Overview

- Responsible investment should be at the core of the relationship between asset owners and investment managers. This introductory guide provides an overview of how asset owners can integrate responsible investment principles and practices into their selection, appointment and monitoring of investment managers.

- It is designed to be practical and includes links to further reading and a toolbox of useful documents and templates.

- These guides were designed for segregated portfolios but aspects will be relevant to reviewing and assessing pooled or co-mingled funds.

- For more information on anything in this guide, or responsible investment more broadly, please get in touch.

While this guide focuses on the selection, appointment and monitoring of an investment manager, other recent PRI work for asset owners covers responsible investment policy statements and mandate requirements. The PRI’s broader work outlines a five-step process that asset owners can follow to address responsible investment principles as they develop relationships with their investment managers.

This guide focuses primarily on steps three to five:

Policy and investment strategy

Setting out a responsible investment policy and incorporating requirements into an investment strategy and mandate design has implications for the selection, appointment and monitoring of investment managers.

The PRI has published an introductory guide on developing a policy and process, and our responsible investment policy database includes links to over 6,000 responsible investment policy documents from asset owners and investment managers, searchable by AUM, geography or signatory type. Further guidance on policy and mandate design, can be found here and here.

PRI Leaders Group

Based on information from PRI’s annual reporting process, the PRI’s 2019 Leaders Group highlights 47 global asset owner signatories that have demonstrated leading practice in applying responsible investment to the selection, appointment and monitoring of external managers in either listed and/or private equity. They provide some great examples of practice that can be applied by other asset owners.

PRI Data Portal

For asset owners requiring more details on signatories not included in the PRI Leaders group, the PRI Data Portal provides a wealth of information. Asset owners can view their managers’ full responses to the PRI Reporting Framework, as well as their Assessment Scores (if granted access), which can help in the selection and monitoring phases of the process.

Selection

The selection of an investment manager or fund strategy typically takes place after the asset owner has established its investment policy, strategy and mandate requirements.

Some asset owners partly or fully outsource the selection process to a third party. The PRI publication Investment consultants and ESG: An asset owner guide offers advice on the role of consultants in investment management and suggests due diligence questions for asset owners.

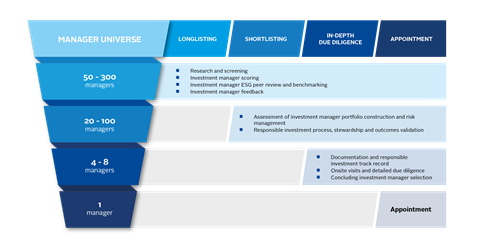

The process of selecting an investment manager can be broken down into three steps: longlisting, shortlisting and in-depth due diligence.

Investment manager selection

Longlisting

The longlisting process starts with the asset owner assessing potential investment managers against the requirements set out in the Request for Proposals (RFP). That will involve assessing managers against both traditional criteria – such as risk management, financial performance and costs – and responsible investment practices, processes and outcomes.

The PRI has outlined a set of minimum requirements for signatories covering aspects of responsible investment policy and process. These could help with initial screening of prospective managers. In 2020 these requirements covered a responsible investment policy, senior level oversight and internal resources.

PRI minimum requirements:

- RI policy, setting out:

- overall approach or guidelines on E, S, or G factors;

- covers >50% of AUM

- Senior-level oversight of responsible investment

- Staff (internal/external) implementing responsible investment

Based on data reported to the PRI, the first high-level factors that asset owners typically assess are:

- culture

- governance

- responsible investment policy

- investment strategy and fund structure

Asset owners use scoring methodologies to combine the range of structured and unstructured data including in-house sources, third-party data providers and questionnaires. This information is then often assimilated into scorecards, rankings, peer reviews or benchmarking exercises. The PRI has produced a series of due diligence questionnaires for assessing prospective investment managers – to help the collection of data on process and practice in specific asset classes. The PRI Reporting Framework can also be used as tool for manager assessment.

It is important that asset owners provide feedback to managers that do not make the shortlist to help them improve their responsible investment practices.

Shortlisting

Shortlisting involves testing the managers’ abilities to ensure that they can deliver on the mandate requirements and have the required ESG integration expertise, process and practice – across the appropriate asset class and geography. The process requires the asset owner to understand how the manager incorporates ESG factors into portfolio construction, risk management and engagement with investees.

It also requires the asset owner to validate the information provided by the manager, by – among other things – considering how the manager tracks and evaluates positive and negative ESG outcomes from its investments.

In-depth due diligence

The final part of the selection includes a review of the manager’s financial and non-financial track record using quantitative key performance indicators and qualitative assessments. An indicative list of necessary documents is included in the Investment manager selection guide (p. 23).

Onsite visits, interviews and meetings can be a key section of this due diligence process and provide additional insight into managers’ resources for both mainstream and ESG capabilities.

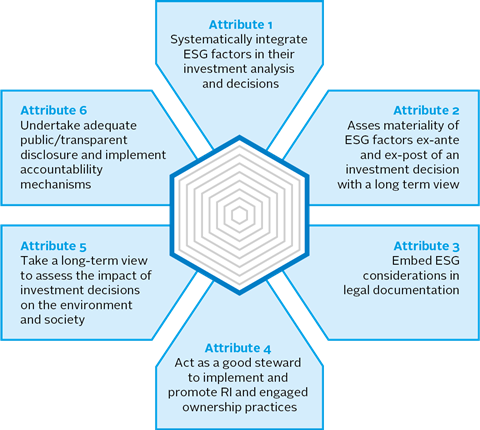

At the conclusion of this process, the asset owner should be able to identify an investment manager aligned with the RFP to reflect some, or all, of the leading practices outlined below.

Leading practices to look for in an investment manager

PRI resources

- Investment manager selection guide

- Considering ESG integration in manager selection in listed equities

- LP responsible investment DDQ: and how to use it.

- Investment consultants and ESG: An asset owner guide

Appointment

The manager appointment process involves the asset owner, supported by its legal counsel, transferring the mandate requirements into a formal arrangement. This might include contractual arrangements or documentation such as the investment management agreement (IMA). For pooled or co-mingled funds, the asset owner might review the formal documentation to ensure it reflects aspects of its own responsible investment policy. Depending on the relationship, any differences could be raised and discussed with the investment manager.

Within this process, it is important that any ESG requirements laid out in the RFP are addressed in the legal documentation. ESG clauses for use in the appointment process might address issues such as the asset owners’ commitment to responsible investment principles (such as the six Principles for Responsible Investment), industry reporting requirements on ESG issues (e.g. climate reporting), engagement practices and human rights.

Sample ESG clauses for investment management agreements

The PRI’s Investment manager appointment guide, written in collaboration with law firm Grant & Eisenhofer, includes a series of clauses that could be included, or adapted for use in, investment management agreements. Though private equity and other alternative asset classes such as hedge funds have different legal and client agreements, these clauses might be appropriate to include in side-letters or other similar agreements.

These sample clauses cover topics such as the adoption of the six Principles for Responsible Investment, exclusions, violations and remedies, human rights, climate change, stewardship and stock lending.

As an example, the clauses on ESG integration and TCFD and Climate Scenario Analysis state:

ESG Integration

“The IM agrees to take into account the six PRI Principles in connection with each Portfolio Investment. Specifically, the IM agrees to integrate financially material ESG factors – which should include climate change, corporate governance and other relevant risks and opportunities – into its investment analysis, decision-making and stewardship policies and practices, including by engaging with management (or equivalent) of the issuers (or equivalent) in which the AO is invested to improve ESG performance.”

TCFD and climate scenario analysis

“The IM will commit to the Final Recommendations of the Task Force for Climate-related Financial Disclosures to provide the AO with a clear and comparable overview of how the investment process incorporates climate-related risks. This should, as outlined in the guidelines, include reporting on governance, strategy, risk management and metrics and targets.”

Drafting the IMA will be an iterative process and may require the asset owner to educate and work with its legal counsel about its objectives in introducing a responsible investment policy.

Appointment process

PRI resources

- Investment manager appointment guide

- Considering ESG integration in manager selection in listed equities

- Incorporating responsible investment requirements into private equity fund terms

Monitoring

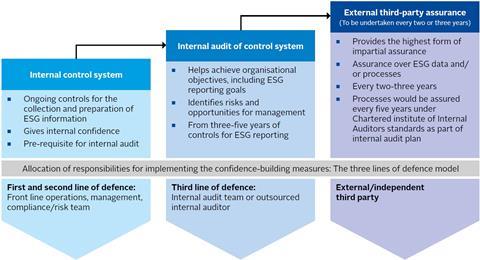

To ensure that the investment manager delivers against the ESG requirements set out in the RFP and meets the expectations included in the IMA, asset owners should introduce a review process that includes regular disclosure and reporting.

The PRI’s Investment manager monitoring guide provides a framework and indicative list of questions that asset owners can tailor to their own needs. This framework aims to help promote consistency in manager reporting, reducing variances in reporting requests faced by managers and enabling comparability between them.

Monitoring process

Disclosures

The suggested disclosures, or questions, should enable the asset owner to judge whether a manager is meeting its responsible investment objectives and fiduciary duties. They are separated into firm, fund, asset class, stewardship and outcomes levels.

They are compiled using some underlining principles that disclosures should be:

- Consistent – Expectations on the format and detail of reporting should be agreed between the asset owner and manager. Ideally, the format will be consistent across similar investment managers to enable analysis, comparability and ease of use.

- Regular – Regular reporting typically improves performance by allowing issues to be addressed in a timely fashion. Reporting should take place annually at a minimum, and on an ad hoc basis in response to incidents, with criteria for both agreed by both parties.

- Verified – A thorough document trail should exist for all reported information, allowing for audit and verification. The investment manager’s governing body accountable for policy implementation should specify the levels of internal sign-off and third-party verification required.

- Continuously reviewed – A monitoring tool or database can allow the asset owner to review and assess its investment managers on their ESG reporting, performance and alignment with any requirements set. The review will provide discussion points to raise with the manager, providing opportunities for learning, education, collaboration and improved responsible investment outcomes.

- Driving continuous improvement – The review process may raise areas where remedial improvements are needed, or where improvement or change is necessary.

PRI resources

- Investment manager monitoring guide

- Monitoring managers’ ESG integration in listed equity

- ESG monitoring, reporting and dialogue in private equity

Actions for asset owners

To summarise, asset owners should take the following actions.

Develop a circular approach

- Ensuring that the selection process is connected with the legal documentation or contractual agreements

- Providing feedback to unsuccessful applicants

- Developing actions from insights generated by reporting

Challenge legal agreements

- Challenging investment managers and legal advisers on key ESG clauses in the contractual agreements

With the goal of:

Moving towards leading practice

Drawing upon resources and case studies provided through the PRI Leaders Forum and within the selection, appointment and monitoring guides to develop leading practice in ESG incorporation in the asset owner/manager relationship

Downloads

An introduction to responsible investment: selecting, appointing and monitoring investment managers

PDF, Size 3.11 mbIntroduction à l’investissement responsable : Sélection, Nomination et Suivi des Sociétés de Gestion (French)

PDF, Size 0.87 mb責任投資の入門ガイドー運用会社の選定、指名、モニタリング (Japanese)

PDF, Size 1.3 mbSeleção de gestores de investimento (Portuguese)

PDF, Size 1.96 mbSelección, designación y monitoreo de administradoras de inversiones (Spanish)

PDF, Size 3.04 mb