This final chapter offers practical ideas for bringing ESG matters raised during the manager selection process together in order to facilitate ultimate decision making.

This guide has so far focused on the various areas to evaluate when assessing a manager’s ESG-related investment approaches and capabilities. This chapter takes into account generic models for the manager selection process, the organisational ownership structure of ESG assessment and scoring methodologies.

Generic models for the manager selection process

There are several overviews of the manager selection process that asset owners can refer to, primarily from organisations offering manager research and selection services. Such models tend to feature four or five stages and can be generically described as the following:

- Identification of the manager universe (qualification)

- Quantitative screening (creating a longlist, verification of the information)

- Qualitative screening (creating a shortlist, RfPs)

- Due diligence visits (analysis of the shortlist)

- Portfolio inclusion

The content and descriptions of each stage will depend on the organisation in question - its philosophy and the competitive advantage being promoted. The areas of focus within each stage are also fluid depending on an organisation’s overall investment approach.

We see value in all approaches and this guide has highlighted areas of exploration when it comes to understanding the role of ESG in manager selection, without outlining a standard process. The areas covered can fall into various stages in different taxonomies.

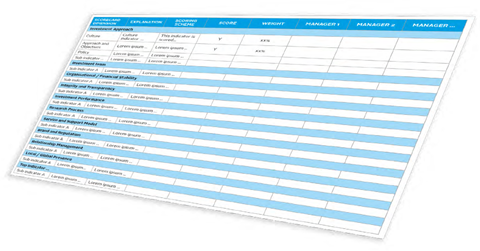

Scoring methodologies

While the stages of manager selection may flow differently among organisations, there is common ground when it comes to methods of assessment. A scoring system based on various dimensions should be developed with weights that correspond to organisational priorities. Scorecards will vary in complexity, structure and levels of narrative.

| Rank | UK | US | Nordics | France | Germany | Italy | Netherlands | Switerland |

|---|---|---|---|---|---|---|---|---|

| 1 | Organisational stability | Local presence | Integrity and transparency | Brand and reputation | Financial stability | Research process | Research process | Brand and reputation |

| 2 | Investment team | Investment philosophy | Investment performance | Financial stability | Investment performance | Financial stability | Product innovation | Investment performance |

| 3 | Financial stability | Research process | Assistance with regulatory compliance | Service and support model | Research process | Assistance with regulatory compliance | Third-party external ratings | Investment team |

| 4 | Integrity and transparency | Investment performance | Investment team | Organisational stability | Alignment | Local presence | Local presence | Local presence |

| 5 | Investment philosophy | Service and support model | Brand and reputation | Investment philosophy | Relationship management | Investment philosophy | Service and support model | Financial stability |

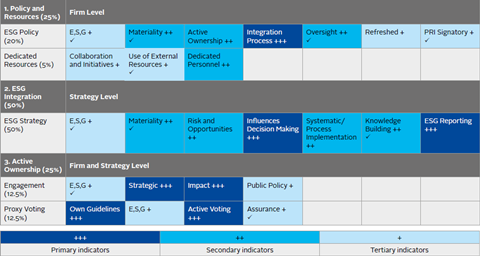

ESG scoring

When it comes to scoring ESG capabilities, considering and assessing the elements discussed in this guide, asset owners have two main options:

Integrated approach: ESG scores are integrated into a scorecard of all or several dimensions via sub-indicators, with indicator explanations and scoring schemes describing desired ESG-related behaviours.

Standalone approach: A specific ESG selection scorecard with its own indicator explanations and scoring schemes to be integrated as a dimension in the overall manager selection scorecard.

Given the relatively nascent nature of ESG, best practice is typically approached in a standalone manner, driven by dedicated teams or individuals. This has ensured ESG insight is given sufficient exposure vis-a-vis more integrated selection elements, prompting ESG as a discipline to gain wider organisational acceptance and allow ESG competence to expand.

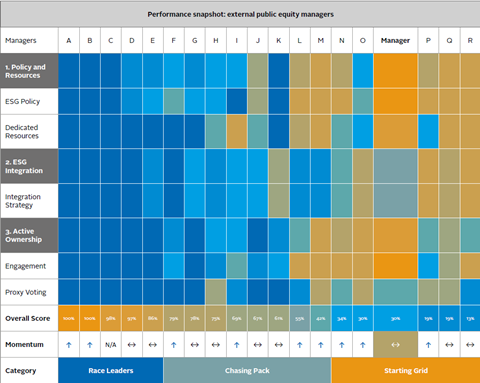

A standalone assessment could involve sending a reporting or selection questionnaire to a prospective manager (or an existing manager if regarding an appraisal) and then benchmarking it against a universe of managers. A process tool uses the below heat map to assess individual manager scores. The Wespath Analytical Insights - ESG Integration Evaluating and Monitoring External Asset Manager Performance report also provides questionnaire examples, indicator definitions to use in assessments and further elaboration of using the process as an annual assessment of managers’ ESG competency.

In organisations where ESG efforts operate as a distinct pillar of the overall investment function, the team or individual responsible generally designs and conducts ESGrelated selection due diligence. Although this bodes well for resource allocation efficiency, ESG staff should act in a consultative manner with other investment teams and/or staff responsible for the full selection process for ESG to become a more integrated activity.

Download the full report

-

Asset owner guide: Enhancing manager selection with ESG insight

March 2018

Asset owner guide: Enhancing manager selection with ESG insight

- 1

- 2

- 3

- 4

- 5

- 6

Currently reading

Practical tips for making selection decisions