities for circularity to address linear economy risks.

Investment process

Investors should:

- identify sectors with high linear material use and environmental impact – including their associated physical and transition risks and where increased circularity could mitigate these – when considering risks and opportunities. They should prioritise the most impactful circularity processes, such as re-use and remanufacture (see Figure 1. An approach to circularity);

- allocate capital to sectors or business models that support circularity and present financial opportunities;

- where they want to shape sustainability outcomes, measure progress against recognised global sustainability goals – e.g. the SDGs and the Paris Agreement.

Stewardship

Investors should engage with holdings:

- on implementing circularity (e.g. greater use of product lifetime extension models, recycled content and product and material re-use, increased recyclability or composability of products) to address systemic environmental issues, particularly those operating in high-priority product manufacturing sectors (such as consumer packaged goods);

- to ensure their political engagement[29] is responsible and supports the development of real-world policies that will contribute to a circular economy transition.

They should adopt a value chain-focused approach, considering harmonised asks for relevant sectors and engaging – collectively, if possible – across product value chains.

Investors should define harmonised asks to engage with policy makers collectively to:

- implement real-world policies that support a circular economy e.g. reforming incentives to drive its implementation (including the development of recycling infrastructure and logistics);

- integrate circular economy principles into sustainable finance policies to minimise and avoid systemic issues, such as climate change and nature loss.

Reporting and disclosure

Investors should:

- engage with leading standard setters and disclosure bodies to support the development of harmonised circular economy indicators, metrics and targets;

- engage with companies and data service providers to encourage the provision of relevant, sufficient, and comparable circular economy data;

- encourage stakeholders to embed these circularity considerations within wider relevant sustainability standards for related climate and nature issues (e.g. the TCFD recommendations and forthcoming Taskforce on Nature-related Financial Disclosures).

The PRI will continue to support investors to scale up action on the circular economy, building on our previous work to help them address plastic waste and pollution. The PRI will support investors to consider risks and opportunities across a wider range of relevant value chains (beyond plastic), as well as integrate circularity into their existing work on climate and nature issues. We encourage signatories that wish to contribute the development of further technical guidance to share their views.

Appendix: Regulatory drivers

Several international and regional frameworks and regulations are emerging that support a transition to a circular economy, by:

- explicitly focusing on circular economy, or

- by requiring investors to consider how they can mitigate or manage broader systemic issues, such as biodiversity loss and climate change (where circularity can play a role).

Understanding company circularity will help investors to meet new and existing obligations in relation to these issues. Below we highlight a few examples. A comprehensive list of existing and emerging sustainable finance policies can be found in the PRI’s Regulation database.

| International frameworks | |

|---|---|

|

One-third of NDCs updated and submitted in 2021 mention a circular economy (e.g. the Netherlands, Finland, Chile).[30]

|

|

|

The CBD is set to outline global biodiversity targets in 2022 (at the time of writing) as it agrees the Global Biodiversity Framework. A circular economy could help deliver on these by addressing pollution and biodiversity loss. |

|

|

UN Environment Assembly Resolution - End plastic pollution: Towards a legally binding instrument |

A resolution to create a legally binding global agreement to end plastic pollution by 2024 was passed at UNEA in 2022. An intergovernmental negotiating committee will now define the specifics (including any legally binding obligations, and those best addressed through national action plans or voluntary measures). This agreement could harmonise policy maker action to govern plastic production, use and recycling worldwide, and support a more circular economy for plastics. |

|

The circularity of companies/holdings can be relevant for investors to adequately disclose climate opportunities. |

|

| Regional policy frameworks and regulations | |

|---|---|

|

European Commission’s Circular Economy Action Plan |

The EU’s transition to a circular economy is a prerequisite to achieving its 2050 climate neutrality target and halting biodiversity loss. Adopted in 2020, the action plan targets product design, promoting circular economy processes, encouraging sustainable consumption, preventing waste, and keeping resources in the economy for as long as possible. It prioritises sectors using most resources and where potential for circularity is high: electronics and ICT, batteries and vehicles, packaging, plastics, textiles, construction and buildings, food, water, and nutrients. |

|

A circular economy is one of six environmental objectives that economic activities need to substantially contribute to, to be eligible under the EU taxonomy. The thresholds for this objective are under development – see initial recommendations released for these in March 2022. |

|

|

The SFDR includes several principal adverse impact (PAI) indicators directly related to the circular economy, namely the ratio of hazardous, radioactive and non-recycled waste and average water usage and recycling – see SFDR Delegated Regulation – Annex 1 and the PRI’s investor briefing on SFDR. Circular economy approaches may also help companies and investors mitigate adverse impacts in relation to other PAI indicators, e.g., on biodiversity and climate. |

|

Several countries have joined regional alliances or adopted national policy frameworks that either explicitly reference a circular economy or could contribute towards its transition. Examples include:

- China: Its 14th Five-Year Plan (2021-2025) aims to develop a circular economy through recycling, remanufacturing, green product design and renewable resource initiatives.

- Japan: Its 2018 Fundamental Plan for Establishing a Sound Material-Cycle Society stated that financial institutions should be funding companies creating a “sound material-cycle society”.

- Finland and the Netherlands: both have strategies to transform and base their economies using circular economy principles by 2035 and 2050, respectively.

- The UK: has introduced a plastic packaging tax for packaging containing less than 30% recycled content. See the PRI’s Plastics landscape: Regulations, policies and influencers report for further global examples.

| Global and regional alliances |

|---|

|

The Global Alliance on Circular Economy and Resource Efficiency: launched by the EU and UNEP with the United Nation Industrial Development Organization in 2021. Members include Canada, Chile, the EU, India, Japan, Kenya, Morocco, New Zealand, Nigeria, South Africa and Switzerland. |

|

The Circular Economy Coalition of Latin America and the Caribbean: led by a rotating committee, starting with Colombia, Costa Rica, the Dominican Republic and Peru for 2021-2022. |

|

The African Circular Economy Alliance: members include Côte d’Ivoire, Ghana, Nigeria, Rwanda, and South Africa. |

Downloads

Closing the Loop: Responsible investment and the circular economy

PDF, Size 7.29 mb

References

[1] The Ellen MacArthur Foundation What is a circular economy?

[2] The most effective way to retain the value of products is to maintain and reuse them. Recycling is the option of last resort because it means the embedded value in products and components is lost. See The Ellen MacArthur Foundation Circulate products and materials.

[3] This paper uses the terms circular economy and circularity interchangeably.

[4] Systemic risk refers to the risk that an event at a particular point in time or a chronic economic condition destabilises or leads to a collapse of the financial system. An example of a systemic risk materialising is several “too-big-to-fail” financial institutions defaulting on obligations to their creditors. An example of a sustainability-related systemic risk would be a sudden repricing of assets across the fossil fuel sector, resulting in cascading defaults that destabilise financial markets.

[5] European Parliament (2015) Circular economy: definition, importance and benefits

[6] The Ellen MacArthur Foundation What is a circular economy?

[7] The most effective way to retain the value of products is to maintain and reuse them. Recycling is the option of last resort because it means the embedded value in products and components is lost.

[8] Ekins, P., Domenech, T., Drummond, P., Bleischwitz, R., Hughes, N. and Lotti, L. (2019) The Circular Economy: What, Why, How & Where

[9] The Ellen MacArthur Foundation What is a circular economy?

[10] Systemic risk refers to the risk that an event at a particular point in time or a chronic economic condition destabilises or leads to a collapse of the financial system. An example of a systemic risk materialising is several “too-big-to-fail” financial institutions defaulting on obligations to their creditors. An example of a sustainability-related systemic risk would be a sudden repricing of assets across the fossil fuel sector, resulting in cascading defaults that destabilise financial markets.

[11] See for example Corporate Crime Reporter (2022) Nathan Proctor on the Growing Right to Repair Movement

[12] The Guardian (2022) Rush of lawsuits over plastic waste expected after ‘historic’ deal

[13] UN Chronicle (June 2012) Feeding the World Sustainably

[14] The World Bank (2020) Minerals for Climate Action: The Mineral Intensity of the Clean Energy Transition

[15] This paper uses the terms outcomes and impact interchangeably. As highlighted in A Legal Framework for Impact, investors are permitted – and in some cases required – to consider pursuing positive sustainability impact, especially where that is instrumental in realising their financial objectives. This work has flipped the focus from how ESG issues are affecting investments to how investments can affect and shape sustainability outcomes in the real word. Achieving circular economy targets is a means by which investors can achieve sustainability impact.

[16] European Commission (2020) Circular Economy Action Plan

[17] This is not representative of how many signatories are taking action to support the transition to a circular economy as the Reporting Framework did not ask this explicitly.

[18] These were voluntary indicators in the 2020 Reporting Framework.

[19] It is crucial that all renewable materials are responsibly sourced and sustainably managed. There is also an opportunity for infrastructure to use more re-used and recycled materials.

[20] See, for example, Arup, The Ellen MacArthur Foundation (2020) Realising the value of the circular economy in real estate.

[21] For example, the World Bank has identified 63 countries where extractive industries play a strong economic role. Its Climate-Smart Mining initiative aims to help them manage the increased demand for energy transition minerals sustainably (including through supporting the recycling of minerals).

[22] The Financial Times (2022) Thematic funds triple share of global investment in a decade

[23] Environmental Finance (2021) Circular economy funds grow and outperform in 2020

[24] Climate Bonds Initiative (2020) Financing waste management, resource efficiency and circular economy in the green bond market

[25] Chatham House (2021) Financing an inclusive circular economy

[26] Environment+Energy Leader (2021) Record-Setting 81% of DuPont Shareholders Approve Plastics Pollution Proposal

[27] As you Sow Right to Repair

[28] Planet Tracker (2022) Environmental and social issues overwhelmingly ignored by proxy voters, Planet Tracker finds

[29] See PRI (2022) The investor case for responsible political engagement for more guidance on how to do this.

[30] WRI (2021) How the Circular Economy Can Help Nations Achieve Their Climate Goals