Organisation name: Kempen Capital Management

Signatory type: Investment manager

Region of operation: Europe

Assets under management: €73 billion

Why we use ESG criteria to assess external managers

Our asset owner clients are increasingly embedding ESG information in their processes for selecting and monitoring external managers. Therefore, it is important for us to set up clear ESG criteria to score and evaluate external managers to ensure they meet our clients’ sustainability requirements.

How we score external managers on ESG issues

Over the last two years we have created a proprietary manager scoring framework with six pillars to help us understand and evaluate how external managers integrate various ESG factors into their investment processes.

Within this framework, fund manager products are classified on five levels of our Sustainability Spectrum: compliant, basic, avoid harm, do better, do good (see Figure 1). We have created this to help the selection team define managers’ sustainability profiles and assess whether their funds meet specific client beliefs and requirements.

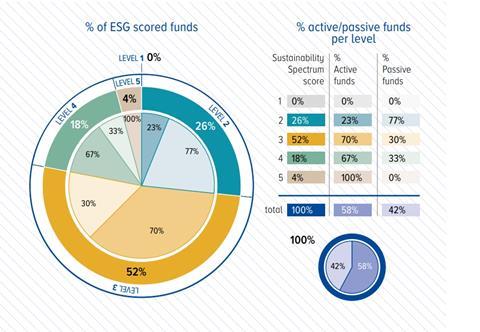

We assessed 83 listed funds by the end of 2020, representing around 24% of our AuM, and their ESG scores ranged between levels 2 and 5 on sustainability. As a percentage of AuM, 2% of the funds scored basic (score 2); 15% scored avoid harm (score 3) and 7% scored do better (score 4). Less than 1% of the AUM came from managers scoring 5 on the Sustainability Spectrum (see Figure 2).

Figure 1: The Sustainability Spectrum

Figure 2: Sustainability scores of fund managers

The investment funds that fit into the first two levels (compliant and basic) are legacy investments and are not actively offered to clients, with this classification potentially encouraging them to improve their practices.

We expect our external managers and own internal funds to at least fulfil the level 3 criteria (avoid harm) and are aiming to move towards level 4 (do better) or beyond for a large number of our funds, to promote responsible business conduct.

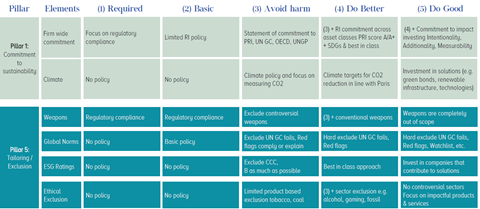

To assess where a fund fits within the Sustainability Spectrum we have developed assessment criteria based on the six pillars outlined in Figure 3. For each of the pillars there are requirements that managers need to satisfy to qualify for the corresponding level.

Figure 3: Six pillars of the manager monitoring framework

For example, to qualify for level 3 (avoid harm) managers need to have a public commitment to responsible investment and global norms, avoid investing in companies that produce tobacco or controversial weapons, violate or potentially violate the UN Global Compact, OECD Guidelines or UN Guiding Principles for Business and Human Rights. We also expect managers in this level to have a climate change policy and integrate ESG criteria into their investment process.

Furthermore, we expect managers to engage and vote in line with their policies and clearly evidence that their policies and commitments are implemented in their investment portfolios.

Figure 4 shows some example criteria for Pillars 1 and 5 (Commitment to sustainability and Tailoring/exclusion respectively).

Figure 4: Criteria examples from two pillars of the manager selection and monitoring framework

To qualify for sustainability level 4, managers should not only meet the requirements of level 3 but also have CO2 reduction targets and a best-in-class or thematic approach that shows how they are benefiting stakeholders.

Level 5 is reserved for managers that invest in companies that intentionally contribute positively to solving specific global challenges through their products and services.

Example: Developing a bespoke sustainability index

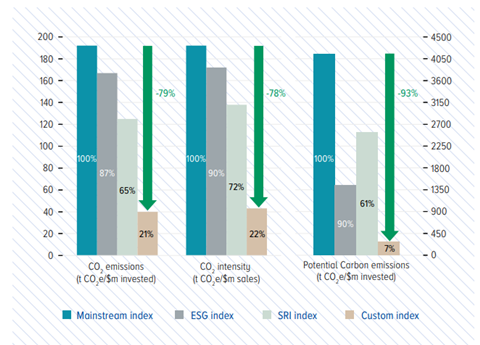

We have also used our proprietary scoring framework to create bespoke products. For example, in 2020 we worked with a long-term pension fund client, alongside one of our data providers, to develop a sustainability index for its European equity investments. The index methodology we helped devise sought to reward companies taking ambitious climate action and excluded what we called carbon criminals. It resulted in an index with a low carbon footprint compared to the mainstream MSCI Europe Index (see Figure 5).

Figure 5: Carbon footprint of the bespoke index. Sources: Kempen, MSCI

The pension fund made it clear that they wanted the product to at least meet the requirements of level 4 (do better) on our sustainability spectrum – that is, it had to have a best-in-class approach, avoid controversial sectors and activities and actively contribute to achieving three Sustainable Development Goals (climate action, healthcare, and affordable and sustainable energy).

It was very important for the client to have an investment strategy in which companies contributed to these SDGs through their products and services. The index methodology was designed to over-weight companies that contribute to the treatment of important illnesses, food security (nutrition) and the prevention of pollution.

The index consists of about 200 companies and tilts towards those with high ESG ratings and/or a focus on carbon footprint reductions. It is still in its early days but encouragingly, 2020 performance was above a mainstream index by quite some margin.