As providers of capital, asset owners sit squarely at the top of the investment chain.

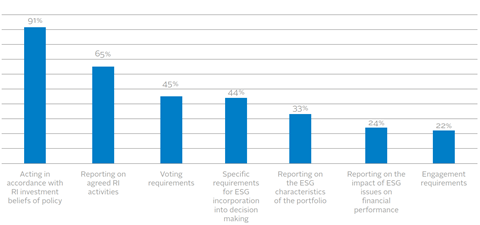

PRI data shows that sustainability considerations are often missing from asset owners’ investment processes, in particular from the selection, appointment and monitoring of investment consultants and investment managers.

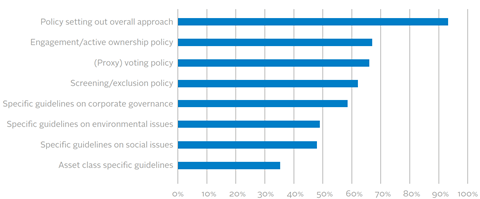

Less than half of PRI asset owner signatories include specific guidelines on environmental and social issues and, in many cases, investment mandates lack detail on asset owners’ specific ESG expectations of their managers.

“Investment management is an intermediated market. Generally this means that asset owners – other than when they specify bespoke solutions – need to choose the most suitable products from those that are available from investment managers. This is a key reason for the apparent disconnect between investment beliefs and the mandates that are issued.

There are, at present, relatively few plain vanilla products that include ESG. In practice, the funds being offered tend to either be full-blooded ESG/sustainability products or to not include ESG at all. There is some competition between passive managers but this is a very low-fee and low-margin business where engagement gets offered as a differentiator. It is unlikely that clients would pay more to have engagement included in the service that they receive.”

Nico Aspinall, Head of UK DC Investment Consulting, Willis Towers Watson

There are three distinct sets of signals that asset owners send to the financial system.

Direct investment signals

- Direct investment signals through the weight given to responsible investment and ESG issues in appointment and reappointment decisions for investment managers. Many research providers see that questions from asset owners about ESG-related issues have resulted in investment managers paying much greater attention to these issues in their investment processes and, in turn, challenging research providers to publish more and better quality research on these issues. Research analysts explained that questions from investment managers have encouraged them to build their capacity and, in turn, to proactively raise ESG and sustainability issues with their other clients. and investment consultants, and through the formal conditions included in investment mandates.

Indirect investment signals

- Indirect investment signals to the wider investment markets through investment beliefs, principles, policies and statements that tend to be seen by the wider investment market as indications of the issues that are of concern to the asset owner.

Policy signals

- Policy signals, where investors encourage policy makers to adopt measures that support responsible investment. These tend to be seen as leading indicators of potential change but, until regulation is both very likely and very close, of less importance than the signals sent through investment mandates.

Many research providers see that questions from asset owners about ESG-related issues have resulted in investment managers paying much greater attention to these issues in their investment processes and, in turn, challenging research providers to publish more and better quality research on these issues. Research analysts explained that questions from investment managers have encouraged them to build their capacity and, in turn, to proactively raise ESG and sustainability issues with their other clients.

Download the full report

-

How asset owners can drive responsible investment: Beliefs, strategies and mandates

March 2016

How asset owners can drive responsible investment: beliefs, strategies and mandates

- 1

- 2

Currently reading

Asset owner influence

- 3

- 4

- 5

- 6