By Stefano Battiston, University of Zurich and University of Venice, and Irene Monasterolo, EDHEC Business School and EDHEC-Risk Institute, France

Within sustainable finance, institutional investors face increasing demands to assess their exposure to climate risk. Climate mitigation models that factor in investor expectations are a key component of that.

Climate change is recognised today by financial supervisors as a source of financial risk for institutional investors.

Mitigating and adapting to climate risks requires us to change our production systems and lifestyles at such a scale and pace that most economic activities are affected, whether positively or negatively. As a result, large portions of financial portfolios are affected too, because they are currently invested in such activities.

Besides the physical impacts of climate-related hazards, financial actors need to consider climate transition risk. The term does not imply that the transition to a low-carbon economy, per se, generates risk. Rather, the risk emerges if the transition is delayed and then occurs suddenly, what is referred to as “disorderly” in the literature.

The window of opportunity to stabilise the global temperature below 2 degrees C closes in the next 2-3 decades. Hence, the later the transition starts, the faster it needs to be, bringing about large adjustments in asset values that investors may not be able to fully anticipate or hedge against.

In our paper, published in Science in May 2021, we explore the importance of factoring investors’ expectations and reactions into the climate mitigation scenarios used by financial authorities and investors belonging to the Network for Greening the Financial System (NGFS). Doing so has important implications for financial stability, for risk management and for the fate of the low-carbon transition overall.

A new framework for climate transition scenarios

Our paper introduces a new generation of climate transition scenarios[1] that account for investors’ expectations on market prices of high and low-carbon assets, and how investors adjust risk pricing when those expectations change. This, in turn, leads to market instability and insufficient allocation of capital to low-carbon investments, if climate policies and regulations (for instance, the implementation of the EU Taxonomy of sustainable investments) are not perceived as credible by the investors.

Capturing or missing this feedback from expectations on to scenarios could, in principle, make the difference between achieving or failing the low-carbon transition. It can also lead to properly assessing the financial risks and opportunities associated to the transition or not.

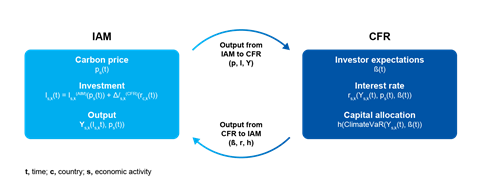

The new framework couples large-scale process-based Integrated Assessment Models (IAM) and a Climate Financial Risk (CFR) model to produce a new generation of climate mitigation scenarios that can complement the current ones by capturing the key role of investors’ expectations and are therefore more relevant for climate stress-testing. The framework can be already applied to different internal credit and financial risk models.

As such, these new scenarios fill in a relevant gap in climate financial risk assessment.

What do current climate mitigation scenarios look like?

A raft of voluntary or mandatory initiatives around the world invite investors to assess climate-related financial risk.[2]

More specifically, financial supervisors encourage investors to test their portfolios against a disorderly transition with losses on a wide range of financial assets. They do so, not because they consider this the most likely outcome. But because this is an adverse and yet plausible outcome that can be avoided precisely if investors get prepared in time.

The use of IAM climate mitigation scenarios for financial risk assessment, initially proposed in a scientific article in 2017, is recommended to investors as the first building block of a climate risk assessment today.

Climate mitigation scenarios provide trajectories of carbon prices and corresponding production output of high- and low-carbon energy technology sectors, which are consistent with a given target in terms of maximum global warming (e.g. below 2 degrees, or net zero 2050).

The Network for Greening the Financial System (NGFS) provides a reference set of scenarios, generated by large-scale IAM, adapted from the set of scenarios reviewed by the Intergovernmental Panel on Climate Change (IPCC).

Translating scenarios into financial shocks involves several steps. In the Climate Financial Risk (CFR) model, transition risk results from a change in markets’ expectations, for example, switching from the expectation that the economy continues as on a carbon intensive path (baseline) to the expectation that a full-scale decarbonisation of the economy (i,e. a low-carbon transition) takes place.

In the NGFS scenario database issued in May 2021, as baseline one could take the Current Policy, characterised by a continued reliance on fossil fuel, although with a decline of coal. As a transition scenario, one could take the Net Zero 2050 scenario (1.5 degrees C), or the below 2 degrees C scenario.

In both baseline and transition scenarios, the financial valuation of equity can be estimated as the net present value of future cash flows under the future trajectories of production output. For debt, the valuation is in terms of adjusted default probabilities and loss-given-default. The change in expectations induces, potentially in a very short time span, a substantial re-valuation of financial securities, because for many sectors output trajectories are very different in the two scenarios.

The way investors perceive the risk of high- and low-carbon assets has an impact on the materialisation of transition risk itself, as their perception impacts how investors reallocate capital. In aggregate across investors, this makes the difference between achieving the low-carbon transition in an orderly or disorderly fashion, or even missing it entirely.

However, investors’ expectations are not accounted for in this first wave of climate mitigation scenario and models. This, alongside policy credibility, can have important and global consequences for economic competitiveness and financial stability.

If investors find a climate policy, such as the introduction of a carbon tax, credible, they reallocate capital into low-carbon investments early and gradually. If they do not find the policy credible, they could have a delayed or sudden reaction that would lead to large asset price adjustment, leading to financial instability.

Note that a sudden collective change in expectation regarding the value of an entire asset class is precisely what happened in the 2008 financial crisis. Importantly, this dynamic could result in an insufficient reallocation of capital into low-carbon investments to meet the Paris Agreement targets.

Implications of the new climate transition scenarios

Our paper sheds new light on the importance of clear and strong climate policy signals to trigger the adjustment of expectations in the financial system that would allow an orderly transition. In the proposed framework, long term economic policies backed up by durable public investments would pay off for all actors, and signal to the market. In contrast, reverting previously announced or approved climate policies would backfire.

Financial supervisors can also play a key role by conveying to policymakers that economic policy credibility for a low-carbon transition is needed for financial stability, and conveying to investors that robustly assessing transition risk is in their collective interest.

When we look at financial markets today, there are some signs that investors start to price climate risk and yet risk premia are currently small and insufficient to redirect financial flows at the scale needed to achieve the Paris Agreement. However, the wind may change swiftly, especially if investors become aware of their impact on climate scenarios.

Find out more about the PRI’s work on climate change here.

This blog is written by academic guest contributors. Our goal is to contribute to the broader debate around topical issues and to help showcase research in support of our signatories and the wider community.

Please note that although you can expect to find some posts here that broadly accord with the PRI’s official views, the blog authors write in their individual capacity and there is no “house view”. Nor do the views and opinions expressed on this blog constitute financial or other professional advice.

If you have any questions, please contact us at [email protected].

References

[1] Battiston, S., Monasterolo, I., Riahi, K., & van Ruijven, B. (2021). Accounting for finance is key for climate mitigation pathways. Science, 28 May 2021, 10.1126/science.abf3877. https://www.science.org/doi/full/10.1126/science.abf3877 **

[2]For instance, the European Central Bank published guidelines in 2020 for banks to conduct a climate stress-test by 2022. The European insurance authority, EIOPA, requires insurance companies to integrate climate change risk scenarios in their own risk and solvency assessment, while the Swiss financial authority, FINMA, now requires a quantitative climate risk assessment for large banks and insurance companies. Similar developments are ongoing in the US after the current administration signed an Executive Order on climate-related financial risk last May.